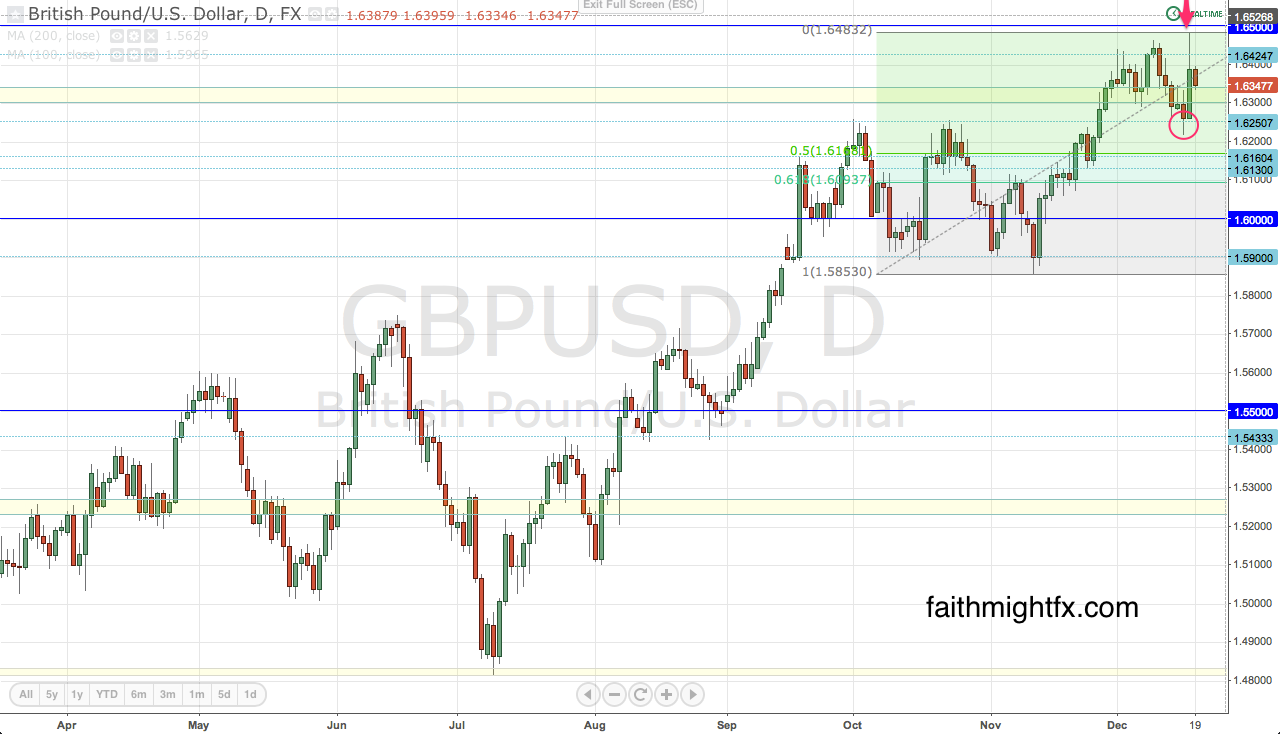

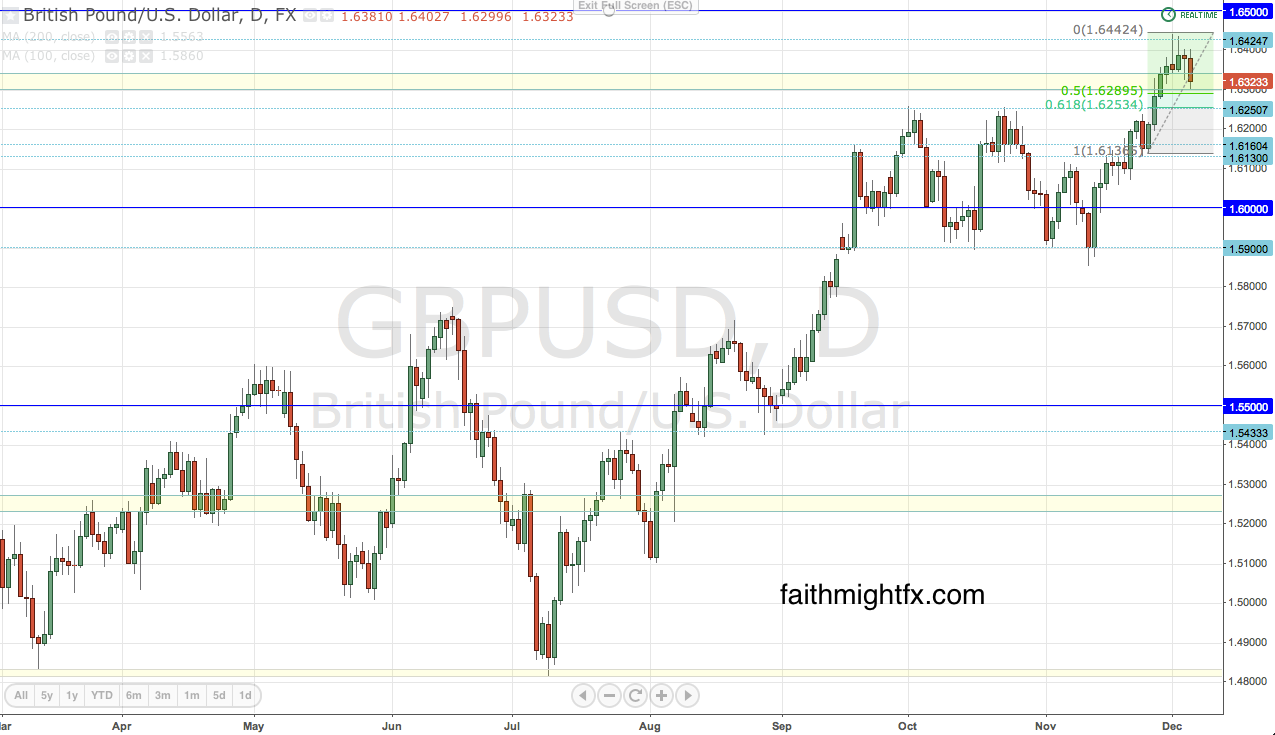

$GBPUSD will start 2014 at highs not seen in several years. Taking out the big psychological level at 1.65 is a big deal and it wouldn’t be surprising to see price move higher on spike rallies. Despite these levels, cable still remains in a range on the weekly chart. Also consider that $GBPUSD has always seen a turn in the long term trend at the new year. For the past 5 years, December has marked a new high or low and then January sees the beginning of a reversal. Seasonality would suggest that $GBPUSD starts to turn lower after the new year.

PREDICTION: $GBPUSD will fall to 1.5750 for the 1st half of the year and have a decision to make – either return to 1.65 or move lower to 1.50. This decision will largely be a function of the UK economy and Bank of England monetary policy. If the economic recovery continues into 2014, the BoE will not just consider a taper of its own but will actually move straight to the raising of interest rates. This will be extremely bullish for sterling as its central bank would be the 1st QE wielding central bank to raise interest rates since 2007. However, if the economy starts to waver GBP will come quickly undone as the driver of its 2013 rally starts to deteriorate.

As the Reserve Bank of Australia continues to intervene in the forex market, GBP continues to be a major beneficiary. Since the admission of RBA intervention, $GBPAUD has remained very strong. In fact, it seems to me that the RBA is actually weakening the AUD by buying GBP instead of USD to effectively lower the $AUDUSD exchange rate. It is very interesting that the RBA would choose to hold GBP rather than USD and perhaps a large reason why the USD has been unable to really rally since the December taper.

PREDICTION: $GBPAUD will move to 2.00 on continued RBA intervention.

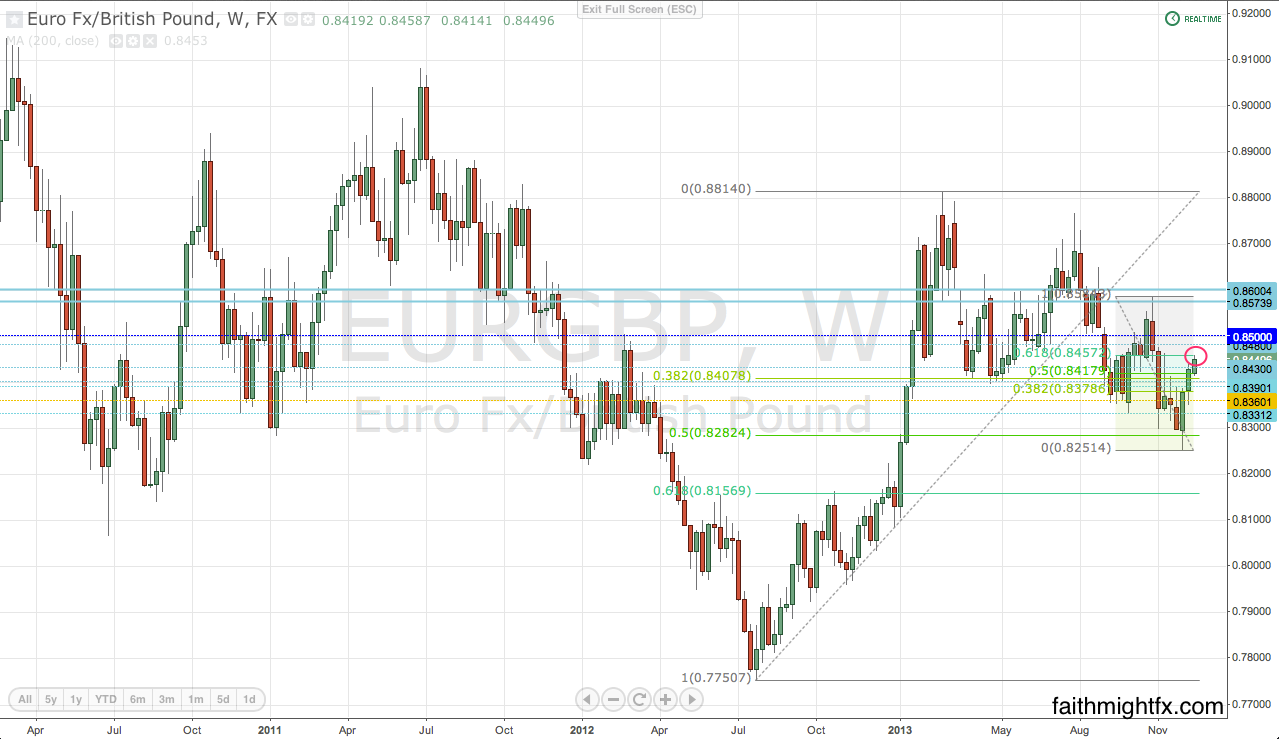

While Germany remains robust, all other European countries are still struggling to find economic footing. So despite the global economy picking up steam, the European Central Bank will continue to be very accommodative to support the European economies in 2014. As the $GBPUSD enjoys a steep correction, those flows will rally the $EURGBP back to 0.8600. However a late year rate cut by the ECB along with USD strength will knock the luster off the EUR. Unable to make new highs, the surge in GBP will see $EURGBP to new lows at 0.8000.

PREDICTION: The $EURGBP will fall below 0.8000 on a BoE rate hike and ECB rate cut combo.

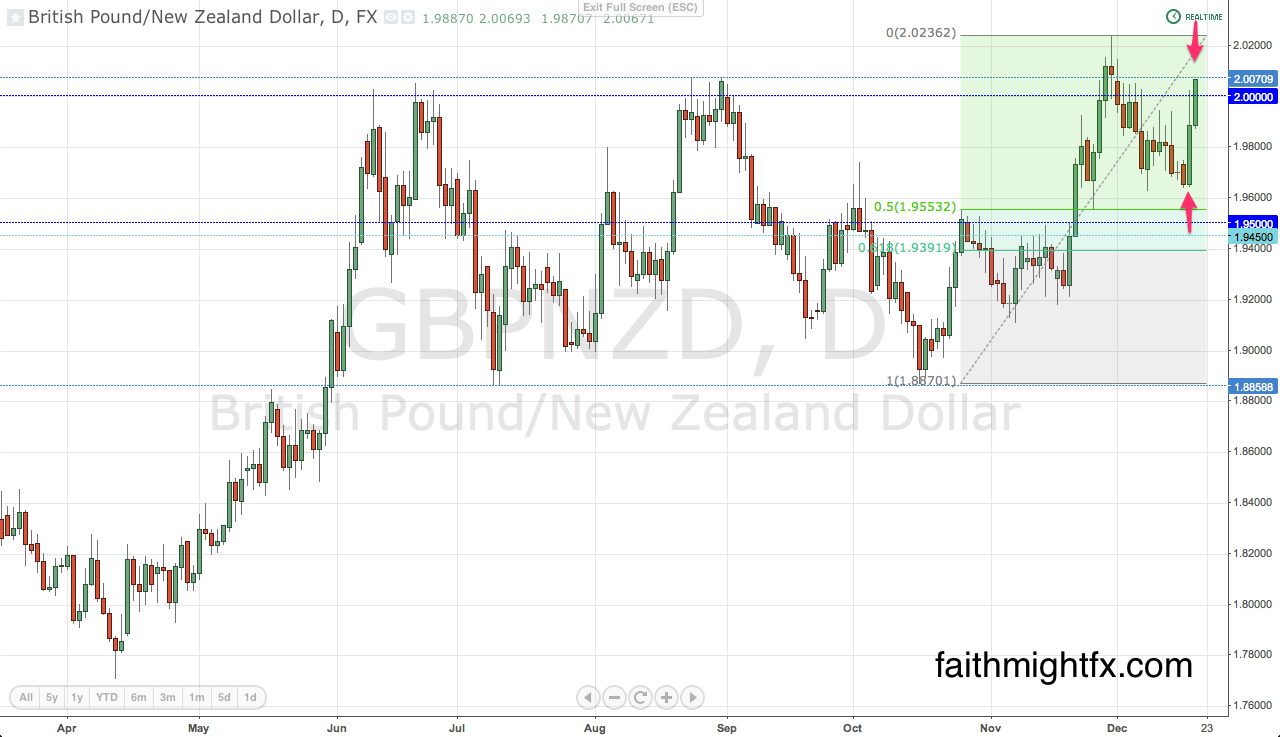

While New Zealand enjoys economic growth and relatively high interest rates, the NZD has weakened substantially versus the GBP in 2013. The big reason for this is the Reserve Bank of New Zealand using monetary policy to cool the New Zealand housing sector and the $NZDUSD exchange rate. Back in October, the RBNZ admitted to intervening in the forex markets and that admission marked a bottom in the $GBPNZD. The currency pair went on to rally over 1400 pips. Additionally, as the USD strengthens, commodities stand to weaken which could also further rally the $GBPNZD.

PREDICTION: The $GBPNZD will continue its rally and revisit the highs at 2.1000.

Since the dawn of Abenomics, the JPY has weakened as a matter of national policy. As such, the $GBPJPY has enjoyed a tremendous rally that was only fueled by the good turn in British fundamentals. The $GBPJPY rally of 2013 has begun to correct the 14,000 pip decline perpetuated by the financial crisis of 2008. Japanese officials are getting exactly what they want in a weak JPY and only have plans to keep that gravy train going.

PREDICATION: The $GBJPY continues its rally to 200.00.

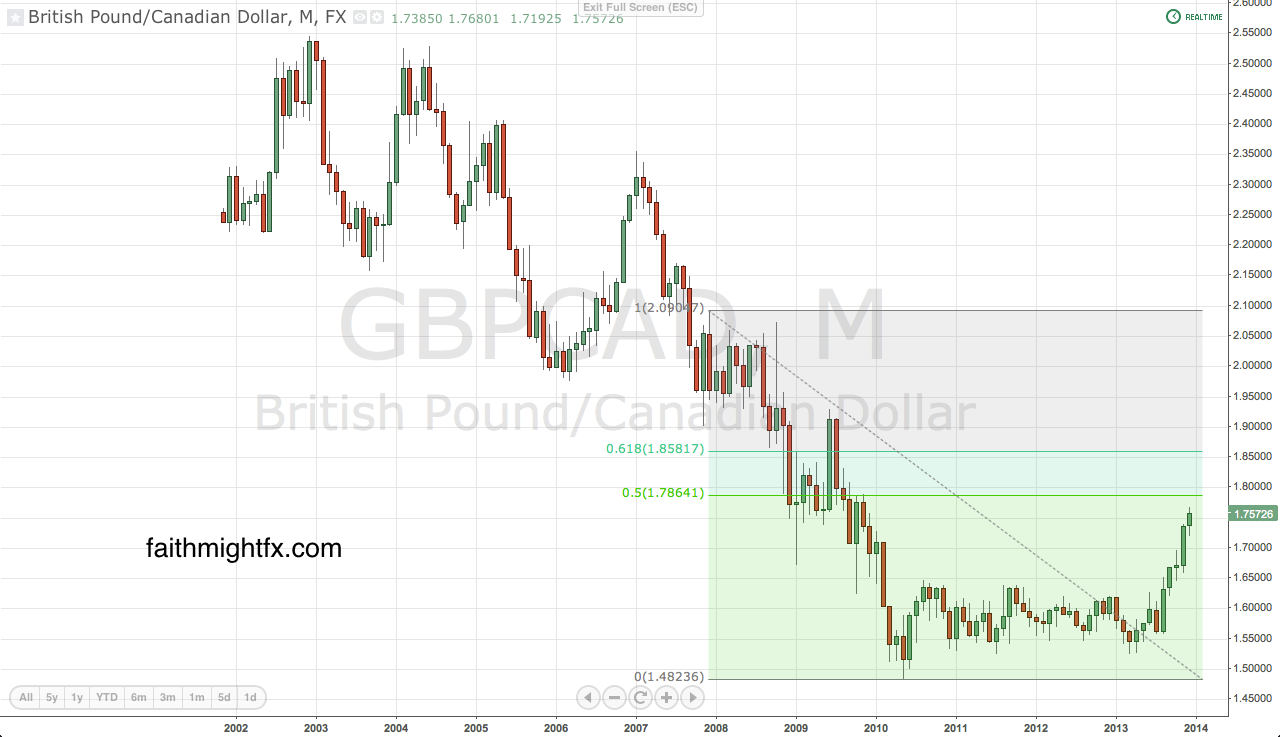

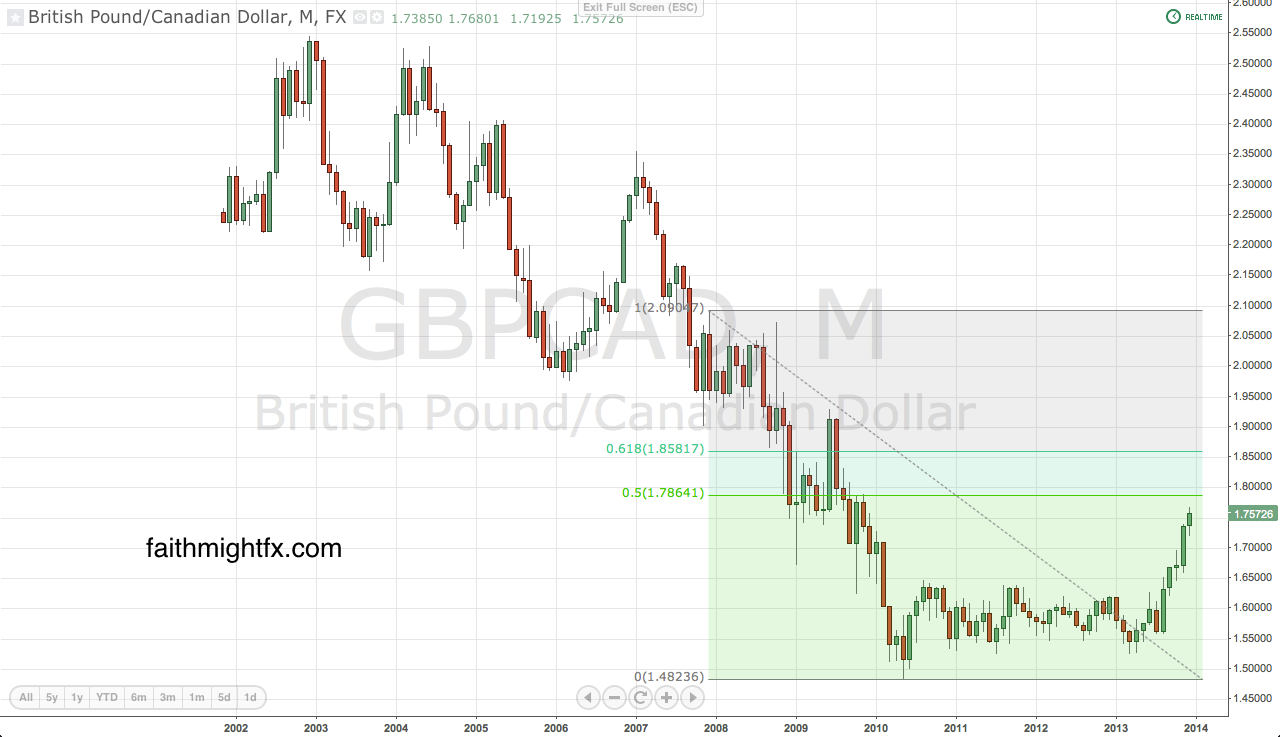

The Bank of Canada began 2013 as one of the more hawkish central banks. However, in the 2nd half the year, the BoC turned more dovish citing concerns about economic growth and inflation. As a result, the $GBPCAD surged to levels not seen since 2010. With the $GBPCAD now above 1.7500, the technical picture points to more strength.

PREDICTION: The $GBPCAD continues higher to 1.8500 – 1.9000.

The Swiss National Bank put a cap on the $EURCHF back in 2012 and defended that exchange rate with unlimited currency interventions in the market. As such, the $GBPCHF has been rangebound between 1.4000 to the downside and 1.5000 to the upside for all of 2013.

PREDICTION: $GBPCHF remains rangebound between 1.4000 and 1.5000.

2013 has been a fantastic year for me both personally and professionally. My girls started new schools. My boy came into his own this year. I spoke on my 1st panel. I made multiple appearances on FXStreet’s Live Analysis Room (watch my latest). I appeared on BTFD.tv for the 1st time. (Catch our new year show this Friday, January 3 at 6:00am EST at BTFD.tv! It’ll be fun!) I launched, then shuttered, a forex service. I invested more and traded better. I had failure and success and learned tremendously from it all.

Happy New Year!