- Time Running Out for Greece (Currency Solutions)

- CBI: UK Oct Retail Reported Sales Surge; Highest Since June (Forex Live)

- BOE: Number Of Institutions Participating In FLS Rises To 30 (Forex Live)

- U.K. Gilts Retain a Sheen In the Face of U.K. Growth (Wall Street Journal)

- EU to UK: budget rebate “no longer warranted” (Financial Times)

Tag: GBPUSD

-

Sterling Digest, October 31 2012: mixed signals – banking vs. economy

-

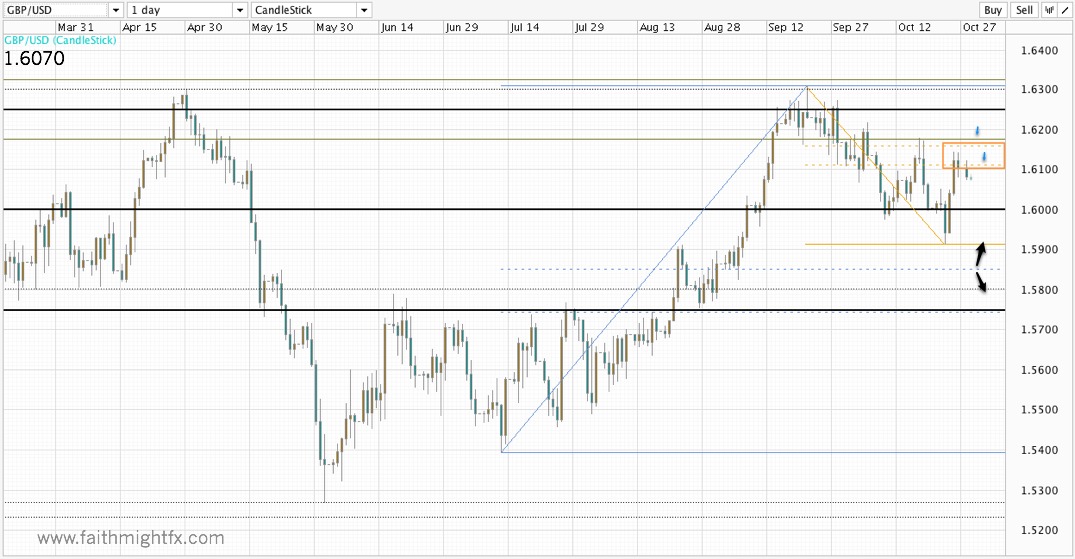

GBPUSD Update: Maintain Perspective

I woke up this morning to commentary on the streams saying that risk is ripping higher this morning. Naturally, I checked on the $GBPUSD currency pair to find it rallying off yesterday’s lows near 1.60. It is always good to keep some perspective so I checked the Fibonacci levels and have concluded the following:

This is not a rally. This is merely a corrective bounce in the $GBPUSD. Until price gets back above 1.61 (and closes above the level), the bigger picture still remains intact. Always keep perspective.

Disclosure: Still short.

-

GBPUSD Reckons

With the 61.8% Fibonacci level being respected, $GBPUSD looks ready to head back to the bottom of its down channel as London opens the new week. Watch $GBPUSD test and break 1.60 on its way to new lows at 1.5850, the 50% Fibonacci level of the summer breakout of 2012.

Furthermore, the USD moves could actually dominate flows as US events risk increases in this last week before the election and NFP Friday. Nevermind Sandy and a docket full of economic releases heading into the jobs report. In contrast, the UK has a very light calendar with only 2 PMI numbers released this week. It seems a very good week for the USD to strengthen significantly against sterling. Could this be the week of reckoning for cable?

Disclosure: Short at 1.6068

-

Sterling Digest, October 28, 2012: returns

- Surprisingly Strong U.K. GDP Tests British Pound’s Downtrend (Seeking Alpha)

- What’s In Store For Today: “Sandy Closing The NYSE Trading Floor Tomorrow” (Forex Live)

- Jobless Rate Probably Climbed in October Amid Lax Hiring (Bloomberg)

- The UK and Austerity: some facts (Mainly Macro)

- BOE’s Bean Cautions on Growth, Says Final Quarter May Be Weak (Bloomberg)

-

Cable Runs Higher

Now with FOMC behind it, this week’s market open in $GBPUSD was deja vu. Remember when cable closed above 1.60 for the first time in 5 months? The new market opened chopping around 1.60 before breaking higher to 1.6250. We have the same price action as price now chops around 1.6250.

But not everyone believes in this trend. There are a lot of bears out there.

Retail traders have remained net short on $GBPUSD for nearly six weeks.

— John Kicklighter (@JohnKicklighter) September 18, 2012

That’s an incredible statistic in the face of a 500-plus-pip rally. It makes me shake my head to the fact that this pair could run higher just on sheer unwinding of losing positions. Many of these bears point to the sterling’s own weak fundamentals. But the fact is the BoE’s on-hold (for now) monetary stance is much more hawkish than unlimited QE. The very notion of unlimited money printing is ridiculous. QE-infinity is rightfully killing the USD. Even QE3-backed pounds are more attractive at this point. As such, I think that the $GBPUSD can still run higher. Technically, it has given nothing but bullish signals since breaking and holding above 1.58.

Commented on StockTwits: $GBPUSD Only one lower low in past 13 trading days. stks.co/mAeH

— Peter Brandt (@PeterLBrandt) September 17, 2012

As cable opens the week chopping around 1.6250, it works off its overbought nature without retracement. While I do agree that $GBPUSD is overdue for a pullback, we cannot overlook the power a trend. Don’t mistake this chop as a bearish signal. Trends are powerful. I believe this one has just gotten started.

With 1.63 resistance looming not too far ahead (price at 1.6240 as of this writing), time your entries well. Even a pullback to 1.60 doesn’t change the bullish outlook short term. Trade what you see.

-

Cable Closes Bullish

So my 1st full week back in the markets was treated by a long-awaited breakout in the $GBPUSD.

The breakout above 1.58 to 1.5900 still needed confirmation. We have been faked out by cable’s breakouts before. But this week’s breakout actually looks for real.

1. The Fed

The Federal Reserve has been very vocal about adding another round of QE to the markets. The Fed meeting minutes released this week confirmed this. In fact, during Friday’s session, a letter from Bernanke hit the newswires. This letter confirmed and justified more QE from the Fed Chairman himself. QE is always dovish and the USD has taken a hit every time the market anticipates any QE from the Fed. This time is no exception.

2. 1.5800

1.5800 has been a very key level for the past year. Whether price is trading above and finding support or trading below and finding resistance, action around this price level has been historically indicative of further direction. To close the week above 1.5800 is a very bullish technical signal from the $GBPUSD.

Last week, I was very skeptical of cable’s rise. Even as it staged a breakout, sterling’s fundamentals kept me wary. However, now that we have had technical confirmation with this bullish weekly close, I trust the charts to support this breakout back towards 1.6000. The only thing that changes this bullish view this week is a daily (or weekly) close below 1.5750. Trade what you see!

-

Cable Breaks Range

After watching cable remain rangebound all summer, the market used the Federal Reserve as a reason to weaken the USD further. As a result, the $GBPUSD broke its range to the upside. Traders know this to be a bullish signal but I am skeptical of this rally.

1. The Bank of England

The BoE is also very dovish. It, too, has signaled more QE is coming. That’s QE4 folks.

2. UK Economy

The British economy was the first of the G10 to slip back into recession when it did so in the Q1 2012. The Olympics may give the economy a welcomed bump, it will be temporary rather than a kickstart to a recovery.

3. The Eurozone

The UK’s biggest trading partner remains on the brink of financial collapse. To boot, the Eurozone countries are also falling into recession one by one and suffering staggering unemployment.

So the GBP fundamentals are very weak. But the market is all about the USD for the moment. And for that reason, $GBPUSD can go higher. In fact, the bullish close 60+ pips above the key 1.5800 level confirms a technical breakout has occurred. However, follow through could be hampered by the big 61.8% Fibonacci level on the daily chart. Will this breakout turn into a fakeout? It is still a very real possibility. Like I said, I’m skeptical. But trade what you see!

-

Trust The Chart

While this move higher into 1.5800 has peaked a lot of interest, $GBPUSD still closes below the key resistance level. Cable remains rangebound. It looks like a big move but she has yet to prove herself. I love how 50 puts it this morning

euro and cable, just a reminder > price tends to not only move in one direction 😉 focus on the levels and bigger picture

#forex $$— 50 Pips (@50Pips) August 22, 2012

Trust the chart. And this is why I love StockTwits because that wise nugget comes through to keep things in perspective. Because I actually understand the bulls. It seems the market expects a dovish move from the Fed. I am more skeptical but that doesn’t matter. All that matters today is the market’s reaction to the Fed minutes. If they support the market’s notion for a QE move in September then a breakout could be imminent.

But it is still summer. Trust the chart. The $GBPUSD has yet to become bullish after yesterday’s big move. Not very constructive as the market awaits the release of the Fed minutes. Trade what you see.

-

It’s Still Summer

Vacation is over. Kids head back to school this week. It’s back to business. My family is excited for the routine to return. I’m sure traders are too. It’s been a slow-moving, rangebound market.

While vacation may be over, it is still summer. And the $GBPUSD has been rangebound all summer. It’s been a choppy range though. Channel traders who stuck through it profited very nicely. Showing the kids a good time this summer, I mostly watched from the sideline shaking my head. There were days that the market didn’t even move. There were days it moved 70 pips. $GBPUSD typically has an ATR of 150+ pips. In a trending market, cable can be a thing of beauty. But it is summer. And the long term downtrend has consolidated into a nice-looking channel.

But it takes trust to trade the channel. Given the state of the market right now, it’s hard to trust this market. But with several more weeks left of summer, there is little reason for $GBPUSD to move beyond 1.5800 to the upside and 1.5300 to the downside. As traders play the range, we take care not to get lulled by the lazy days of summer. Rather, sentiment is cautious. Will cable actually follow through on its range break? Because eventually the range will break. Until then, we trade what we see.

-

The Temperamental USD

The USD has threatened to rally for months now. But the $GBPUSD remains in its 300-pip range between 1.5500 and 1.5800. Every time traders, and I do mean ME, gets bullish or bearish due to price action, the USD finds a way to do just the opposite.

For example, despite completing the quarter to 1.5750 on USD ($DX_F) weakness this week, cable never broke above the level to challenge the highs at 1.5800 midterm support and resistance. I was bullish cable going into this trading session. I thought price would continue to rally into 1.5750 – 1.5800 zone and then experience a sharp selloff. The selloff came sooner than expected when risk aversion kicked in as Spanish bond yields and equities spooked the market

So what happens next week? With Spanish (and Italian) yields hitting these high rates at the end of the European session, we can expect the USD to continue to rally when the market opens in Monday trading causing this “Strong USD, Strong GBP” theme to play out once again. As such, this week’s GBP bears should enjoy some profits heading into the weekend. $GBPNZD and $GBPAUD short positions, in particular, paid out nicely this week with continuations in the weak sterling vs. commodities trend. However, do not underestimate this USD. It still rules capital flows and when it is strong on risk aversion fever, GBP will also benefit in the crosses. Most notably, the $EURGBP, $GBPNZD, and $GBPCAD are strong candidates into next week. Trade what YOU see!

Looking for 0.7800 to hold on a bounce

This week’s hold above 1.95 despite kiwi rally looks very good for bulls

A close above 1.58 supported by the 61.8 Fib gives some life to bulls