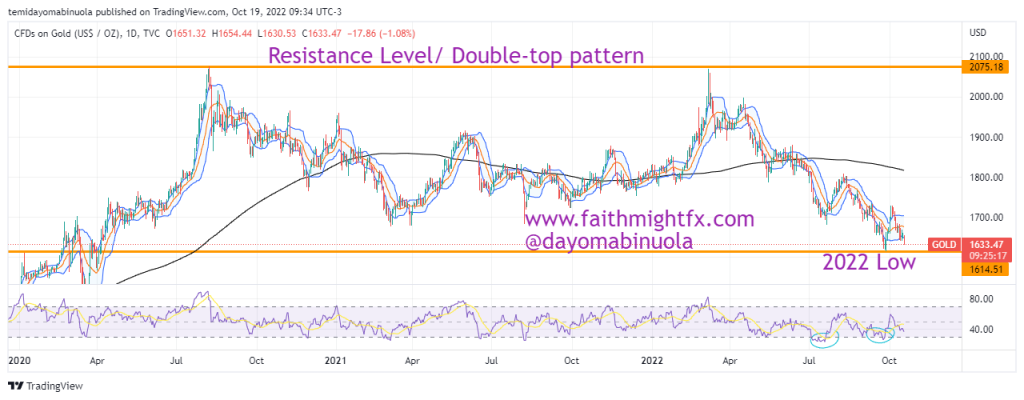

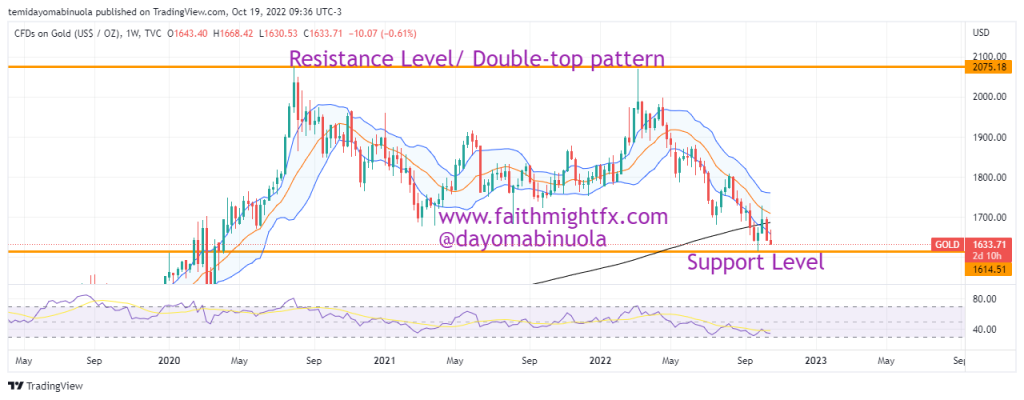

Globally, the prices of commodities have dipped this year. At the beginning of the year, the price of Gold was at $1829 per ounce. There was a rally in the first quarter of the year, which made price reach $2071 per ounce. Since the year’s high was reached, it has continued to fall. We wrote an article in July 19, when price of Gold was at $1711. Our analysts on this day said price could fall below the then support level of $1676. The price of Gold today stands at $1632.

Just like the cryptocurrency market is down in this year, the gold market is also down. We might be seeing a new 2022 low below $1616, which is the current year’s low. On the weekly chart, there is a double-top pattern, which must have led to price fall. Despite RSI shows price has been oversold twice on the daily chart, price could still fall further.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get commodities in your portfolio? Schedule a meeting with us here