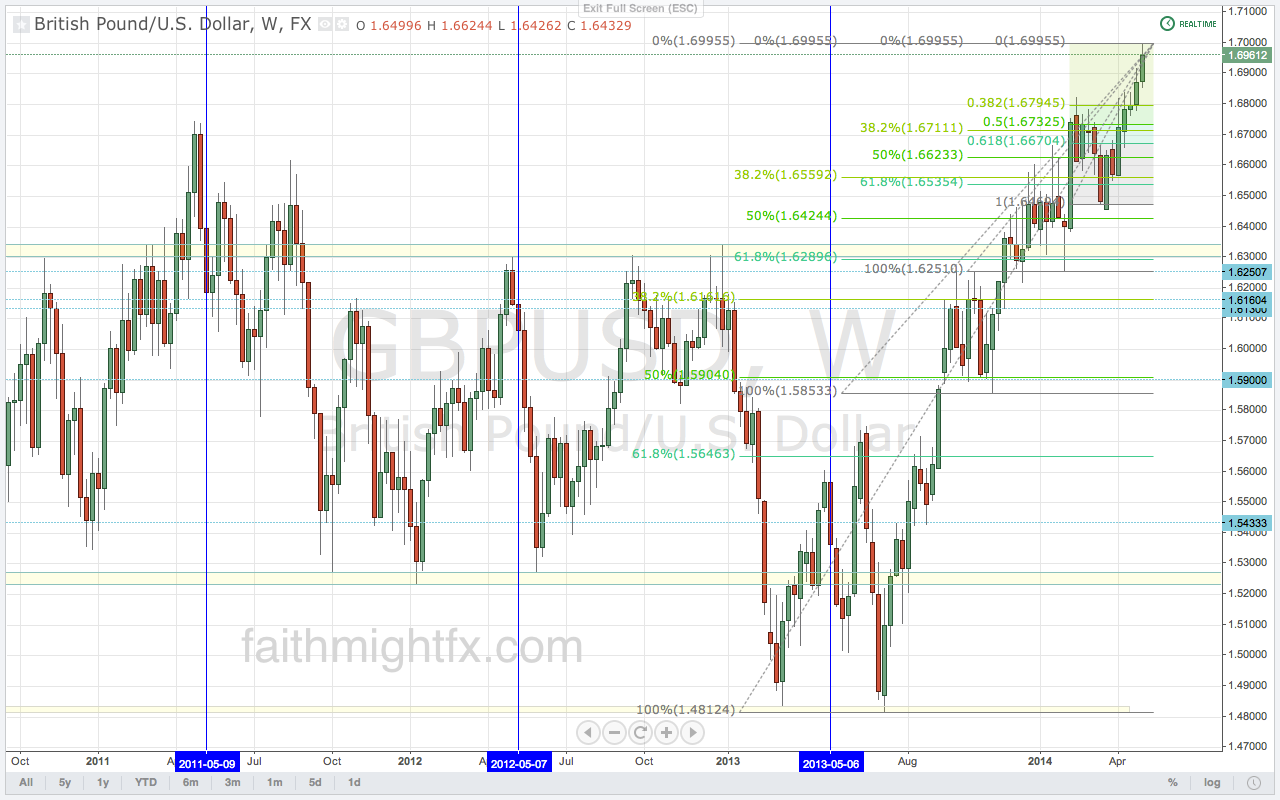

I came out of my long position just around break even as the bears trumpet grows louder. I was bullish on $GBPUSD when price bounced off the 50% Fibonacci level last week.

But I missed these clues when price revisited former resistance at 1.6920.

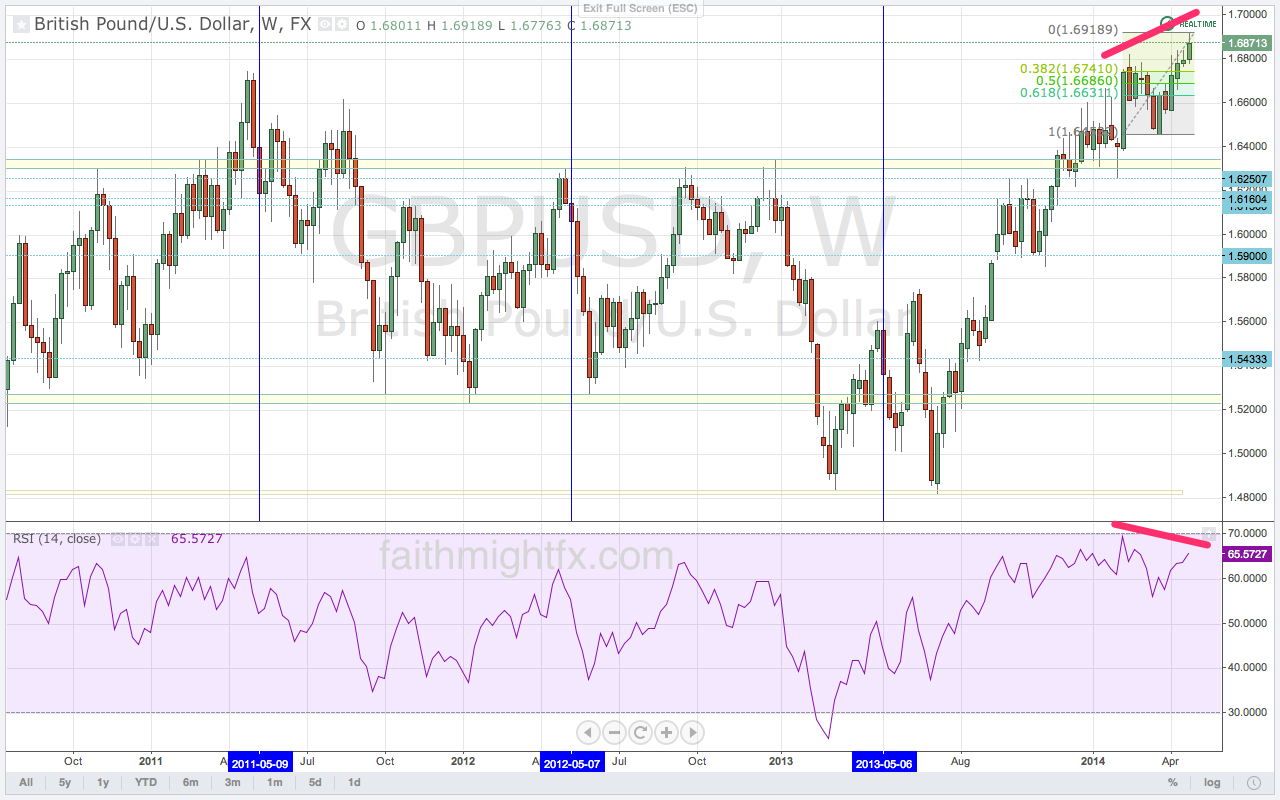

On the rally last week, I failed to pay attention to the 4-hour chart. I liked how the daily chart was setting up but failed to see what the shorter- time frame was signaling. Worse yet, when price failed 1.6850 (my mental stop) I failed to exit my position. I didn’t make my mental stop a physical stop. I put too much weight in the bullish UK CPI, BoE minutes, and retail sales and not enough weight to price action.

Moral of the story: Stick to your rules for getting out of the trade. Technicals trumps fundamentals. Journal your mistakes so you’ll never repeat them.