As of 19th March 2023, the total number of Bitcoin in circulation was 19,658,256 BTCs, which is 93.61% of the total number of Bitcoins to be supplied.

Bitcoin is a decentralized cryptocurrency originally described in a 2008 whitepaper by a person, or group of people, using the alias Satoshi Nakamoto. It was launched soon after, in January 2009. Crypto investors are looking forward to having the crypto halving. Bitcoin halving is a pivotal event in the Bitcoin network where the reward for mining Bitcoin transactions is cut in half. The event occurs approximately every four years or after 210,000 blocks.

In April 2024 the block reward will be reduced from 6.25 Bitcoin per block to 3.125 Bitcoin per block. The next Bitcoin halving is expected to occur in April 2024, when the number of blocks hits 740,000. The exact date of the halving is not yet known as the time taken to generate new blocks varies, with the network averaging one block every ten minutes.

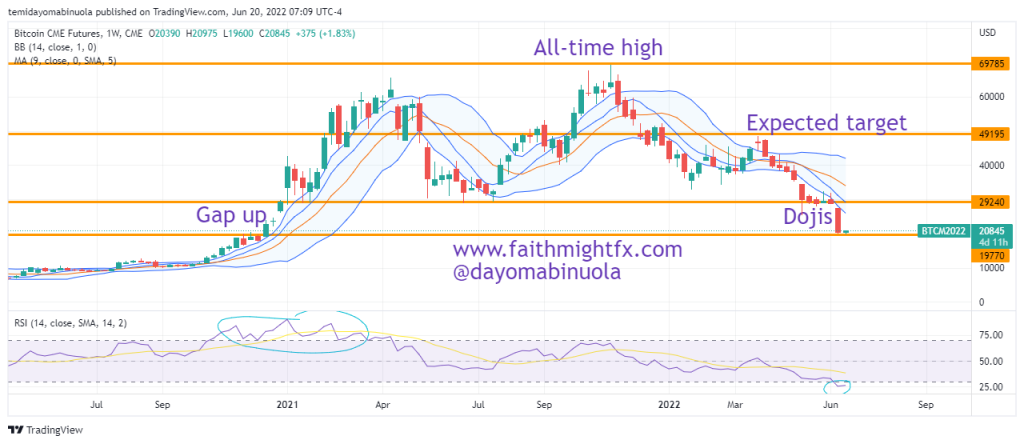

In 2024, as the Bitcoin halving date fast approaches, the price of Bitcoin has been able to break the previous high of $69,149 in 2020. Bitcoin has maintained a support level at $24,779 since June 2023. The bulls have been able to push price higher to $73,800 which currently stands as the all-time high. The all-time high was reached on 14th March, 2024. The current price of Bitcoin is at $63,200 after price fell from the all-time high. The price of Bitcoin might fall below $50, 000 in the coming weeks as RSI shows price has been overbought on the weekly chart. A Doji candlestick pattern has also been spotted.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get cryptos in your portfolio? Schedule a meeting with us here