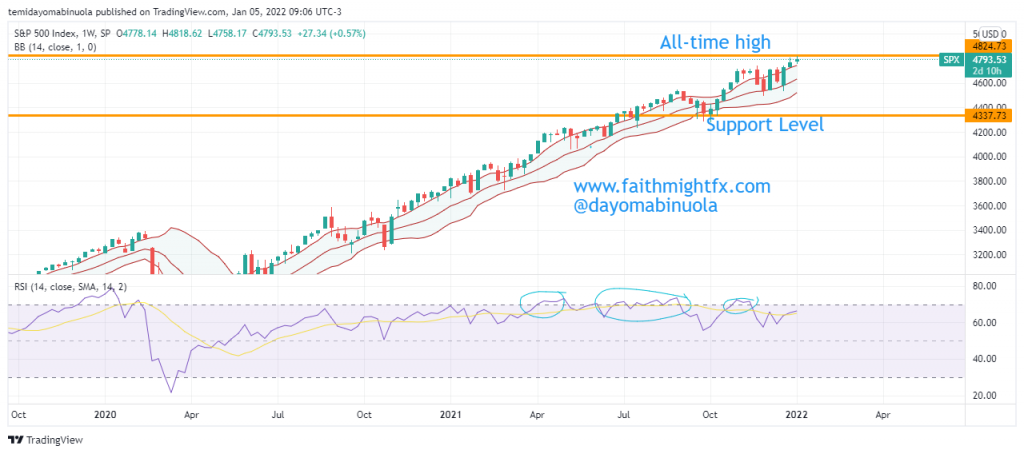

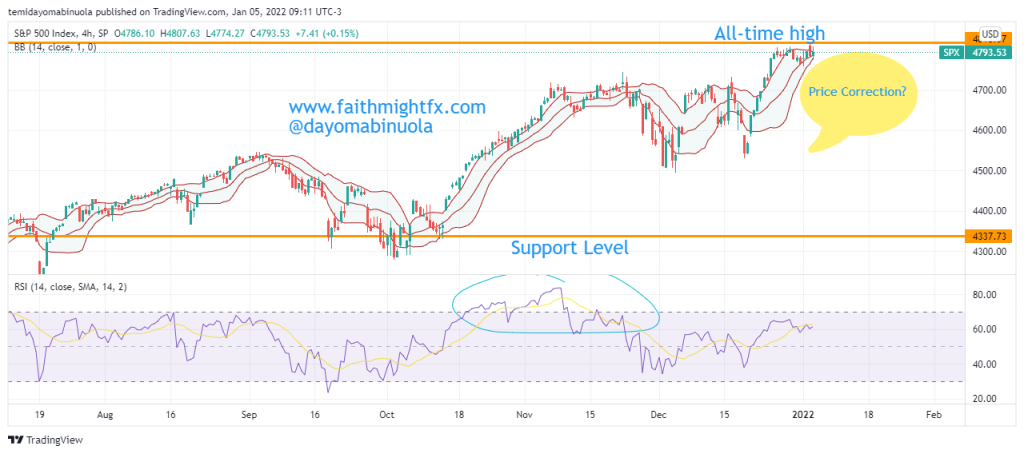

The Dow Jones has enjoyed a bullish run since the first quarter of 2020. The price was as low as $21,600 in March 2020. The bulls have been able to move price to an all-time high at the beginning of this year. The current all-time high is at $36,950 which was reached on the 5th of January 2022. The bears have been more effective this year as the year’s low is at $26,630. In mid-June, after the year low, the bulls resumed activities as a bounce occurred to reach $34,200 in August 2022.

After the 2022 second quarter high was reached at $34,200, the $DJI bears are back in action as stocks generally have fallen. The Dow Jones Index is not left out as price has fallen to $31,400. On the daily chart, RSI has shown that price is overbought, which resulted to the recent price dip. There could be continuous bearish turn in the next few weeks, as the 2022 support at $26,630 might be broken to the downside. With the recent fall of Dow Jones, price has fallen to the lower region of the Bollinger bands.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks indices in your portfolio? Schedule a meeting with us here