The American company that manufactures and sells electric cars, as well as power storage and photovoltaic systems, Tesla Inc., is currently ranked the 9th biggest company in the world by market capitalization. The current market capitalization as of yesterday, November 20 2023, was $748.95billion. In the last one year, the value of Tesla has risen by 40.35% with the current share price at $235.60. It has been a bullish year for the $TSLA stock. From the year of IPO when the price of Tesla was $1.09 to the current price at $235.60, it has been a profitable deal for investors.

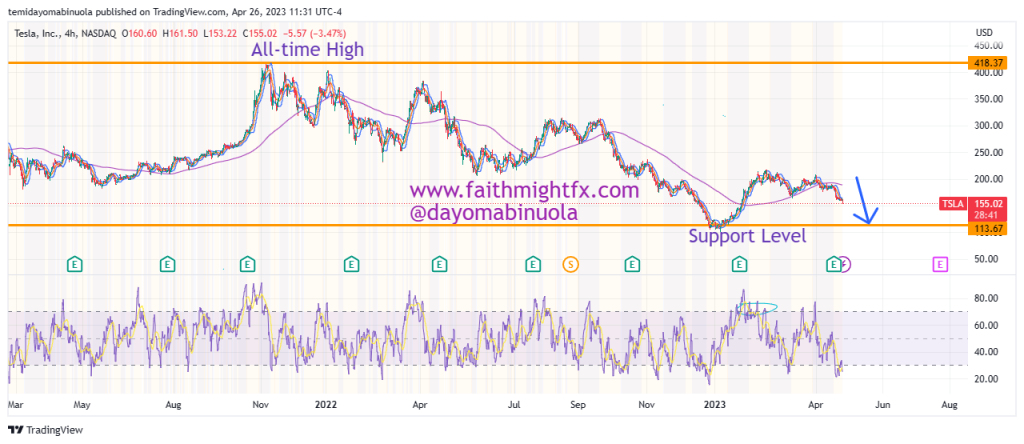

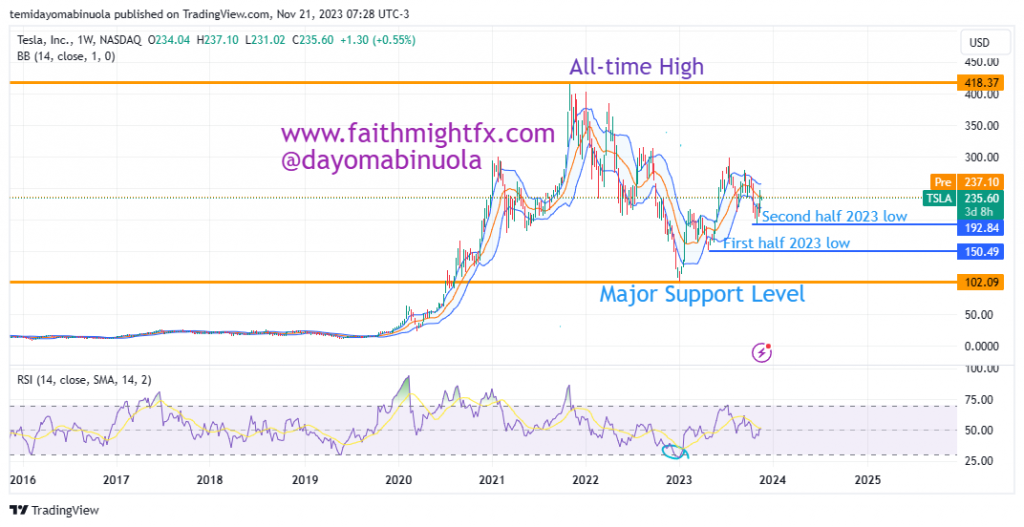

The adoption rate of electric cars in the world has increased over the past few years as it is receiving widespread acceptance across many nations. This month of November, the value of $TSLA has increased by 17.31%, as price has rallied from the month’s low of $197.85. Price of $TSLA is currently below the trendline as we might see price fall in the coming days. On the 4hr timeframe, RSI has indicated that the price of Tesla might fall soon. The next fall might see the price of $TSLA fall below the psychological level of $200.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get companies in your portfolio? Schedule a meeting with us here.