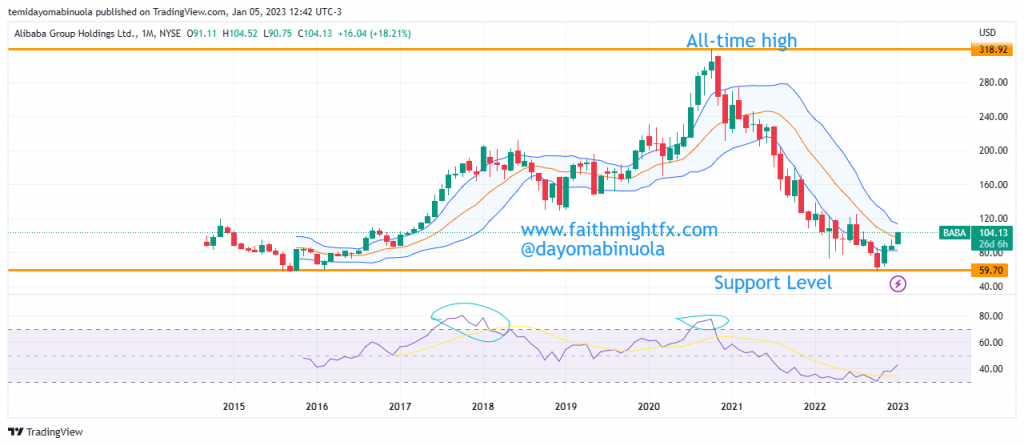

Alibaba had its IPO on the New York Stock Exchange at $94.11 in September 2014. After Alibaba’s share price reached its all-time high at $318.92 in October 2020, the share price began to slump and it reached a 2-year low at $58.26 in September 2022. The last time Alibaba’s share price got this low was in October 2015.

In November 2022, there was a bounce in share price from the support level. This bounce continued into the new year. The first few trading days of 2023 have been promising for Alibaba investors as price has rallied to $103.92 from the 2022 close of $88.45 which is about 17.4% appreciation in just two trading days.

From a technical analysis standpoint, this rally could be a temporary one. Price may slump again in the coming weeks as bears are still in control. On the monthly chart, despite the bearish run for about two years, price is yet to be oversold which means price can still fall further. Our analysis shows that Alibaba’s share price might still fall back to the 2-year low at $58.26.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stock your portfolio? Schedule a meeting with us here