Apple is an American multinational technology company in the USA. Apple is the world’s largest company by revenue, with $383.93 billion in 2023. Microsoft on the other hand is also an American multinational technology corporation, with a revenue of $211.91 billion. These two companies are part of the Big five American information technology companies alongside Alphabet, Amazon and Meta Platforms.

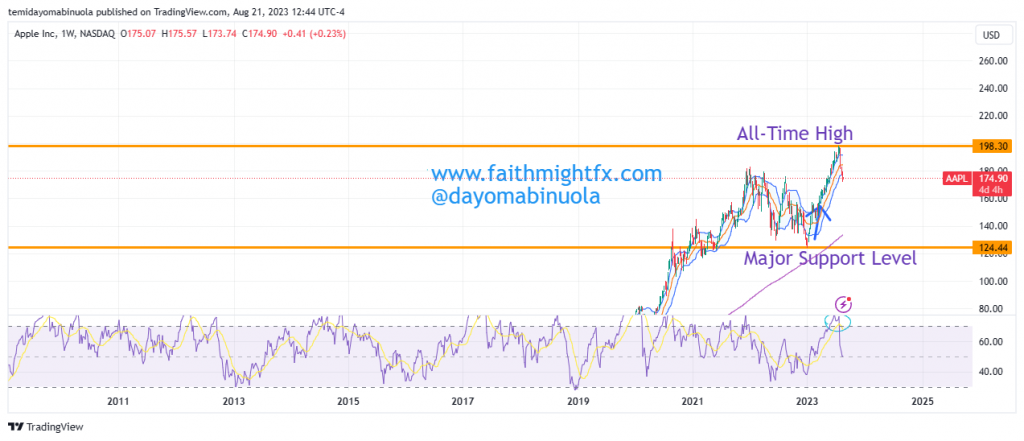

Based on market cap, Apple and Microsoft lead the companies globally with $2.738 Trillion and $2.366 Trillion respectively. The year 2022 was not a good year for Apple investors as price dipped to $124.44, from the highs of $174.44. The year 2023 has shown relief for investors after price jumped from the support level of 124.44. The rally this year has made the share price of Apple reach an all-time high of $198.50.

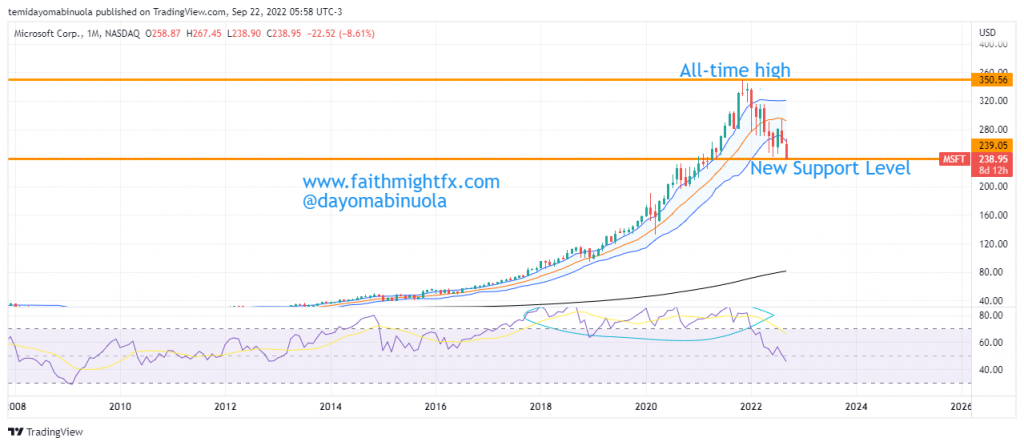

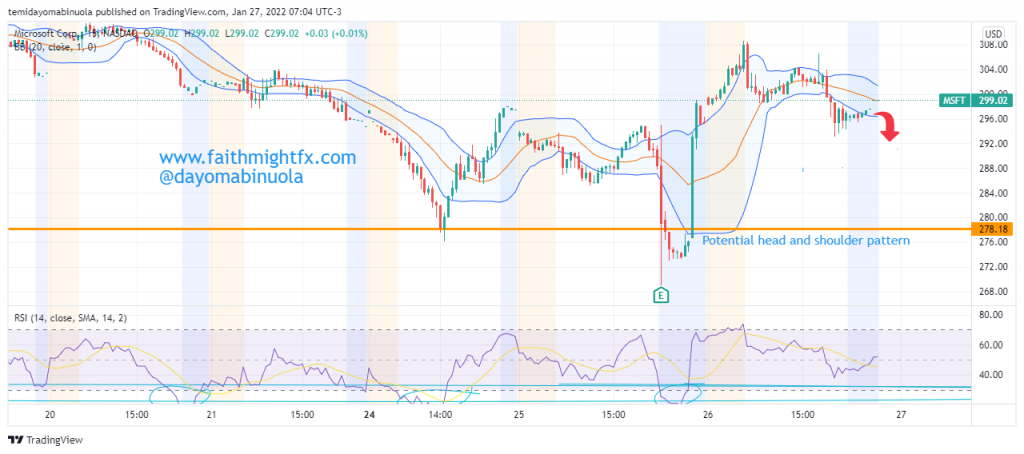

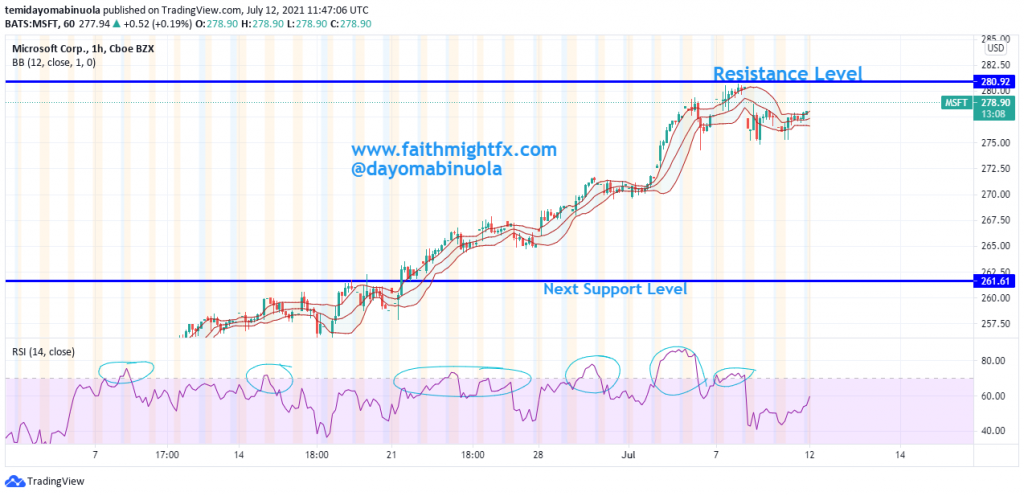

Microsoft also had a major bearish run in 2022 as price fell from the high of $350.02 to $211 in November 2022. The bounce in 2023 has made the share price of Microsoft reach an all-time high of $367 in July 2023. For both stocks, a correction has occurred this month. We might see a continued price rally in the coming weeks as $AAPL cold reach $195 per share from the current $174.74, and Microsoft could reach $340 from the current price of $319.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here.