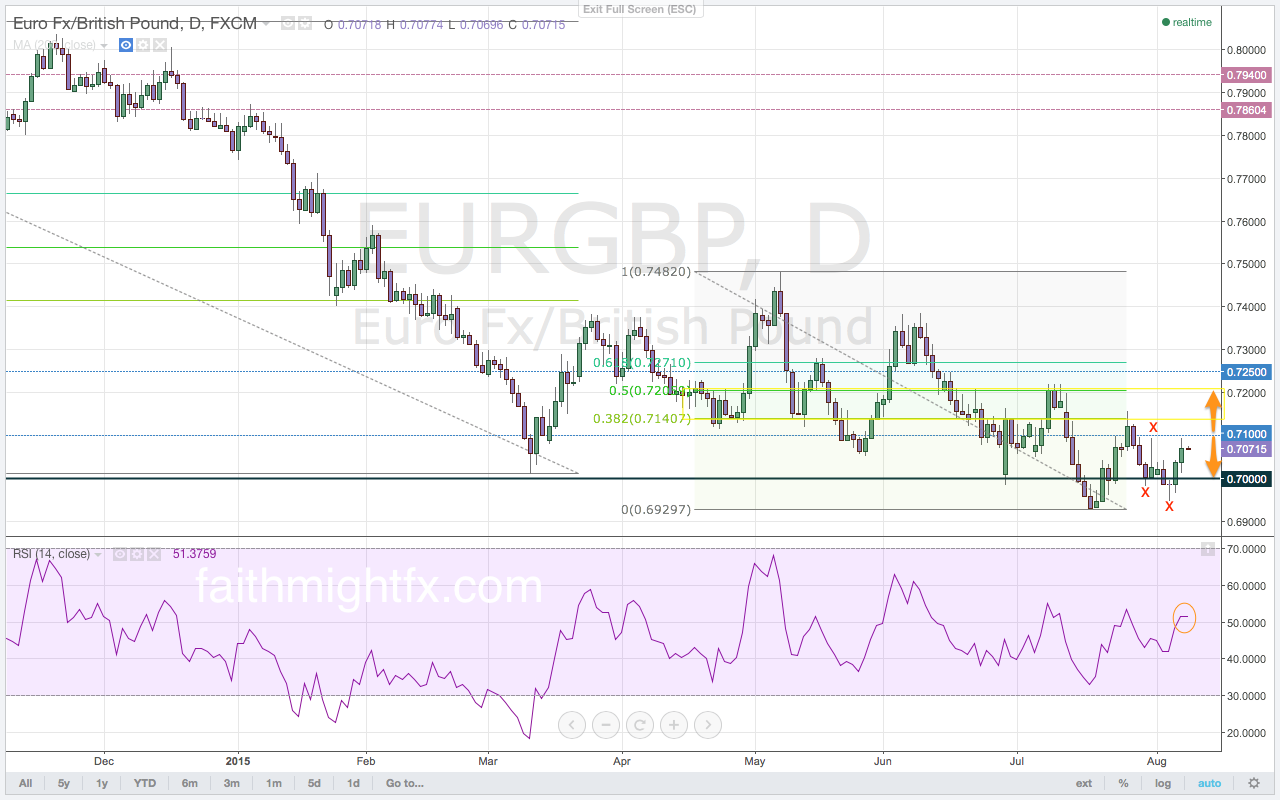

The $EURGBP ended last week back above the key 0.7000 support level. After breaking last week’s low, the EUR/GBP printed another failed low at 0.6949. The first failed low at 0.6984 was a result of a euro relief rally. Just when it seemed as though the $EURGBP was moving lower within its Fibonacci move, the BoE released its dovish policy statement and inflation report. The unwinding of interest rate expectations is now the reason for the latest rally in the $EURGBP. As a new fundamental shift in the markets, this rally looks to carry much more credibility than the last. As such, the failed low looks to target new highs above the previous high at 0.7159. The one obstacle for bulls is the 0.7100 resistance level. The rally into the end of the week held below this important level for another weekly close below 0.7100. When there is a close below the 0.7100 level, there is a subsequent drop in prices. When there is a weekly close above the 0.7100 level, the $EURGBP typically rallies after the subsequent hold of support. So last week’s close looks like a bearish signal for the $EURGBP. However, it is more likely price met profit-taking at the key level after a bullish week. It is expected that the $EURGBP continues to rally in the new trading week to break above the 0.7100 resistance level.

The $EURGBP repeated price action last week from the week prior. The failed low led to a rally that held below the 0.7100 resistance level. However, the new trading week is opening very differently from last week’s open. Last week, the $EURGBP immediately slumped lower as the market anticipated a bullish BoE Thursday and a hawkish BoE in the coming week. Now as the market processes new expectations in interest rates and a more dovish BoE, the $EURGBP opens the new week still elevated just below the 0.7100 resistance level. Momentum on the daily chart is back in bullish territory to start the new trading week. The price action at the open this week versus last week leads to a conclusion that the $EURGBP is looking to break to new highs. If the $EURGBP is unable to make a new low below the 0.6949 failed low, then a rally will set in that targets a new high above the 0.7159 high. It is important to note that a new high can still respect the sell zone for a Fibonacci move lower. However, with a second failure to make new lows below the 0.6929 lows, the probability is tilted towards a move higher above the key resistance level at 0.7100.

This is an excerpt from this week’s issue of QUID REPORT. Subscribers receive my research on all major GBP pairs at the beginning of the week, including access to @faithmightfx on Twitter for daily, real-time updates to the weekly report. AVAILABLE NOW.