Due to the holiday shortened week and it being the very last week of 2015, no Quid Report was published this week. Instead, I am doing a video update to last week’s written report. While I have been on many forex shows, this is my first time hosting a live broadcast. This should be a quick update and review for the week in progress. Enjoy! And please leave your feedback in the comments. Perhaps this will be a new thing for me in 2016.

EUR WTF

The European Central Bank (ECB) lowered its deposit rate this month by 10 basis points to -0.3%, moving rates further into negative territory. Additionally, the ECB extended its current quantitative easing (QE) program well into 2017 while maintaining the amount of bonds purchased each month. The ECB wants to support Europe for as long as possible. They need to. While these changes in policy constitutes huge monetary action by the ECB, the market was expecting an increase in QE not just an extension and slight adjustments of the same program. The market also anticipated a larger interest rate cut than 10 basis points. This was less aggressive easing than the market was actually expecting. For this reason, the euro continues to rally tremendously (Volume 41). Despite the strong rally that gripped the $EURGBP in the aftermath of the ECB monetary policy easing, there had been no real follow through in either direction for the past two weeks. Dips were met with buyers while sellers capped rallies. Consolidation below the 0.7250 resistance level was not necessarily bearish price action. Despite breaking above the 0.7250 resistance level, the $EURGBP was unable to close above it until the Friday close last week. Additionally, the Friday close remains above the key 0.7100 level (Volume 22) and is a higher close than the previous close on the weekly chart. As such, the $EURGBP maintains its bullish bias for the new trading week.

The $EURGBP has to move below the 0.7200 support and psychological level in order to change the bullish momentum. Last week, sellers continued to step in at and above the 0.7250 level. However, the lows were also met with its own supply. Buyers have been stepping in at the lows above the 0.7200 level. After the volatile surge higher, two weeks of consolidation does not signal a reversal. In fact, consolidating at the highs actually signals a move higher, depending on how the new week opens (Volume 42). As the new trading week opens, this nascent bullish signal has manifested as the $EURGBP has finally moved higher to break above the 0.7300 resistance level that had capped rallies for the past two weeks. This explosive move higher will likely be met with profit-taking after the long consolidation. Pullbacks off the highs need to find support above the 0.7300, now turned, support level. Given price action during consolidation, it is highly likely that it will.

Premium trade setups with targets and stops are published in the $EURGBP Outlook for the Week in Volume 43, this week’s Quid Report.

Ode to Canada

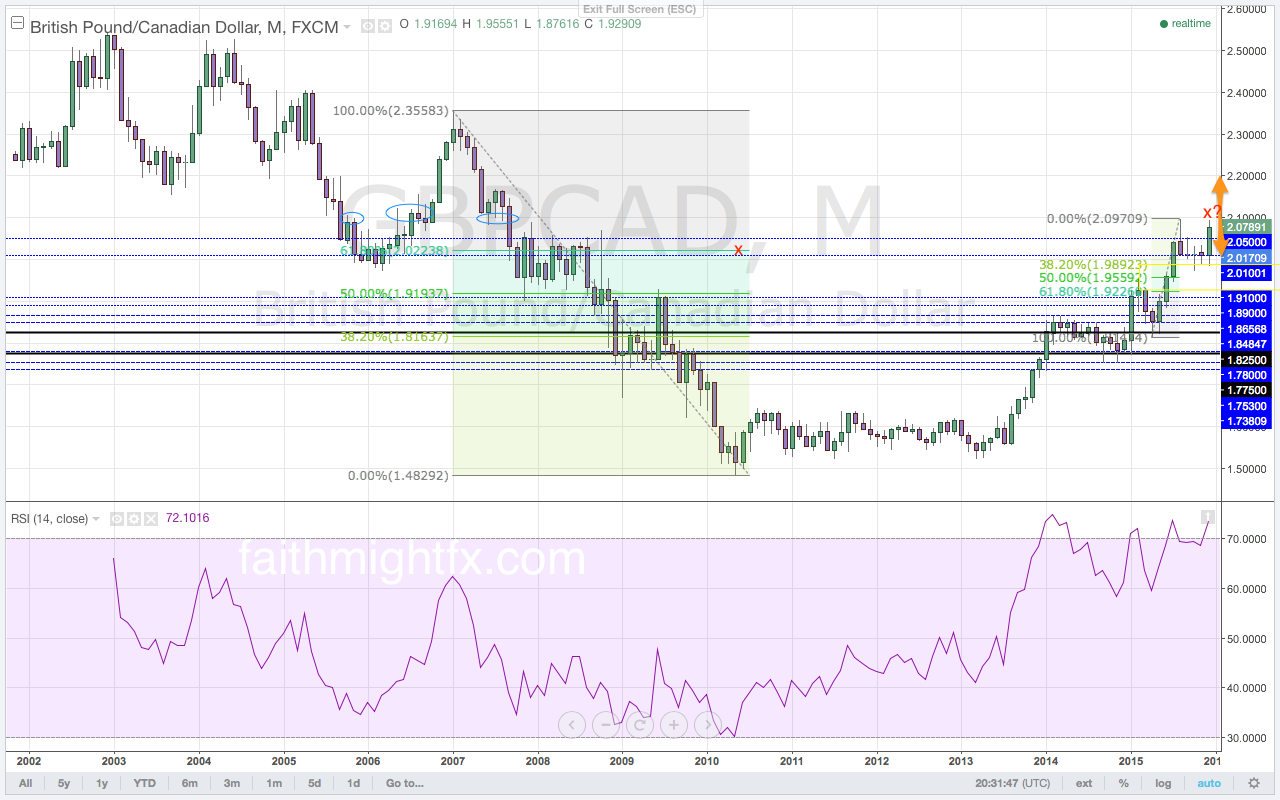

Break the 61.8

This trade could be great.

With the fundies aligned

Long term action divine.

Be patient. The targets

Are a long ways away!

Premium trade setups with targets and stops are published in the $GBPCAD Outlook for the Week in Volume 42, this week’s Quid Report.

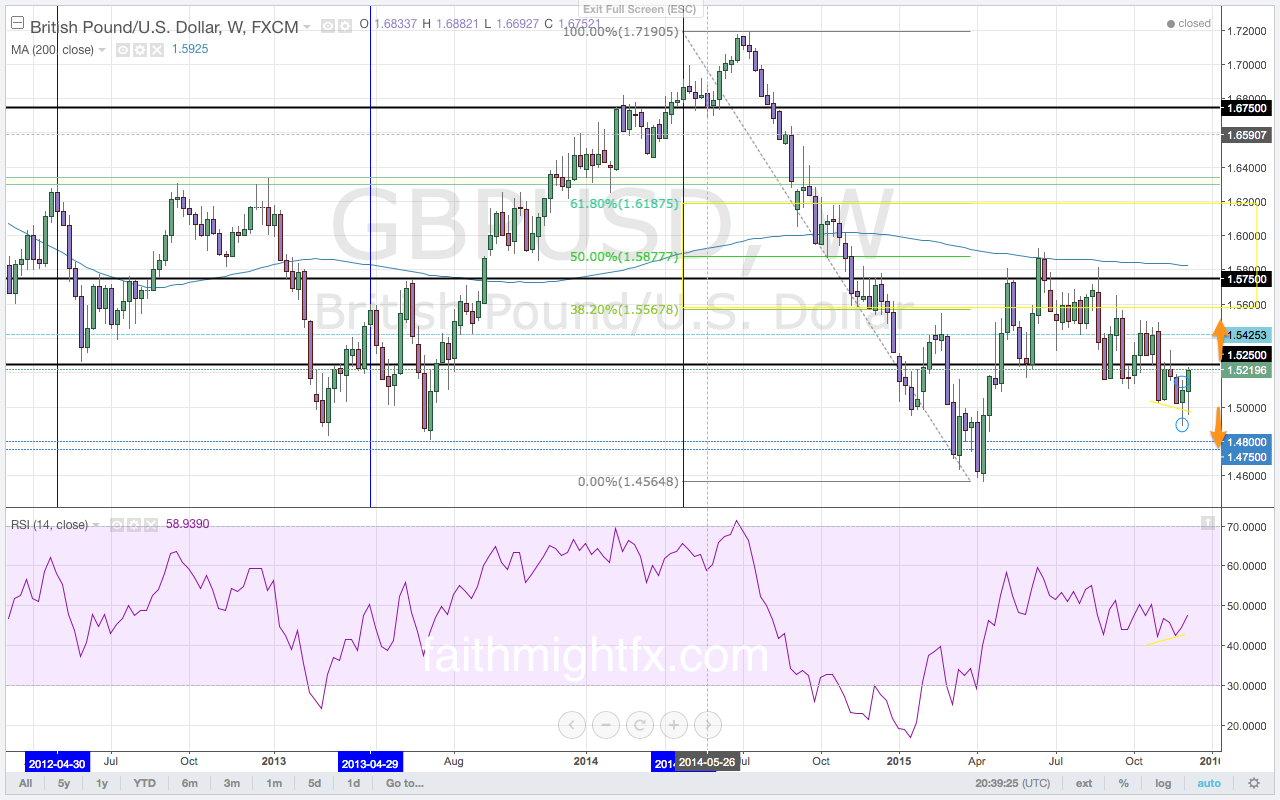

Will They Deliver?

All eyes on the Federal Reserve this afternoon. Will they raise interest rates? Will they sound hawkish? Will the USD rally? Watch this big picture view headed into, and immediately after, the Federal Reserve announcement for future direction in price action for the $GBPUSD.

Premium trade setups with targets and stops are published in the $GBPUSD Outlook for the Week (Volume 42, this week’s Quid Report).

Australian Dollar Defies Commodities

The Australian dollar found strength when the Reserve Bank of Australia (RBA) monetary policy minutes confirmed that the central bank would not move on monetary policy again this year. Though the RBA believes that monetary policy needs to remain accommodative, markets have reacted positively to the decision to leave monetary policy as is. The $GBPAUD has since moved in a down channel on the back of Australian dollar strength. Last week, the weakness in commodities finally caught up with the Australian dollar. The Australian dollar finally weakened in the face of extended new, multi-year lows in commodities. After moving to the bottom of the channel, the $GBPAUD respected support at the lower trendline of the channel. Price rallied higher on the back of the weak Australian dollar. A rally in the $GBPAUD was expected to rally back to the trendline at the top of the down channel. Given the velocity of the moves in commodities, the $GBPAUD managed to return to the top of the channel in just one week of trading. While the $GBPAUD was met with profit-taking just ahead of the key 2.1200 resistance level, the new trading week opened with a move above resistance to 2.1216. However, sellers stepped in at the highs ultimately respecting the upper trendline resistance and moving price back to the key 2.0800 support level.

The top of the channel here has confluence with the key 2.1200 resistance level. For the $GBPAUD to continue to rally, the $GBPAUD needs a confirmed close above the 2.1200 level. Ahead of the channel bottom is first the major 2.0800, now turned, support level. There is also confluence with that support level at the 50% Fibonacci level of last week’s rally. The 2.0800 level remains the key level for direction. With no confirmation on the break above the 2.1200 level, the $GBPAUD actually opens the new trading week bearish even with a Friday close at the highs. The $GBPAUD continues to trade in this channel. As such, after reaching the top of the channel, the $GBPAUD is biased bearish based on the technical developments in price action. Price has already moved to 2.0818 finding support just above the 2.0800 support level. With commodities crashing again as they did this time last year, the Australian dollar should experience another tremendous selloff. However, $GBPAUD price action suggests further Australian dollar strength in the face of weak commodities.

Premium trade setups with targets and stops are published in the $GBPAUD Outlook for the Week (Volume 42, this week’s Quid Report).

My Appearance on FXStreet’s Live Analysis Room

I just had my last interview appearance of the year with FXStreet this morning. I always have fun talking with Dale, host of the Live Analysis Room – the #FXRoom. We talked all things currencies and discussed my market forecasts for the new year.

The biggest takeaway is that the GBP is positioned at at some very critical levels headed into the end of the year. This could set up for some great swing trades in the new year. Take a listen!

The FXStreet article for the interview can be found here.

To receive forex forecasts on the GBP every week delivered straight to your inbox, subscribe to the QUID REPORT today!