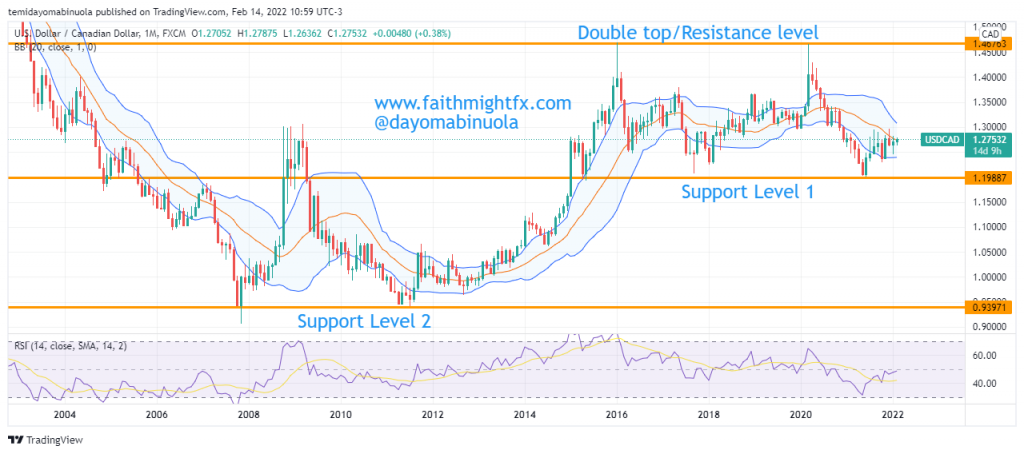

At the beginning of the global lockdown in 2020, the bucks gained massively against the Canadian dollar as prices moved from the ranging market between 1.29582 and 1.33864. This price range was before the lockdown, which lasted for more than 6 months. A breakout of the range occurred in February when the price rallied to 01.46710. That rally was about 150pips. The price of $USDCAD was last reached 1.46710 in January 2016 until the rally before the lockdown. After the lockdown easing, the loonie gained against the dollar which made the price reach 1.20193 in June 2021 after 6 years.

As the $USDCAD maintains support at 1.20103 since last year, a bounce has occurred as the price reached 1.29658 from the support level. Though RSI shows price has been oversold, the bears could still push lower to 1.24754 from its current 1.27472. RSI shows the price has been oversold on the 4hr Chart. Looking at the monthly time frame, the price has been ranging for about 6 months with the bulls more active. The bears might take charge in the next trading days.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get currencies and stocks in your portfolio? Schedule a meeting with us here.