The share price of American media company, Netflix, has been on a rally since May 2022. As of 2022, Netflix had a revenue of $31.6billion with a total number of employees at 12,800. Early in 2022, Netflix lost 200,000 subscribers from its platform and then in June 2022, it laid off 300 employees. The loss of subscribers may have led to these layoffs. Netflix Co-CEO Reed Hastings in June 2022 claimed that the current employee base will grow by 1,500 before the end of 2023.

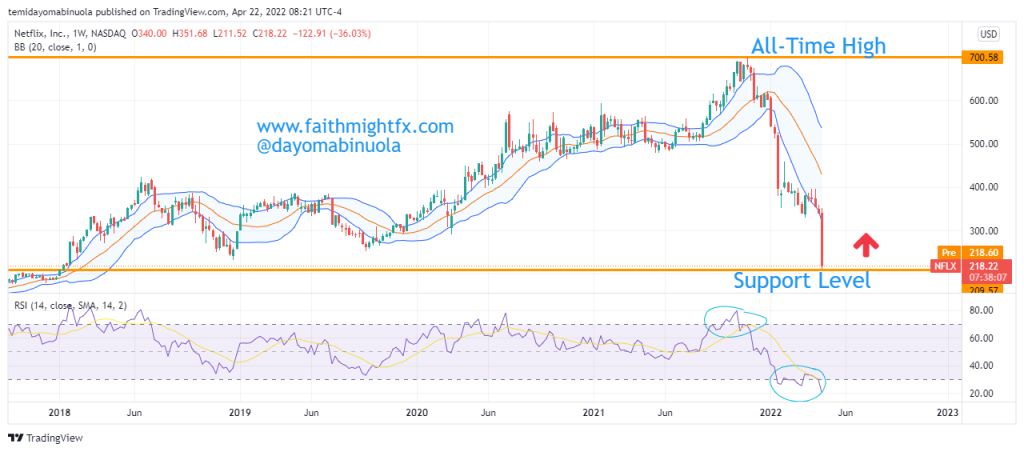

In 2023 alone, tech companies have laid-off 93,000 workers in the US. Some of the numbers are Alphabet 12,000, Microsoft 10,000, Amazon 18,000, Crypto.com 500, Coinbase 2,000, Salesforce 7,000 among others. The current share price of $NFLX stands at $337.50 after a rally from the major support level in May 2022 at $163.02. Prior to the price hitting $163.02, there was a gap down from $331.04 to $245 in April 2022. Since the gap down, price ranged until a breakout occurred in October 2022. This rally has continued for the past 5 months.

The recent rally has made $NFLX recover from the losses it accrued as a result of the gap down in May 2022. We are hopeful price could appreciate further in the coming weeks. The psychological level of $400 might be reached soon.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here