Sterling has been mixed since the announcement of forward guidance giving the Bank of England (BoE) a dual mandate to target both inflation and unemployment. It also means that economic data takes on increased importance as markets parse news to determine central bank sentiment and direction in price action. However, sterling has been mixed in the week after forward guidance was unveiled. Last week, GBP rallied across the board post-announcement taking $GBPUSD to 1.5571 and $EURGBP to 0.8578. In this new trading week, however, GBP has weakened considerably off those highs. The spotlight of this week will be the release of the BoE meeting minutes which will give the market a peek into the central bank’s true sentiment on forward guidance. Given the unanimous vote last month not to increase QE, a split vote threatens to weaken the GBP and increase volatility in the near term.

- The Carney roundup (Forex Live)

- GBP Post-BoE Fwd Guidance: A Buy Or A Sell? (eFXnews)

- Timing Is Always Important (FMFX)

- Bank of England Inflation Report – August 2013 (Bank of England) [PDF]

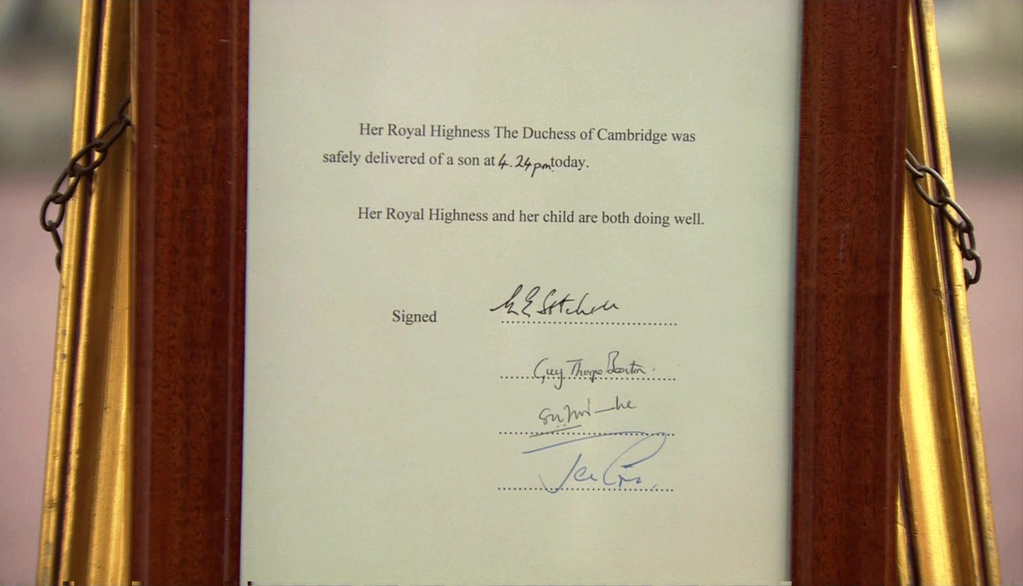

- Bank of England Governor Letter to the Chancellor of the Exchequer (Bank of England) [PDF]

- BoE’s Forward Guidance Cheered by GBP (City Index)

- The mystery of UK slack (FT)

- UK Earning Growth vs. Inflation (Reuters) [CHART]

- New guidance will stamp Carney’s authority on Bank of England (FT)