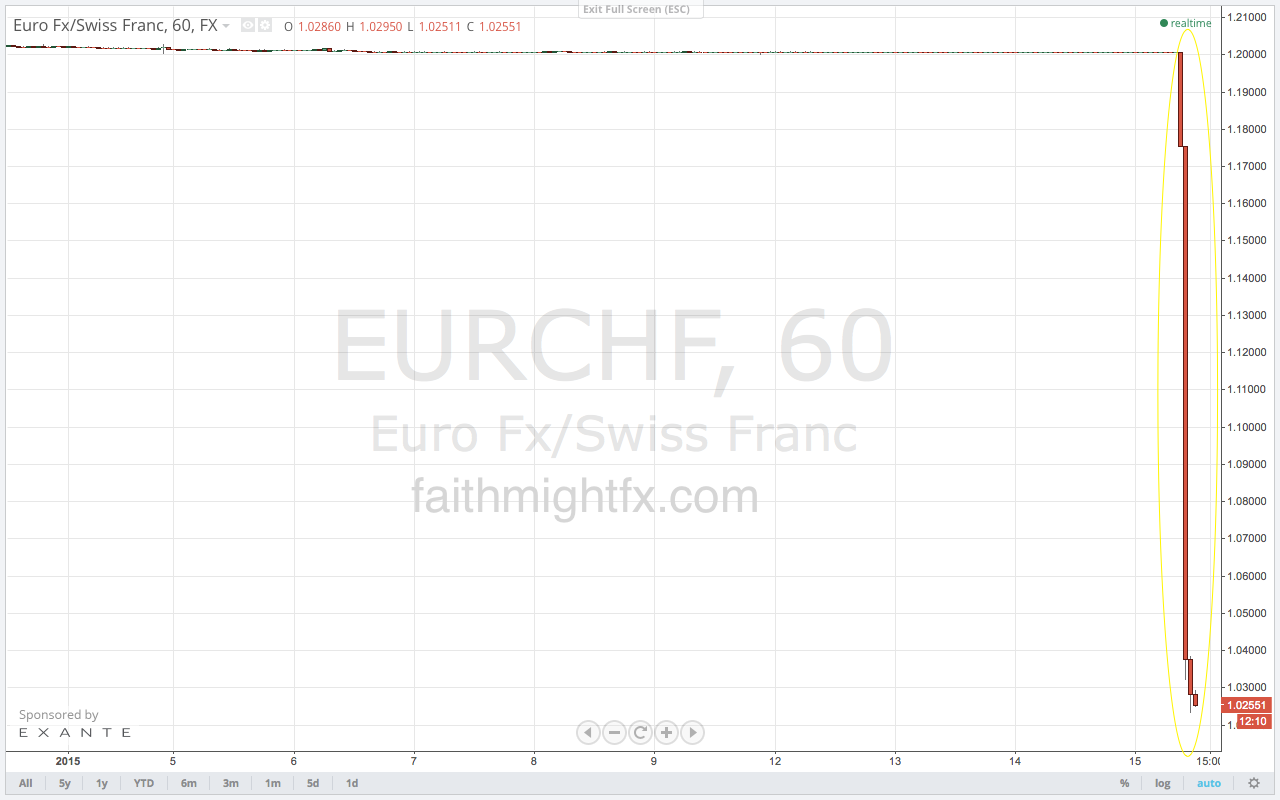

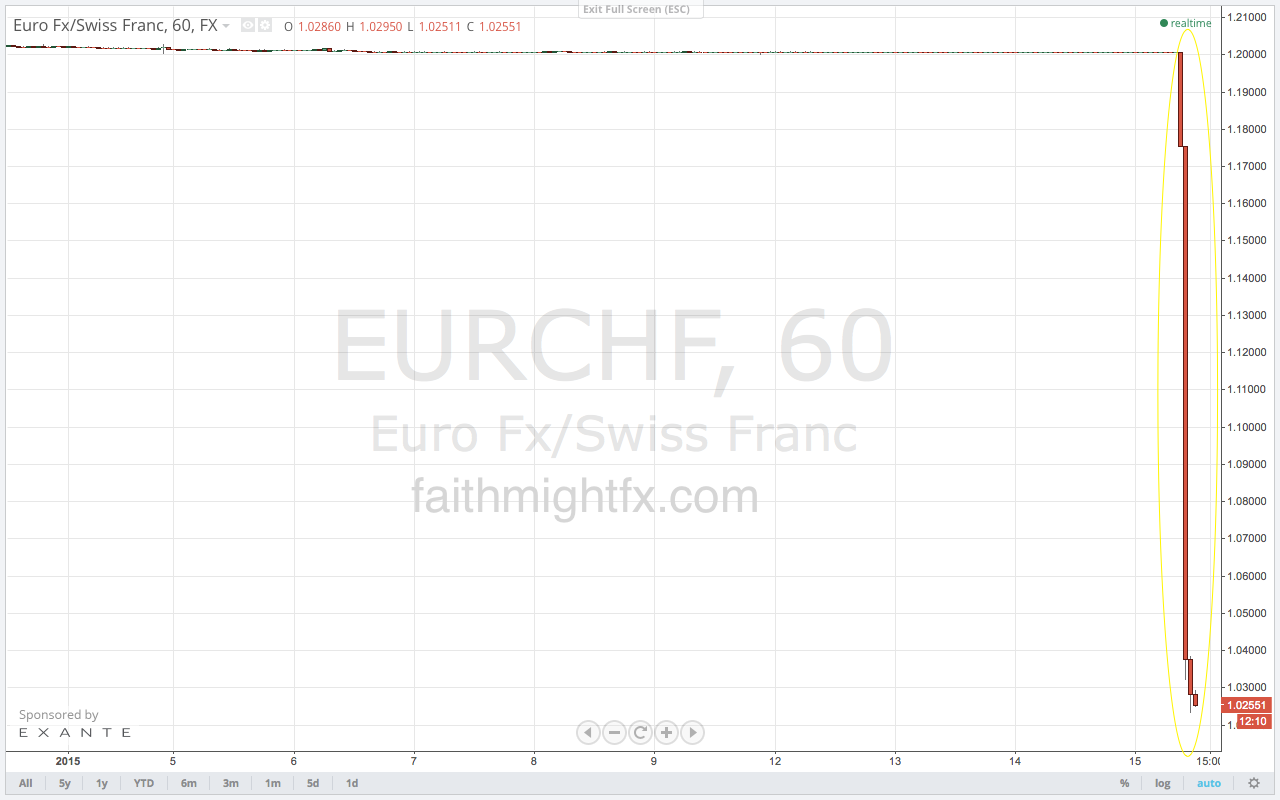

The markets have been ROCKED this morning as the Swiss National Bank (SNB) just announced that they have abandoned the Swiss peg. After 2 years of active intervention in the currency market to hold the $EURCHF at 1.2000, with today’s announcement the SNB has effectively exited the forex markets. This is their 1st monetary policy announcement of 2015 and, while the rate announcement was scheduled, their decision was a major surprise.

The reaction from traders as the decision came down:

And the effect on the CHF pairs has been EPIC.

The SNB also cut interest rates today to -0.75%. With the abandonment of the currency peg, this interest rate cut was absolutely necessary. The CHF has long been a safe haven currency. Switzerland is considered a financial haven and tax shelter for the ultra-wealthy and has a relatively robust economy. During times of uncertainty, market participants buy Swiss francs. So when the financial crisis hit in 2008, the CHF and USD both strengthened considerably. But a strong currency is a stranglehold on the local economy as it dampens exports demand in the face of muted local consumer demand in 2008. The Federal Reserve enacted quantitative easing in response. The SNB combated the markets with a currency peg. With the peg now gone, the SNB understandably hopes that negative interest rates will dissuade the market from buying francs. However, uncertainty abounds, given the epic moves we are experiencing in the commodities markets, and I doubt even negative interest rates will stem the tide of CHF buyers now coming back into the market.

With the European Central Bank (ECB) due to announce their decision on monetary policy next week, “interesting” doesn’t even begin to describe the forex markets at this point. Everyone has a plan until you get punched in the face. Stay nimble traders.

Read also:

You’ll Never Beat Them. Join Them! (FaithMightFX)

UPDATE: The article was updated to reflect the interest rate cut decision.