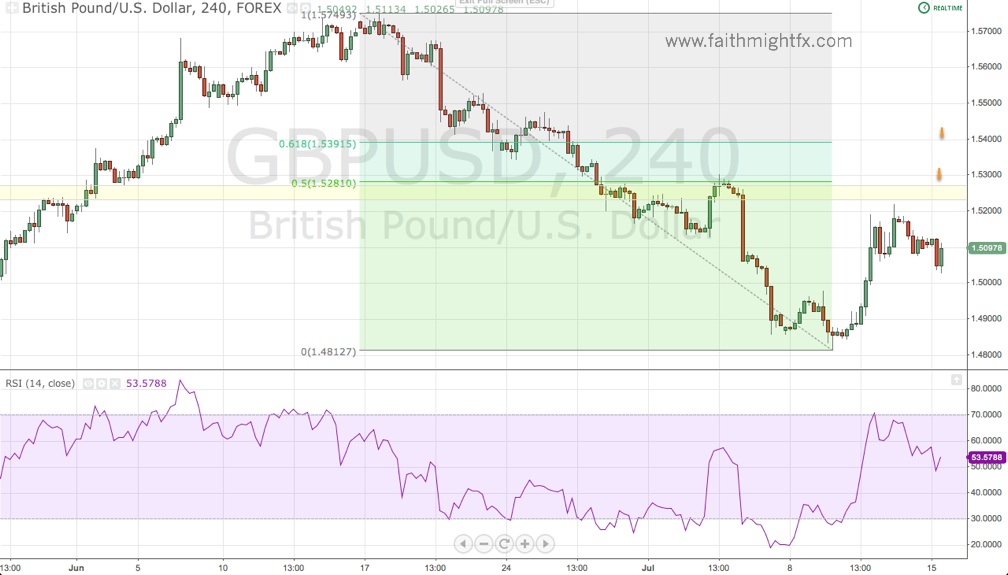

The $GBPUSD rallied back to the support/resistance zone between 1.5230-70. But the rally exhausted far earlier than expected. In fact, offers stepped in ahead of the zone as price topped out at 1.5220 before falling back to 1.5100 level to end the week.

Now at the start of the week, sellers have taken the $GBPUSD below the 1.5075 support level. The early morning bounce in the European session was capped by the former support level and led to further losses to 1.5027 lows.

However, the psychological level at 1.50 is always the big obstacle for cable when we trade at these levels. With the disappointing US retail sales sending $GBPUSD higher above 1.50 (to 1.5115 so far), it is likely now that price may, in fact, rally higher back to 1.5230-70 support/resistance zone and even higher into the Fibonacci levels on the 4 hr chart. This failed attempt lower is likely to be met with more fuel for a corrective rally to new highs this week. Of course, this scenario largely depends on how the market reacts to the slew of US and UK economic data including Bernanke’s testimony before Congress and the release of the Bank of England meeting minutes.

Trade what you see.

Mentioned above:

- Bernanke Talks Down USD (FMFX)

2 Replies to “Sellers Strong But May Need More Time”