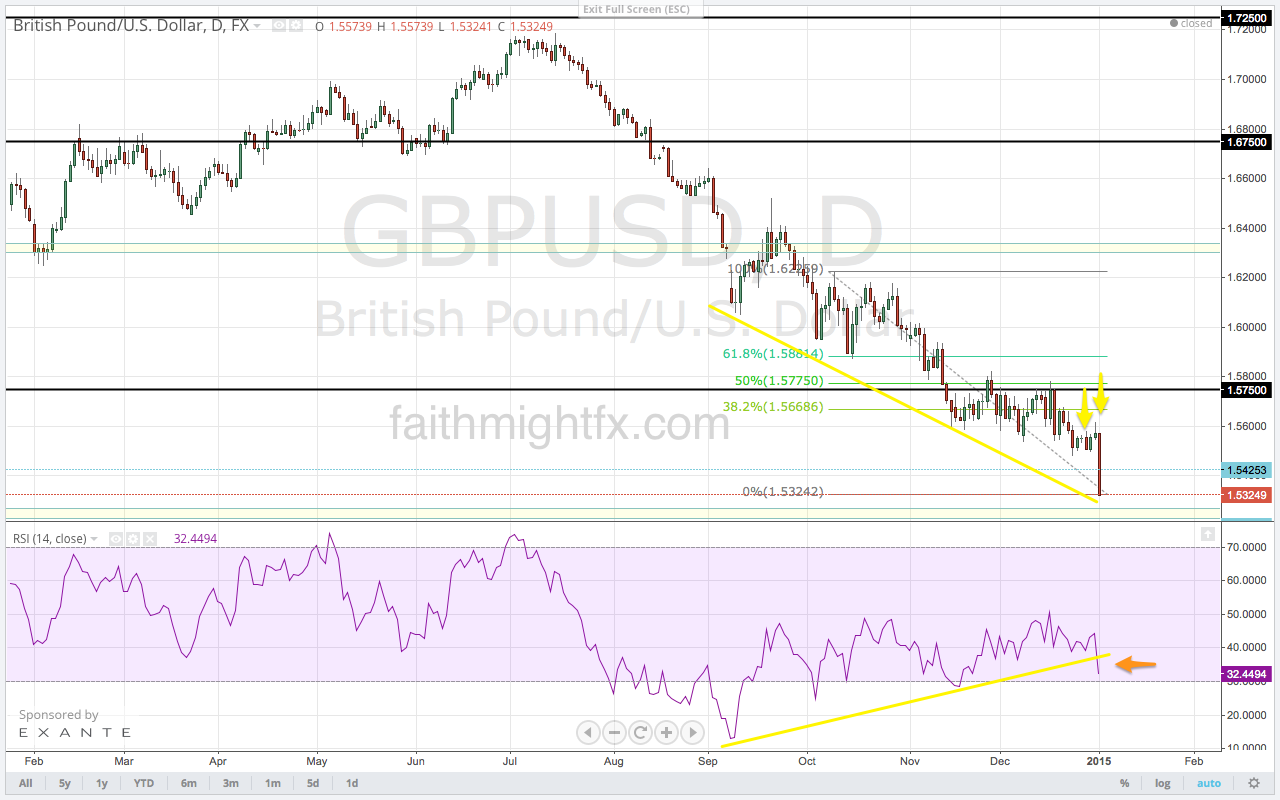

Happy new year! And it certainly has been a good one so far for GBP bears. On the last trading day of 2014 (December 31) and the 1st trading day of 2015 (January 2), the $GBPUSD completely broke down. Economic data out of the United Kingdom has done a complete turnaround from the economic data of 2013. Friday’s manufacturing data missed and sterling broke support nearly across the board. The weakness continued this week with a miss in both construction and services PMI. Both releases are sending sterling lower still against every major currency.

Until Friday’s breakdown, the limited downside was very restricted by the bullish diverging RSI that had been developing since September. But price didn’t care at all about the diminishing selling momentum as $GBPUSD continued to probe new lows. Now that price has broken down again to new lows, we see that momentum is finally following suit. The momentum of Friday’s price action has broken the bullish trendline on the RSI. This break lower in the RSI suggests that $GBPUSD will continue to fall lower. But remember that nothing moves in a straight line. A bounce is very possible as price heads into 1.5150, 1.5100 and 1.5000 support levels. Trade what you see.

Leave a Reply