Apple became the first company to reach a $1 trillion market cap in August 2018 and later crossed the $2 trillion mark in 2020. As of early 2025, it remains one of the most valuable companies in the world, often jockeying for the top spot with companies like Microsoft. Apple has split its stock several times throughout its history. The most recent was in August 2020 when it executed a 4-for-1 stock split.

Apple’s innovation and brand loyalty have been major factors in its long-term performance. Apple began paying a quarterly dividend in 2012. While the company has grown, it also provides regular dividends to its shareholders, making it attractive to long-term investors. A large percentage of Apple’s stock is owned by institutional investors, including mutual funds, pension funds, and hedge funds. This shows strong institutional confidence in Apple’s long-term prospects.

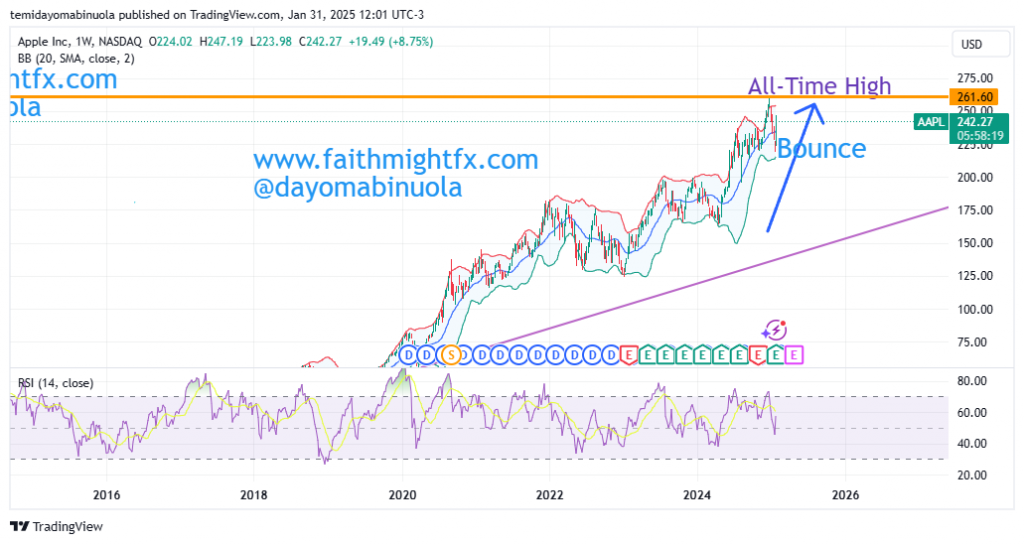

In December 2024, Apple reached an all-time high at $260 per share. The opening price of Apple in 2025 was $249. Price fell to a January low at $218 per share on the 21st of January 2025, which is approximately 15%. Since this low, price has jumped, with the current price at $242.48 as of the time of this writing. We expect price of Apple to hit new highs above the 2024 high.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here

Leave a Reply