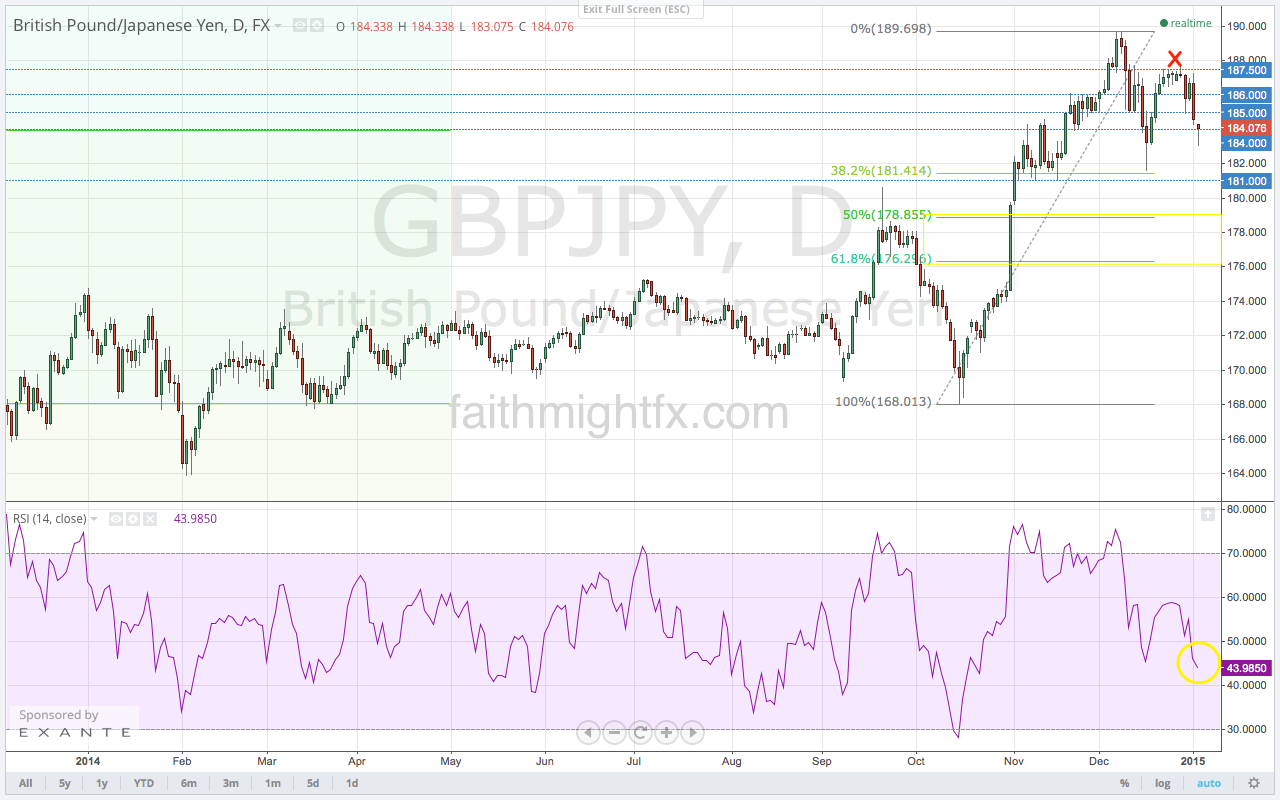

After finding support at 181.41, the 38.2% Fibonacci retracement level, the $GBPJPY was able to stage a rally back to the 187.50 highs. However, the rally petered out before it could make a high higher than the previous 189.69 high. This leaves the bias to the downside for price action coming into this trading week. As such, price has moved lower to close last week at 184.63.

With the RSI already printing a new low on Friday’s price action, price has bias to move lower still. Given that the 38.2% Fibonacci support resulted in a failed new high, I expect that the $GBPJPY make a move into the 50% and 61.8% Fibonacci levels.

However, the 181.00 support level is very formidable. If we look at the bigger timeframes, we can see that 181.00 has maintained support for price even with several false breakdowns when price trades at these current levels. Now that price has moved lower this week, 181.00 is the level to watch.