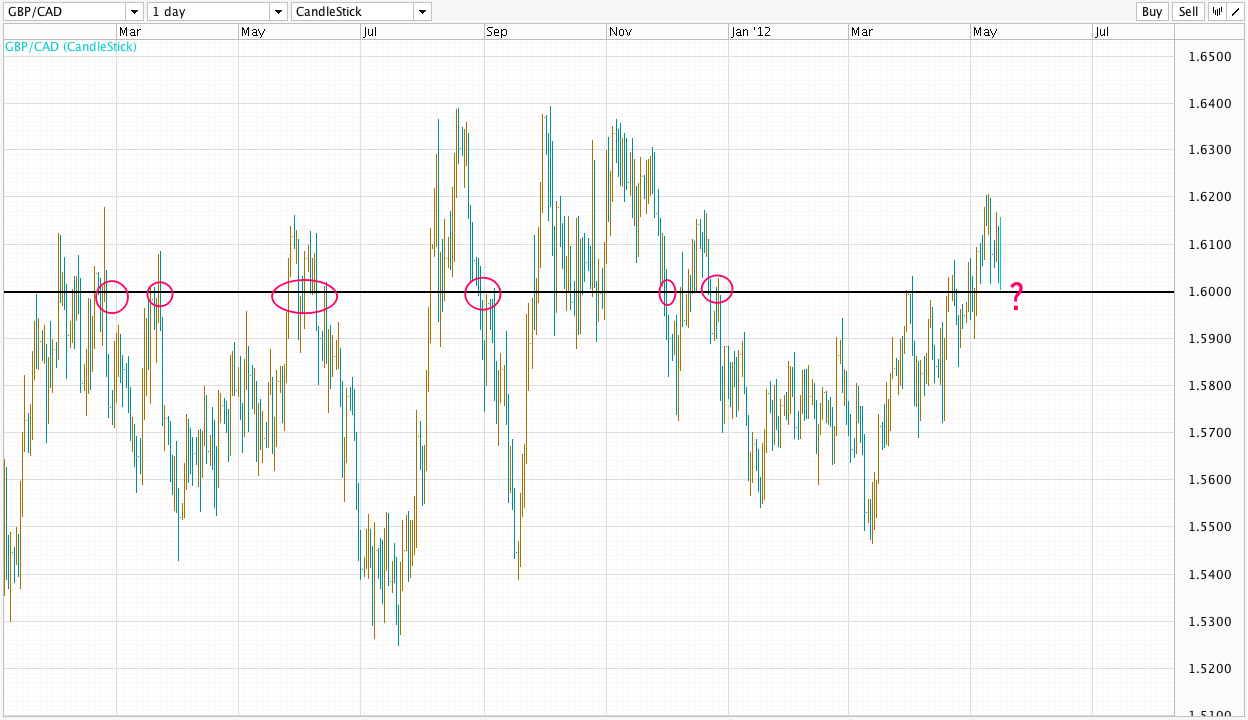

Adam Posen’s flip-flop on QE makes the Bank of England more dovish especially as economic data continues to deteriorate at an alarmingly fast rate. While the $GBPUSD and $GBPJPY have been sterling weak, these pairs’ move lower is also tied to increased risk aversion. Conversely, sterling has remained very robust against the commodity dollars. Both the $GBPAUD and $GBPNZD have already made new highs on the week. Will tomorrow’s UK GDP release be the final nail in the GBP coffin?

- BOE’s ‘Finely Balanced’ Decision Keeps QE Options Open (Bloomberg)

- UK may need more QE, warns Bank of England’s Adam Posen as he steps down from the MPC (The Telegraph)

- Bank of England’s Paul Fisher says no to QE unless crisis hits (The Telegraph)

- WEAK APRIL RETAIL SALES (EconomicisUK.com)

- UK inflation falls to lowest for more than two years (The Telegraph)

- Bank of Japan Holds Off on Easing Policy as Expected (CNBC)

- Originations: Greek Exit Edition (The Basis Point)