If you started this week with a trading plan on a currency pair, good for you. That’s just the first hump. Get a plan. Write it down. Yes, typing counts. Write down what you see the currency pair doing. Write down the key levels. Write down what you will do if it gets to those key levels. So if you managed to get that done between Saturday and Sunday afternoon, I say KUDOS to you! Celebrate.

The second half of the battle is simply trading the plan. Think about your week. Those of you who had the plan, think about your week trading that currency pair for which the plan was written. Did you trade your plan? Did you understand the plan you didn’t write and trade that plan? Did you have to trade your original plan anyway by the end of the week? Was any that successful? Good for you, fellow traders! Some among us had a flawless week. Most of us had mistakes. And yet we all have something to learn and take with us back into the markets on Monday. Celebrate.

My lesson this week is: Trade your plan because nothing beats experience. When the market is bouncing around, it’s easy to loose your way. Go back to the plan.

Sound simple. It’s not. Sound daunting. It doesn’t have to be. Start with a plan. No new words of wisdom today. Just a real profound feeling of pride one gets when you finish a good week of good trading. When you start to execute on that plan with the confidence of experience, you start to become a different trader. Every single time you execute. Get to that point in your trading. Don’t celebrate the money. But by all mean, celebrate a well-executed plan!

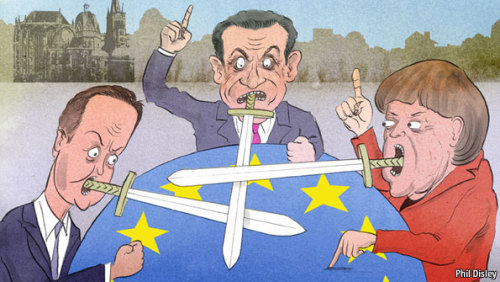

Image credit