Last month, I had the opportunity to speak with Benzinga about its inaugural Women’s Wealth Forum. While we focus on my unique journey growing in this business, it was my first time speaking live with Jason Raznick, founder of Benzinga. I first met Jason back in 2009/10 at the MoneyShow Conference in New York. We would later bumped into each a few times at Stocktoberfest and other events. It’s been cool to see one another grow in our lanes and put in the work to grow your presence and passion into a successful career. Thanks guys for the chat!

Author: @faithmight

-

ON THE AIR with F.A.C.E.

Early this week, I was back on the air with Dale Pinkert. In front of hundreds of live traders in the audience, I walked through my rationale for guppy, a bullish cable, a bearish euro and a continued dumping of the Canadian dollar:

There are ebbs and flows to every market. Trade what you see. Invest with a pro. [sponsored]

-

Will FB kill $FB

The stock was up over $150 last week and that’s if you caught it when it made all-time highs above $30. Of course, we all know that $FB fell much lower just before making what has become the first in a series of all-time highs. That drop in $FB took it below its IPO price. In the good old days of 2013, Facebook gave FB bulls the green light as it proved that it could, and will, monetize its mobile native app. And with that, $FB exploded. It’s been an incredible run since those 2013 highs. If you are like me, you grew up in social media on Twitter. Though I resisted, once I got on Facebook, I got it. And I get it. I spend such an inordinate amount of time on Facebook that I do not allow its notifications to light up my phone. Or send me email, even though those always seem to leak through. So $FB has made a lot of people a lot of money.

This rally has been so great because Facebook has been very good for $FB. And we took some profits in 2017 as a result. But this news about Cambridge Analytica is something a little more sinister. While $FB doesn’t give a fuck about you, we still do hold Facebook to a much higher standard of civility and responsibility. Because I use Facebook. A great deal. We all do. I don’t mind them have my data as long as they keep it safe. Make some money for your efforts, sure, but don’t sell your soul. That’s what this trump-russia-facebook triangle feels like. But maybe Facebook had no idea they were selling data to foreign spies. But if it comes out that they did, the markets may not take that news so lightly and $FB can sell off.

My client told me that we may not know if prices fall until the release of the next financial report. But the price action told us far sooner that that. This was the chart yesterday (Monday close).

$FB has opened today below $168. The Fibs are coming up next. To be sure, markets will let Facebook know that it has a responsibility to be responsible. Which, of course, is very subjective. There are ebbs and flows to every market. Trade what you see.

Or learn with me. And invest with a pro. [sponsored]

-

Equities Get Healthy

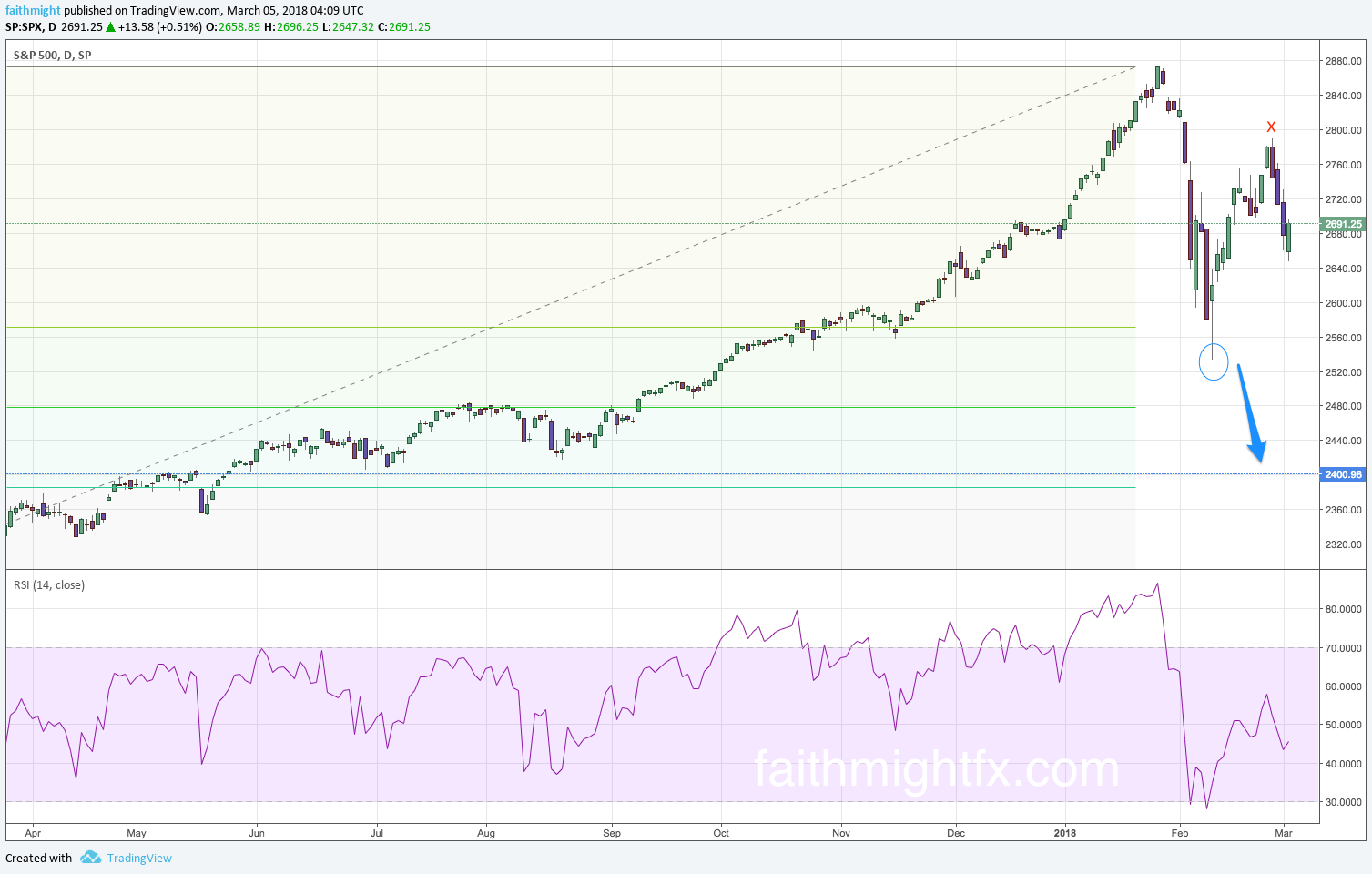

The stock market finally took a hit. The S&P 500 ($SPX) was down as low as 32% from the recent highs this year. A dip that finally really mattered still found buyers and equities attempted to move higher last week. However, 2 weeks ago it the first time that a buying frenzy after a big dip did not result in a new high (a price higher than the previous high price). This is a technical signal that may foretell a move much lower can occur for the U.S. stock market ($SPX).

Now before you starting getting hysterical about lower stock prices, your long-term perspective becomes so critical when assessing whether current price action should actually prompt a response in your portfolio. If you positioned in this blue area, then this recent dip probably doesn’t bother you. However, if you have new money to put to work, it is important to pay attention to where equities make their next move.

As the Federal Reserve welcomes a new chairman and the markets grapple with possible trade wars and a ballooning fiscal deficit, make a plan for what to do with a $SPX chart at much lower levels. Many fund managers and traders alike, myself included, have been waiting patiently for equities to get healthy again. But trying to catch a bottom in a correction this deep will feel scary. However, at the right levels, swing traders will be right back in these markets again. The buyers will return. Be healthy, and smart, enough to see the opportunities.

There are ebbs and flows to every market. Trade what you see. Invest with a pro. [sponsored]

-

Buy The Right Dollar

The $GBPNZD opened the new trading week challenging major support around the 1.8931 level. It even managed to crack below the staunch zone of support as the new trading week got underway. This support level has been challenged by the $GBPNZD numerous times in just the past 6 weeks. But if you look out to the daily chart, the 1.8931 level was also important support back in December 2017. As one of those old trading adages go,

“If price is knocking along a certain level long enough, eventually something gotta give”

This is an interesting time in market fundamentals. The markets are starting to pay more attention to interest rates. As political uncertainty increases, the markets seem to be reverting to the familiar: its relationship with interest rates. With one of the highest interest rates of the major currencies, the New Zealand dollar has been quietly finding buyers on every dip. Even as the Great British pound has found new strength against the Canadian and Australian dollars, it is has not enjoyed the same strength versus the New Zealand dollar.

Since the market opened this week, the $GBPNZD has bounced off this support zone to rally over 100 pips during the Monday trading session. Now that the $GBPNZD is back at the top of its range, kiwi buyers may step here. Watch for $GBPNZD range traders to also step in as 1.9080 has become a first level of resistance for rallies in the $GBPNZD. A break above 1.9080 opens the way to the resistance level at 1.9200.

However, as the fundamentals continue to favor the higher-yielding currencies, watch the $GBPNZD within this range. A final crack below the support zone, will introduce fresh buying momentum in the New Zealand dollar and usher in a deeper correction of the recent $GBPNZD rally (on the bigger timeframes).

-

Twitter GOLD?

I thank God for my follows. I follow great people on twitter. Reading through the news and got this awesome retweet from @AdamPosen:

6/

What else did I learn?In relative terms, China just does not export much steel and aluminum to the US

• $1 billion of steel

• $1.8 billion of aluminum(tbh, I did know that already. It’s because of massive US AD/CVDs already imposed on China’s steel and aluminum) pic.twitter.com/hz0CPNR9oX

— Chad P. Bown (@ChadBown) March 5, 2018

Read the entire thread. And then let’s talk about the Canadian dollar. The loonie is swooning. It’s been weak against the Great British pound all year. But today’s market open weakness seems buttressed after the announcement of the trump’s steel and aluminum tariffs.

The $GBPCAD hit new highs today. New highs that are plowing through the 123% Fibonacci extension and a psychological level at 1.80. Today’s new highs are finally confirming the near-double bottom off last year’s (2017) low.

And to really look at the engine of this new shift in Canadian fundamentals, a girl has to look at the $USDCAD. Of course, there are new highs there too.

Momentum has plenty of room to build. And these are large timeframes. Of course, price won’t move in a straight line but we like the trend potential in the loonie.

There are ebbs and flows to every market. Trade what you see. Invest with a pro.

-

ON THE AIR with F.A.C.E.

Happy new year to the Forex Analytix team! This team of traders are experts and veterans in forex trading. Many of them I have been following for many years on Twitter (@nictrades, @spz_trader, @forexstophunter) and even before there was a Twitter (@pipczar). But the F.A.C.E. community is also full of many expert traders as well as new traders. So when I am asked to come on the show and discuss my views of the market, I consider it quite an honor. The respect, questions and great feedback I get from this team and audience makes it such pleasure to return.

Dale has such great timing as I made my first 2018 appearance on F.A.C.E. right before the Great British pound went on this monster breakout today. I revealed a few secrets that even Dale admitted he hadn’t heard from me before on his shows. The specific levels have been left far behind after Wednesday’s price action but the trading principles I discuss can be applied even now. Enjoy the show!

-

New Year, New Markets

Happy new year! It is 2018 and the only market that doesn’t sleep now is the cryptocurrency market. This is a brand new market being created right before our very eyes. What a time to be alive! No matter the asset or investment vehicle, human nature still reigns supreme. And in a pure market where human nature reigns (and not algos), technical analysis works so beautifully. But if you trade based on the news, you’ve been in for a wild ride. While the king of cryptos is Bitcoin ($BTC.X), 2017 saw an explosion in blockchain innovation that allowed many other coins to be created by just about anybody. This explosion in coins led to an explosion in wealth creation as buyers and sellers raced to the markets. Traders, investors and techies from the West to Zimbabwe have been making money in cryptos and everybody wants in.

Seeing the frenzy for information, I decided to host my first investment event, “What is Bitcoin, Anyway”. I rescheduled this event 3 times since September. I was originally going to talk about the importance of investing. (*yawn*) I forgot to order food. I also forgot to send out invitations. It was my first event! I was concentrating so hard on getting the talk and presentation right that the event production went right out the window. LOL oh well. Thankfully, my office is in a WeWork so the venue hid my blunders well. I had a good audience and the presentation was so well received that I was asked to do another.

Yes, I will have another crypto event despite the crash in cryptocurrencies right now all across the board. While I understand the hesitancy in buying cryptos, I also think it is irresponsible to write off any investment opportunity due to ignorance. However, it is also irresponsible to invest, in a market this new and still unregulated, alone or naive. Do as much learning as you can. Read, watch and ask questions. Hire an investment adviser. Get a mentor. Every investment story is the same, so always do your homework — trade what you see, not what you hear.

And stay tuned for my next event, First Friday Pasadena. February is the #crypto edition?

-

Is It Really A Bloodbath?

Cryptos are finally making news today and not because of the a 3,000% move in a few weeks. No, every digital coin and token is down today and down BIG. It’s blood in the streets now that Jamie Dimon has repented for ever calling Bitcoin a fraud. Markets can be so ironic sometimes that it is poetic. Warren Buffet has to be grinning from ear to ear as he said it was going to end very badly anyway. He must also be buying but that’s a musing for another day.

Well, thankfully, I don’t trade off the news. You’d be in a pickle right now as to what to do with all those coins and tokens you bought yourself for Christmas. Confess now. We all bought some. The smartest of us only sold and even then, we sold too early.

The Fibonacci levels will tell you something different on different charts. So I’ll zero in on ethereum because ether is the only coin falling right now from all-time highs. Many of the alternative coins, the forked coins and Bitcoin itself have been consolidating lower since the 2nd week of January 2018. With the euphoric year that 2017 was for cryptocurrencies, you have to love the narrative already shaping for what 2018 will be. But looking at this chart, is it really a bloodbath yet?

-

What’s Your Trading Style?

A fellow trader asked:

what do u mean by style long term short term swing trade scalping ? ?

For me, trading style ultimately refers to preferred timeframes. Swing traders look at bigger timeframes, typically no less than a 4hour timeframe. A day trader will look at minute timeframes, typically no more than 60 minutes. Of course, the details vary from trader to trader.

A swing trader is comfortable holding a trade overnight and doesn’t want or need to be active in the markets every single day. A swing trader is looking to capture much larger profits on a given position. A day trader couldn’t conceive that. A scalper is very satisfied with smaller profit targets and only wants to be in a position for a few minutes/hours.

Position sizing becomes interesting when you start to look at the 2 distinct styles. Swing traders will typically scale into (and out of) a position to take advantage of the best price the market is giving. Because we are in a position for several days, swing traders take advantage of a market action that provides multiple optimal price points. Scalpers tend to trade their entire position size because they expect to exit the position relatively quickly. So in order to get their desired reward, they are willing to put on their entire position. It seems risky to a swing trader but holding a position for several days seems very risky to a day trader. It’s all about style.

A scalper and swing trader could employ the same trading strategy (Fibs, pivots, support & resistance) but their styles will have very different outcomes. Figure out and trade your style. Most traders pick one. Some traders can trade both ways. Know what works for your personality and lifestyle. Then the hard part: trade thyself.

Originally posted here on the blog on July 1, 2014