Seasonality is an interesting trading edge. Like correlation, it works until it doesn’t.

Taking a closer look at the $GBPUSD seasonality pattern: the pair rallies for the month of April, finds a top at the end of April, and sells off for the month of May. It’s pretty incredible the reliability of this pattern. We find it playing out perfectly in the past 3 years.

Every May since 2010, $GBPUSD has sold off hard to the tune of 500 pips or more. By the end of May, cable puts in a bottom. Conversely, every April since 2010, cable has rallied only to top out at the end of the month. This April was no different. Why should this May be any different?

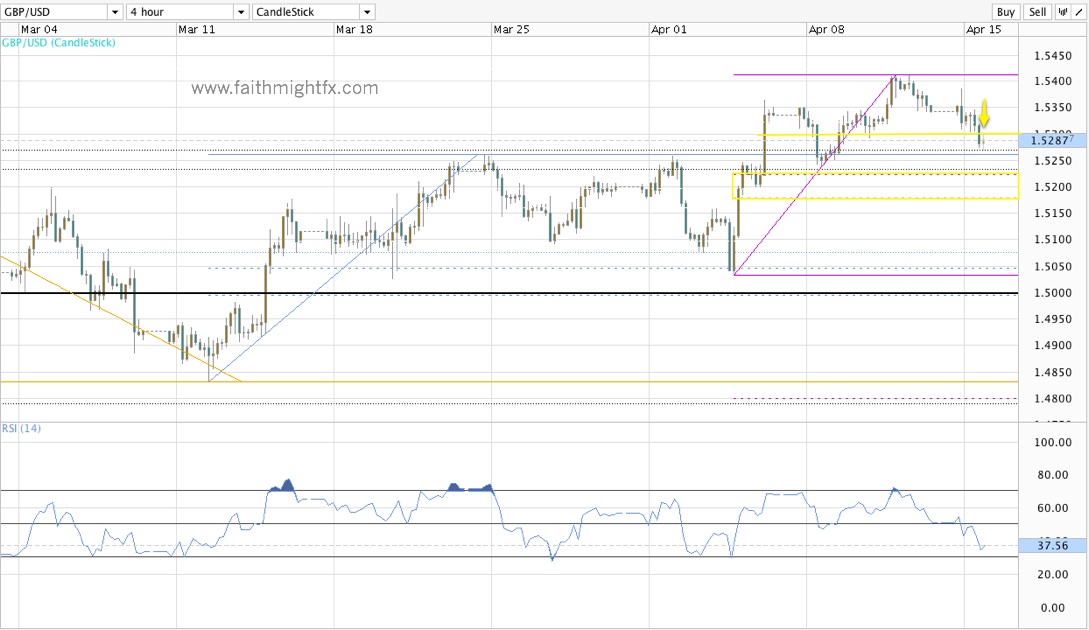

So here we are in the 1st trading week of May and since topping out in April at 1.5606, $GBPUSD has put in lower highs and lower lows. The swings have been very wide and very volatile. Each new low has been met with bids that push price right back to highs. But this type of volatile price action is very characteristic of cable when it is experiencing a change in sentiment and, therefore, direction. What is important to me is that cable is carving out the very definition of a DOWN trend, lower highs and lower lows, despite the volatility.

Looking at the big picture, we see where cable was going and why on the rally. I’ve laid out that bullish scenario all April long (see below).

With sellers back in the picture, the 1st target to the downside is a massive support zone on the weekly chart. This zone sees long term support at 1.5250/30, the 50%Fibonacci level of the April rally at 1.5213, the 61.8% Fibonacci level at 1.5118, and the 1.5075 support level that buttressed the rally to 1.5600. A break below all of these levels would certainly accelerate price lower. The 50% Fibonacci correction to 1.5606 suggests that cable is looking to put in a new low below 1.4830. The seasonality trend says we could very well get there. Here’s to May!

Read Also: