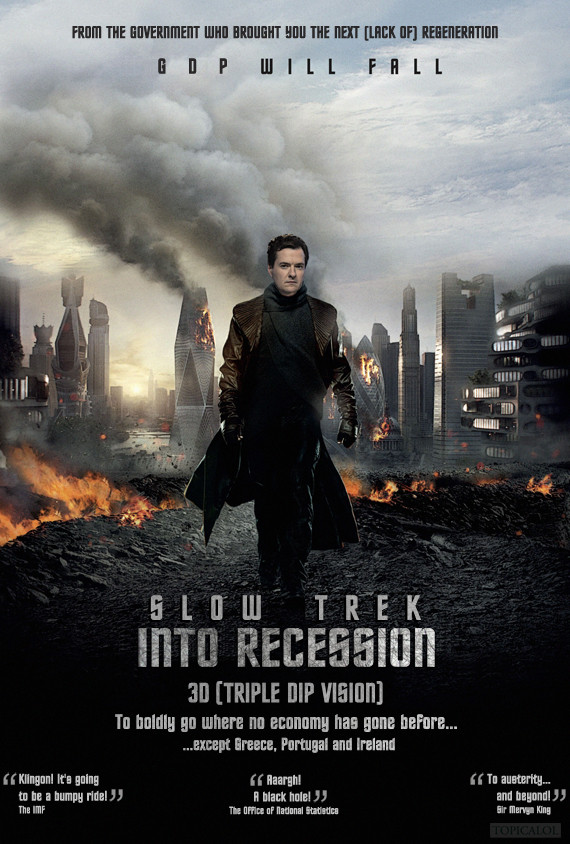

The new fancy buzzword in sterling markets is forward guidance and Carney is supposed to deliver a hardline version of it after the Bank of England (BoE) announces its decision on monetary policy on Thursday. However, there are mixed views on how markets will react. Some expect $GBPUSD to move higher to challenge to the 2013 highs. Many others, on the other hand, believe the $GBPUSD to move back below 1.50 in reaction to forward guidance. Given sterling’s reaction to the soft forward guidance delivered after last month’s BoE meeting and in light of a progressing economic recovery in the UK, it appears that anything is possible. It quite likely sterling satisfies both bears and bulls in the 2nd half of this year.

- State Of Play: Carney’s BOE May Go For Stability, Not Stimulus (eFXnews)

- Savers hammered as long-term interest rates hit nine-year low (The Telegraph)

- The Runway Should Be Rocky For The Pound Until The August Inflation Report (Seeking Alpha)

- Sterling After UK GDP And Ahead Of Next Week’s BoE (Bloomberg via eFXnews) [VIDEO]

- UK GDP Tapers Pessimism, not QE (City Index)

- A very stable cable (Forex Live)

- Standard Bank sees GBP/USD below 1.50 on BOE guidance (Forex Live)

- Why Consider the WisdomTree United Kingdom Hedged Equity Index (WisdomTree) [PDF]

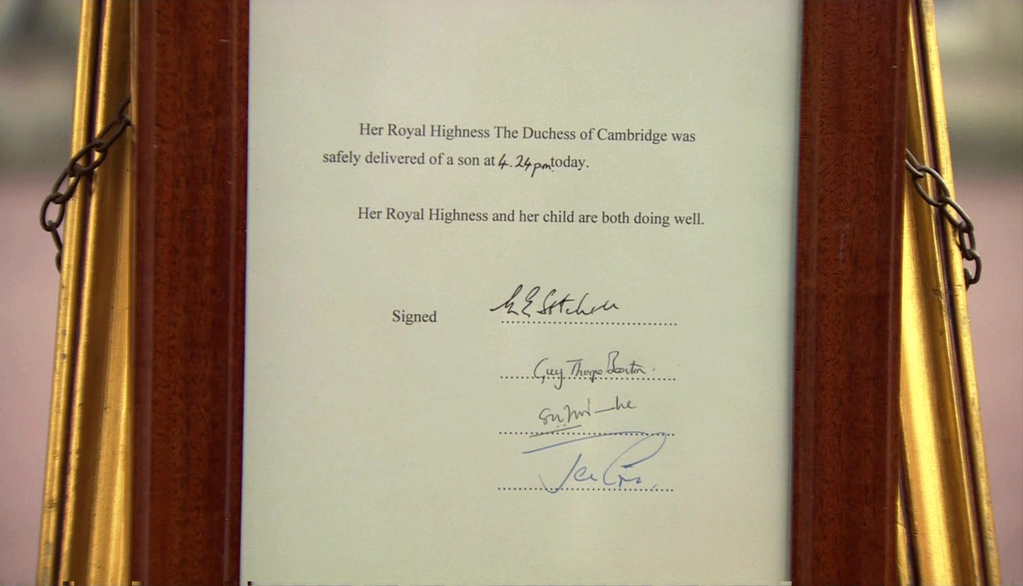

- UK economy ‘on the mend’ after 0.6% growth, says chancellor (BBC)

Image credit (Read the article too)