G8 summit leaders enjoyed their weekend in a retreat, unconference with very mixed reaction from markets. The open was spent violently going nowhere as cable is still bouncing around 1.58. No momentum or conviction on either side. Sounds like opposing G8 stances, doesn’t it. As the news week gets underway a huge drop in UK inflation that has hit its lowest levels in over a year. Less inflation leaves the door open for more QE at a time where economic data has not been supporting the hawks at the BoE. The market looks ahead to the BoE minutes release tomorrow to see if recent hawks have new dovish feathers.

- The Calculated Mover: EURGBP (DailyFX)

- GBPJPY, Pivot Points Standard (Chart.ly)

- GBPUSD Update (50’s Blog)

- Step Aside British Pound, Japanese Yen Returns As Safety Currency Of Choice (Seeking Alpha)

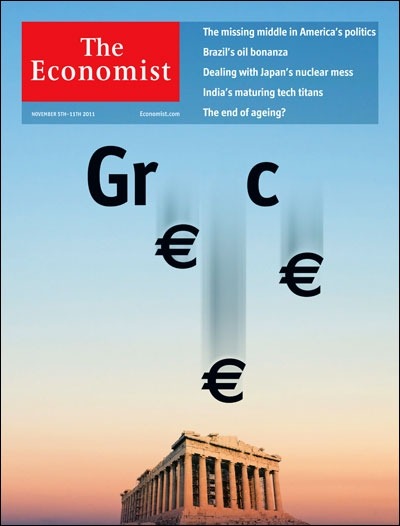

- British economy may ‘never quite recover’ from a severe Euro collapse (The Telegraph)

- IMF tells UK to consider rate cut to boost growth (BBC)

- UK’s Cameron calls for euro contingency plans (Reuters)

- Statement from G8 world leaders (Reuters)

- G8 summit: Leaders must make friends at the G8, says David Cameron (The Telegraph)