ETSY

On 01/03/2022, we forecasted that Etsy will appreciate 100 points. Throughout March, Etsy’s share price has been ranging between $117 and $164. On a longer timeframe, this represents a consolidation that could lead to a bullish breakout as we have analyzed. Etsy is still in the range but the breakout is still to be expected.

EURUSD

On 07/03/2022, our analysts forecasted that EUR will gain against the USD. The expected target is 1.12062 which is a gain of 310 pips from the price it was on the day it was called. Since the call, the pair has hit 1.11854 which is about 289 pips gain. Price has corrected but the bullish trend hasn’t lost steam and the forecasted target is still in position.

COMMODITIES

In March, Gold, Silver, and Oil saw a bullish rally that was largely due to the Russia-Ukraine conflict. We forecasted that the rally will not last and will eventually fall. Two days after our forecast Gold fell from $2070 to $1928. Silver fell from $25.555 to $24.650. Oil also fell from $119 to $100, where it currently is.

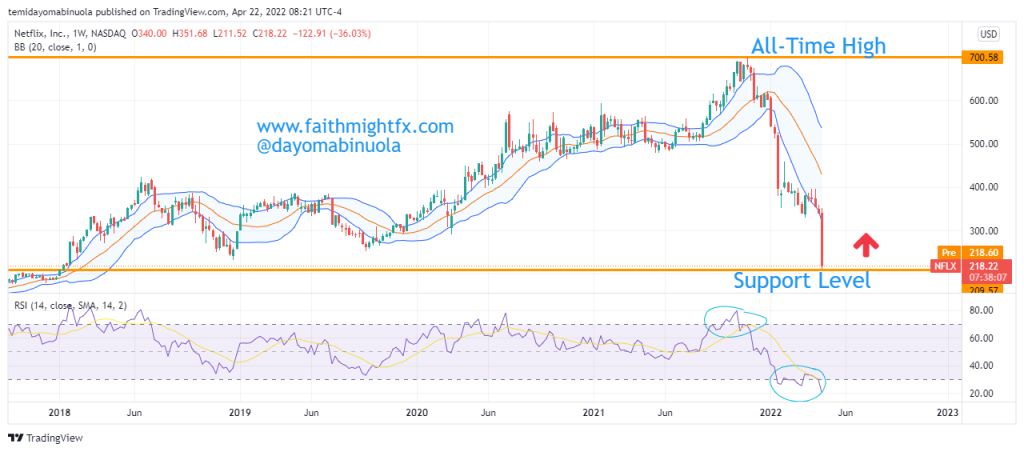

NETFLIX

On 09/03/2022 Our analysts made a forecast that Netflix will hit $615. Netflix was at $341 when we made the forecast. Netflix’s share price is currently at $374 and the call is still valid.

EXXONMOBIL

On 11/03/2022, ExxonMobil’s share price was $84. We forecasted a dip to $60. It is currently $82. Currently, the price is caught up in a range but this would not hinder the price from staying on course towards the forecast.

GBPUSD

On 15/03/2022, we forecasted a rise in GBPUSD from 1.30642 to 1.34298. It rose to 1.32984 which is more than a 50% gain. The price has corrected but the bullish trend is expected to continue.

NZDUSD

On 24/03/2022, we forecasted that NZDUSD will drop from its position on the day of the forecast at 0.69559 downwards to 0.67374. Since the forecast, the pair has dipped to 0.68723 which is more than 83 pips. The price has retraced but the bears are still in action and the call remains valid.

APPLE

On 28/03/2022, we made a forecast that Apple’s share price will rise above the previous all-time high of $182.93. Although this call is in its nascent stages, the price rallied to $179 from $174. Despite corrections, this bullish rally is still in play, and therefore, this call remains valid.

AIRBNB

On 30/03/2022, AirBnB’s share price was $175. We made a forecast that the share price will hit $192. The share price for the online marketplace for rentals & lodgings is currently falling but this is a minor retracement. The call is barely 48 hours and we look forward to the price heading in the direction of the forecast.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks, currencies, and commodities in your portfolio? Schedule a meeting with us here.