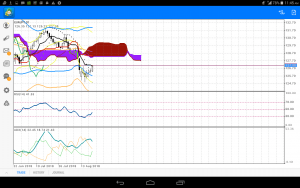

Summer trading comes to an end this week as traders around the world head back to the trading desks en masse. But the Great British pound (GBP) has had quite an exciting summer. In what is usually a tame season for GBP price action, markets saw the $GBPUSD tumble just over 700 pips this summer. The main culprit has been Brexit or the lack thereof depending on the day and headline. Brexit has caused the GBP, to not only move but to RIP in any direction and at any given moment.

“Brexit won’t happen” and GBP rips higher hundreds of pips.

“Brexit will be hard and concrete” and GBP crashes hundreds of pips.

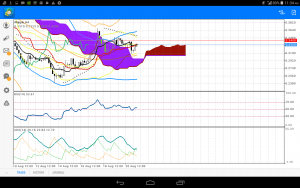

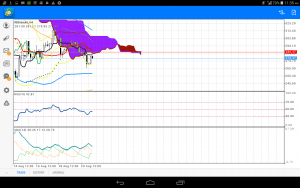

This has been the case for the GBP all summer long. Despite the clear trend to the downside, markets have been looking for any reason to rally in the absence of a real upside correction.

A hawkish Bank of England (BoE), despite the political confusion surrounding Brexit, has also been a source of volatility in the $GBPUSD. While witnessing more hawks voting for an interest rate hike in June and July, it was the August meeting that finally saw the BoE deliver its second interest rate hike in over a decade. And yet this central bank action only extended the trend further to the downside.

Now that the $GBPUSD has found a bottom after falling all summer, it is long overdue for a correction. Despite the 400-pip bounce off the bottom so far, the $GBPUSD has still hardly corrected its downside trend move. While 1.3050 could very well hold as resistance, I am still of the mind that there is more upside correction due. I believe that a true correction happens into the Fibonacci retracement levels. Therefore, as the markets open this new and first trading week of September, the $GBPUSD finds itself having the potential to move at least 500 pips higher.

As always, trade what you see, not what I think!

Sources: Stuck Brexit negotiations point to a GBP/USD retest of 1.1946 (FXStreet)

GBP/USD: Bearish Technicals and No-Deal Brexit Threats Weigh on the Pair (Trade Captain)

British Pound Set To Weaken Further, But Some Hope On The Horizon (Seeking Alpha)

US Dollar Jumps to July High, GBP/USD Folds on Inflation Data (Nasdaq)

GBP/USD – British Pound Slips Over White Paper Blues (Seeking Alpha)

GBP in the Spotlight as Brexit Tensions Flare up (DailyFX)

There are ebbs and flows to every market. Learn how to trade what you see. Or invest with a pro. [sponsored]