#BlackTwitter is the collective of influential tweeps who have given us memes upon memes, social justice movements across the world, and influenced global culture in profound ways through the power of the Internet. So when the release of Black Panther by Disney Studios was announced back in 2014, #BlackTwitter became aflame with excitement and anticipation of the next Ryan Coogler masterpiece. In fact, #BlackPantherSoLit became a trending hashtag for over 2 years before the movie finally opened in 2018 as the production progress strategically leaked to the world.

Then A Wrinkle In Time was announced. And #BlackTwitter blew up with excited anticipation yet again! So I started to pay attention to the market. With #BlackTwitter so hype, I got interested in the stock.

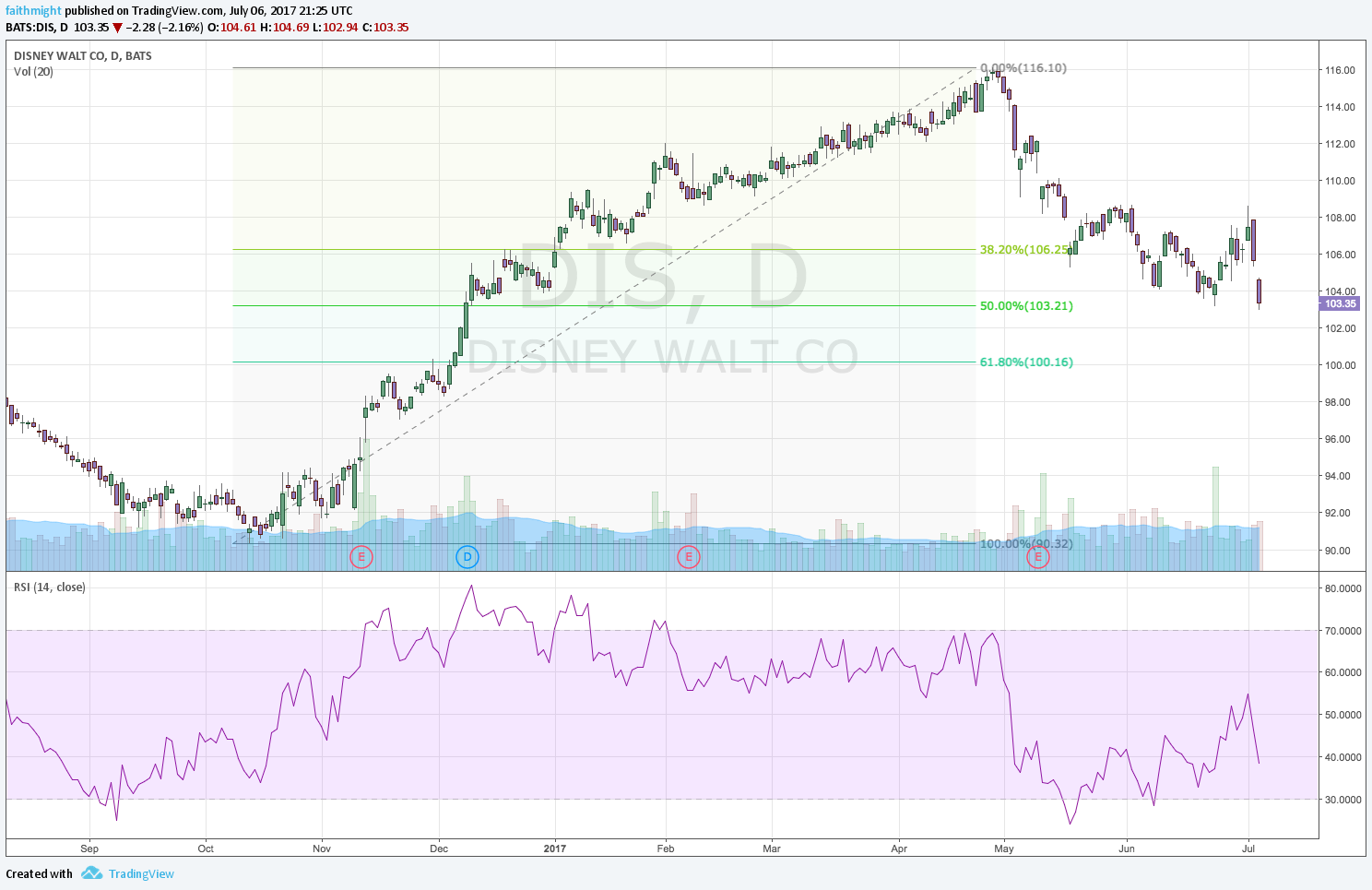

While #BlackPatherSoLit became the top trending topic on social media, the $DIS stock bottomed at $90 and soared to a high in 2017 just above $116. Don’t tell me #BlackTwitter isn’t powerful! Then $DIS took a beating as price crashed at the beginning of the year. In early February, I left an early release screening of Black Panther with a new love for cinematography, set design and costume design in film. Not to mention the acting is good too. Black Panther is just a damn good movie. The box office has born that out with over $1 Billion in ticket sales and it is still 2018. And Disney won a new fan in me that day. I watched Avengers Infinity Wars beforehand so I would have proper context for Black Panther. And that was great too. I don’t think sequels are not out of the question here.

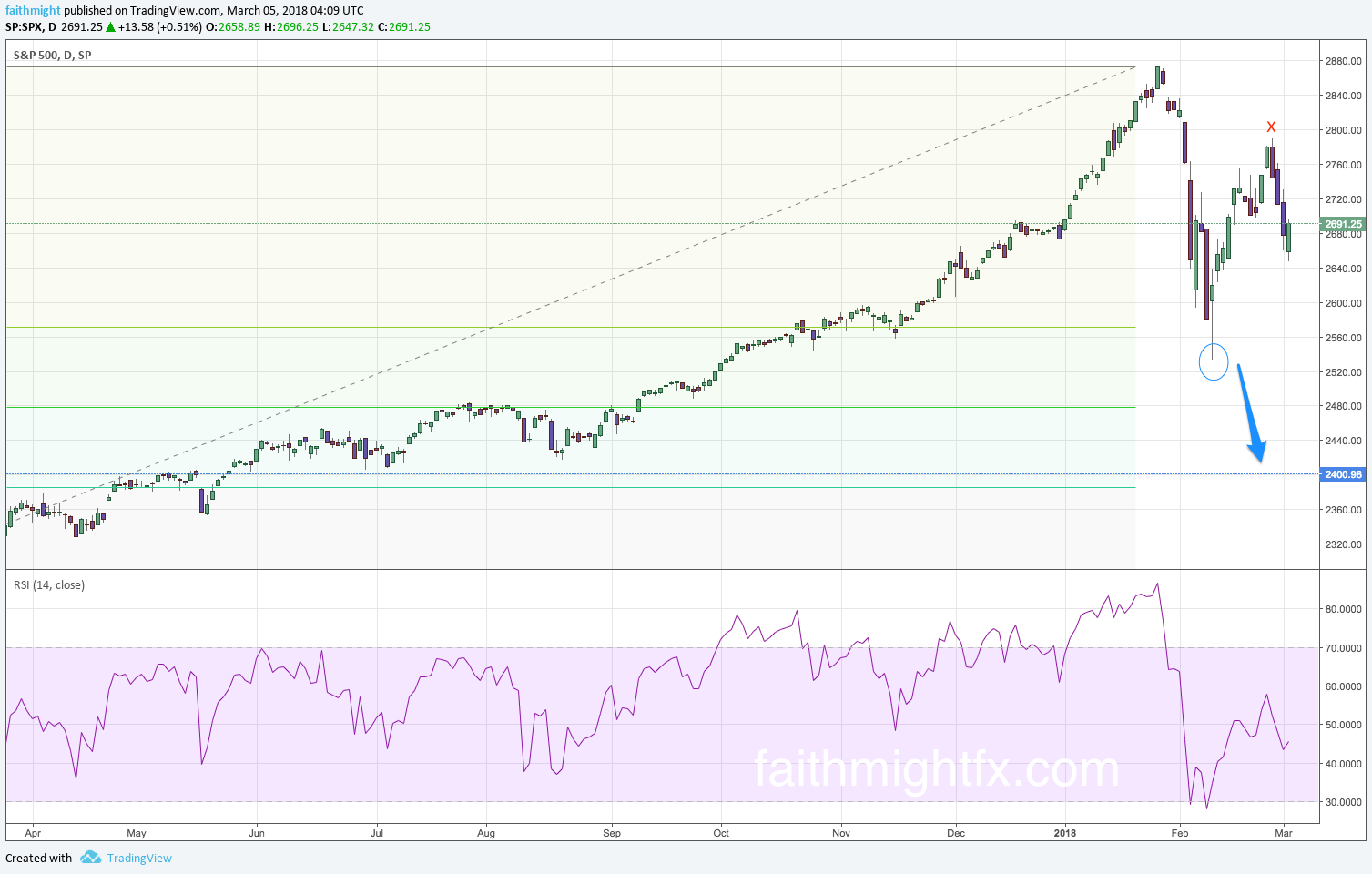

The chart above is from over 12 months ago. Here is the $DIS chart in April 2018 when the saw the movie.

And here is how $DIS closed the trading week on Friday.

With a weekly close above $110, $DIS has not been at these levels since the new year and I believe it is not done rallying higher. And Disney is not done releasing hit movies. But it’s not that I like $DIS because the of the hit movies. Long term, I like Disney’s audacious move to launch its own streaming service. Given its vast archive of content and the hit films that are released just this year in 2018, it’s looking more and more like those dips in the stock price have developed into real opportunity.