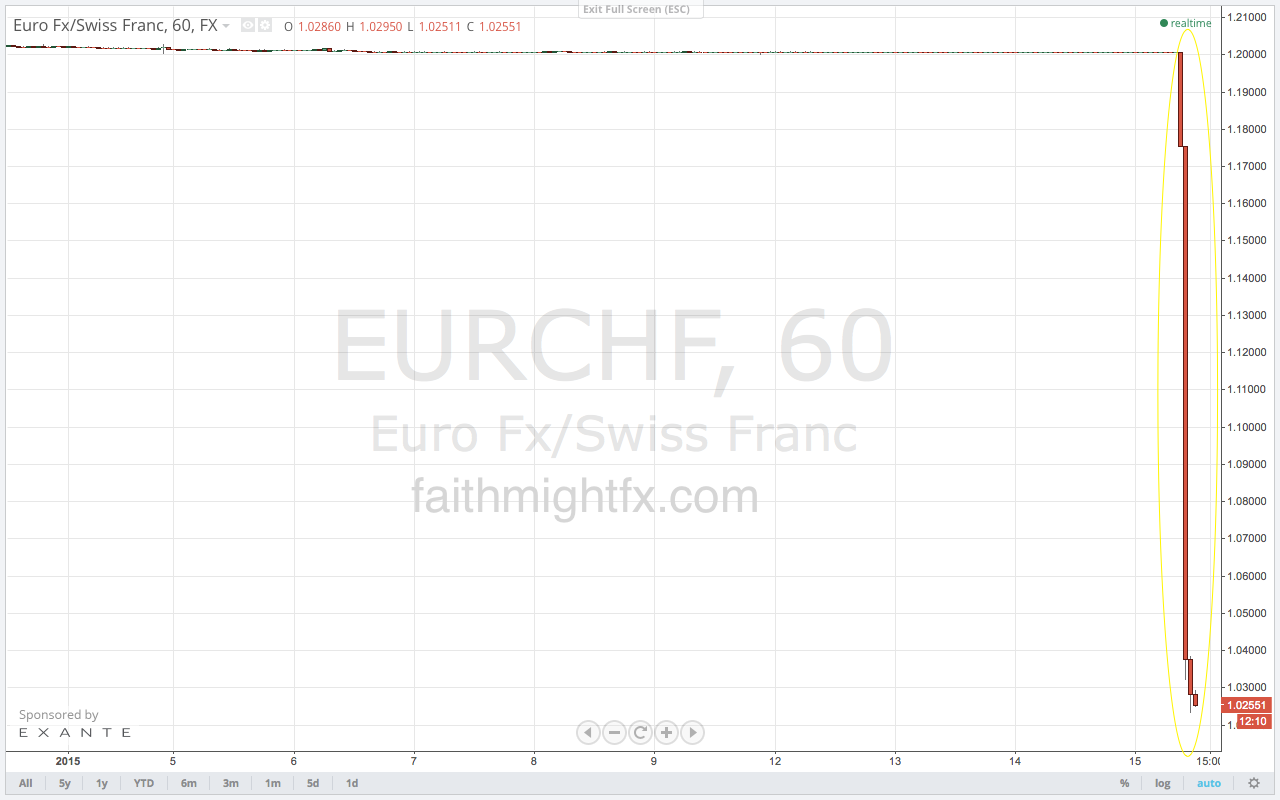

After yesterday’s SNB surprise monetary policy decision, major forex brokers around the world are having serious solvency issues. Unfortunately, bad trades coupled with 100:1 leverage became a recipe for disaster as client accounts went negative and now owe money that they probably can’t pay back. The largest and most well-known broker in the United States, $FXCM, is amongst this crowd and good for them. I have absolutely no love for $FXCM. While I don’t make broker recommendation, I discourage any trader who asks me about $FXCM from opening an account with them. I have firsthand experience and I know they are a piss poor operation.

But the hardest thing for a forex trader, besides trading strategy and consistent execution, is finding a good broker. A good broker is crucial for the success of all traders. I have had to do it 4 times in my 8 years trading forex. Knowing how hard it is, I decided to document my process the last time I switched brokers to help other traders find one that met their trading style criteria. In light of the eventual closing of some brokers due to the SNB surprise, I am reposting the article here in hopes of guiding traders to the decent forex brokers out there.

But the hardest thing for a forex trader, besides trading strategy and consistent execution, is finding a good broker. A good broker is crucial for the success of all traders. I have had to do it 4 times in my 8 years trading forex. Knowing how hard it is, I decided to document my process the last time I switched brokers to help other traders find one that met their trading style criteria. In light of the eventual closing of some brokers due to the SNB surprise, I am reposting the article here in hopes of guiding traders to the decent forex brokers out there.

Again, I don’t make broker recommendations. Follow the process and do the work. You’ll be better for it. Please, also keep in mind that my decisions about a particular broker SHOULD NOT be your own. That’s not the point. You need to have a clear idea of what YOU need from a broker in order to be successful. What works for me won’t necessarily work for you. And, lastly, please don’t be offended if I didn’t like your broker. That’s not the point. It’s about the process in picking a broker that is right for YOU.

Disclaimer: The list of brokers below is 4 years old and some of them are no longer in operation. Good riddance to them too.

****

I hate looking for a new broker. My word, it is exhausting. I remember my first broker experience and I remember reading Trading for a Living by Alexander Elder . Elder stresses that traders must control costs (one of the few factor we can control) and to change brokers if necessary to do so. Every trader is different so my main criteria for a broker is:

. Elder stresses that traders must control costs (one of the few factor we can control) and to change brokers if necessary to do so. Every trader is different so my main criteria for a broker is:

- No slippage and if so, then be courteous enough to ask me if I want to continue on with a requoted price

- No commission

- Not a market maker

- Offers GBP/USD, EUR/GBP AND GBP/AUD. I wanted to start trading the GBP/AUD but my former (and current) broker didn’t (don’t) offer it.

Spreads are not a huge deal for me. If you can deliver on the above, then I don’t mind paying for it (via higher spreads). Because trading with FXCM left me so scarred, I am very wary of the big bank market makers. However, with the new CFTC regulations, I can no longer rule them out as they will probably be the only ones left standing. Also, many smaller brokers are just introducing brokers to the market makers anyway so I may as well deal direct, if I must.

Day 1

My search started with a website that compares brokers. I found a great website in Forex Peace Army (FPA). You always have to take rating and reviews with a grain of salt and try to determine between real traders and the whiners. But it does help to have 2nd opinions as they certainly do help allay doubts and some uncertainties. Through this painstaking search I did find Zecco Forex (through the Google ad, I’ll admit lol). Since Stocktwits partners with Zecco and they met my above criteria, I decided to give their platform a try.

Days 2 & 3

After crawling FPA and checking out different brokers for a day, there had to be a better way. And there is now! I finally turned to Twitter. I have a wonderful crew of traders there so why not ask them? I did and got a slew of recommendations:

- Advanced Markets

- dbfx

- Oanda

- PFGBEST.com

- MB Trading

- Dukascopy

- MIG Bank

- InterbankFX

- Interactive Brokers

- thinkorswim

- Forex.com

- Saxo

- twowayspreads.com

- CitiFXPro

I traded with Forex.com early in my career – don’t like them. In my experience, they have a tendency to permanently widen your spreads once you are trading well. I have an account with InterbankFX already and not too crazy about MT4 (sorry folks). So that left me to judge the remaining brokers based on my criteria. (Most of the links are directly to the page that helped make my decision.)

- Advanced Markets – They have commissions based on initial deposit (which is unfair in my opinion) and trading volume (which as a swing trader I won’t make the cut).

- dbfx – Thanks to the reviews on FPA, it looks like dbfx works through FXCM. I LOOOATHE FXCM.

- Oanda – They meet my criteria though they *may* be a market maker. And I can trade on the iPad?! Beautiful.

- PFGBEST.com – I can’t find any information on their website about fees, spreads, or any other costs involved. That’s a big fail.

- MB Trading – They have commissions. 4 different commissions to be exact. Too much nickel-and-diming for my taste.

- Dukascopy – They have commissions based on initial deposit (which is unfair in my opinion) and trading volume (which as a swing trader I won’t make the cut).

- MIG Bank – They have different leverage, margin requirements AND spreads based on your initial deposit. Too much differentiation for my liking.

- Interactive Brokers – They charge a commission. But it seems fair so I am willing to give them a try. I’m not used to commissions in this market so I am biased against paying them. However, things are changing with the new CFTC regulations so maybe it’s an idea I should get used to. Plus, after researching so many brokers, it seems that commissions may actually be to my benefit.

- thinkorswim – My equity trading friend complained about this platform just last week. Plus, I don’t understand their commission structure – too complicated.

- Saxo – They have a required distance on your stops. Not too crucial for me, as I am not a scalper, but 25 pips minimum stop on my favorite pair is kind of a deal breaker for me.

- twowayspreads.com – I just don’t get it. Are they a broker or a rebate program? Believe it or not, there are forex rebate programs out there. And I’m not going to figure it out with my money.

- CitiFXPro – I researched them a couple years ago. I consider them a market maker. Plus, I wouldn’t bank with Citibank. There is no way I’ll trade with them.

Day 4

Having whittled away at this list, I tried out the platforms of those left standing via a demo account with each broker.

- Interactive Brokers – YIKES! Where are the charts? So confusing as the platform allows one to trade stocks, futures, options. Too many options (no pun intended) for this simple forex girl.

- Oanda – I like the platform. Not thrilled with the chart tools but I think I can work with it.

- Zecco Forex – I love the access to all the different gold charts! Gold/EUR, Gold/GBP!!! That’s about it though. The charting tools here are even worse than Oanda. Plus, they are powered by Forex.com. But the gold charts do keep them in the running.

I plan on trying out these platforms for all of this week but I think I have made a decision.

Conclusion

I like things simple just like in my trading. When it starts to get complicated, whether it was the platform or the fees schedule, I bail. I will miss MGForex. Only time will tell if I made a good choice. If not, I will give Saxo and Advanced Markets another look. I’m not afraid to change brokers even if it is a painful process. As a trader, neither should you.

Originally posted on faithmight.com on September 13, 2010.

Read also:

SNB Rocks The Whole World (FaithMightFX)

Numerous FX Brokers Shutter After Suffering “Significant Losses” Following SNB Stunner (Zero Hedge)

Image credit

But the hardest thing for a forex trader, besides trading strategy and consistent execution, is finding a good broker. A good broker is crucial for the success of all traders. I have had to do it 4 times in my 8 years trading forex. Knowing how hard it is, I decided to document my process the last time I switched brokers to help other traders find one that met their trading style criteria. In light of the eventual closing of some brokers due to the SNB surprise, I am reposting the article here in hopes of guiding traders to the decent forex brokers out there.

But the hardest thing for a forex trader, besides trading strategy and consistent execution, is finding a good broker. A good broker is crucial for the success of all traders. I have had to do it 4 times in my 8 years trading forex. Knowing how hard it is, I decided to document my process the last time I switched brokers to help other traders find one that met their trading style criteria. In light of the eventual closing of some brokers due to the SNB surprise, I am reposting the article here in hopes of guiding traders to the decent forex brokers out there.