This Thursday, the Bank of England (BoE) will deliver its first interest rate decision under Mark Carney. It is widely believed that the BoE will hold monetary policy given that Carney officially stepped into office just 4 days prior. However, Carney could surprise us.

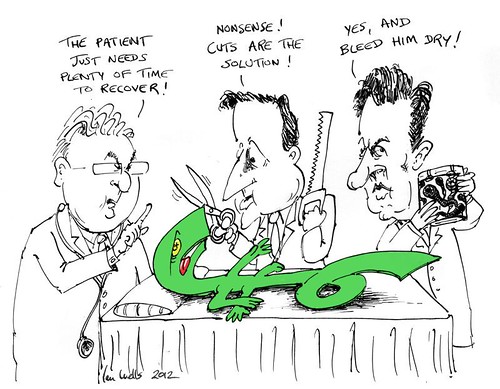

While his official start date was yesterday (July 1), Carney completed his tenure with the Bank of Canada on June 1st. So hypothetically he could have started work on the UK for 30 days already. He certainly has an opinion on British monetary policy (seen here). And the BoE has a good track record for surprising markets.

But enough with the musing. Either way Thursday’s decision goes, the $GBPUSD has resumed its bear trend. After falling to the critical long term support zone between 1.5270 and 1.5230, price fell below it to end the month of June. Bounces have been capped at 1.5250 and price has since fallen to new lows today at 1.5136. Though still in this upward channel, cable is poised to break to the next level of support at 1.5075. If price breaks lower, all eyes are the big psychological level at 1.5000. Given the respect of the Fibonacci retracement levels, cable is still on track to break to new lows below 1.4830.