DriveMe Technologies is an EduTech startup out of Nigeria. Though they are formally classified as a EduTech company, they really are positioned to push the frontiers of the transportation and logistics sector in Nigeria, and Africa at large. Skilled drivers are a rare commodity within the transportation sector in Nigeria. Lack of driver’s education and skills is the number one reason for vehicle accidents in Nigeria. There has long been no requirement (or at the very least, little enforcement) of the requirements put in place for formal drivers’ education before obtaining a license. This has resulted in 35% of driving-related accidents in the world occurring in Africa. Drivers simply don’t know the traffic rules and they become a danger to themselves and other commuters.

Many firms in the logistics sector have to rely on under-educated drivers and when accidents happen these firms find themselves in positions where they have to cough up millions of Naira in damages and business losses. Not too mention the hit on their reputation. These organizations and business owners are in dire need of formally educated and skilled drivers but seeing that this is not their area of competency, they also find themselves struggling with what the right curriculum should be and keeping up with the driving laws. They are left with little or no choice but to hire and fire which inevitably leads to high turnover. High turnover is a huge cost to the business and it further squeezes already small profit margins. Therefore, there is a huge incentive for businesses who are reliant on drivers to find a solution to having high-quality drivers. This is where DriveMe comes in.

DriveMe uses technology to deliver high-quality, up-to-date drivers’ education in Nigeria. They are an accredited driving school educating drivers of all levels: from the novices to the veteran drivers, DriveMe covers all their drivers’ education needs. In recent months, driving laws have changed in Nigeria making drivers’ education mandatory. This is what really attracted us to DriveMe because it is not just supplying drivers’ education solutions. There is a ready demand.

Looking at the demand side, drivers are able to list their services on the DriveMe platform. They have the benefit of being educated on the platform while also having exposure to potential clients and employers who are in search of high-quality drivers. In that respect, DriveMe also acts as a matching platform that provides job opportunities for drivers.

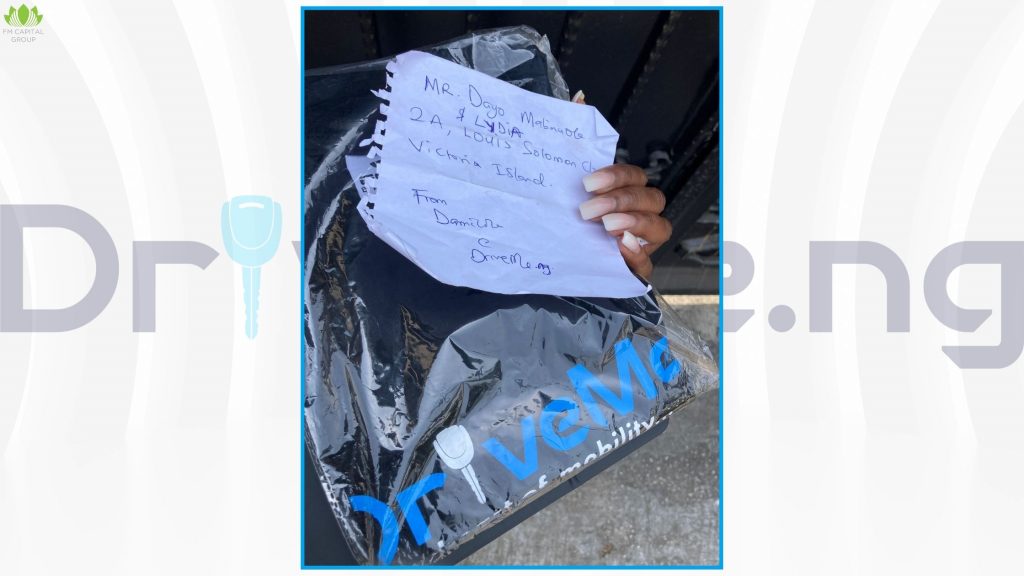

DriveMe is one of the first investments that I was fortunate enough to visit onsite (physically) in Nigeria during our Due Diligence process. It is not uncommon for angel investors to deploy capital into startups/companies we have not “physically” met. In this age of teleconferencing, physical on-site meetings have become less of a requirement in order to make a good investment decision. However, nothing can replace a physical meeting and it was a pleasure to meet Dami and Charlotte Odunlade at the DriveMe offices in Lekki, Lagos. We got to meet some of their students and spend time with their staff. We spoke with Dami and Charlotte in their offices discussing their long-term vision and current operational successes and challenges. Dayo and I walked away from that meeting confident that investors should make the investment in DriveMe. Even as virtual conferencing explodes all over the world, there will always be a place for in-person onsite meetings during Due Diligence and even post-check. In person meetings remain invaluable.

We are glad to make the DriveMe investment. We trust the DriveMe team will continue to grow the business and exceed their near term milestones!