Despite several forecasts of BTC to reach $100,000 or $200,000, BTC has failed to reach $70,000 with the recent bull run. BTC reached an all-time high at $68,999 on November 10, 2021. Most times when Bitcoin dips, other cryptos follow the same direction. Bitcoin had a previous resistance in April 2021 at $64,898. After the April all-time high, the price dipped by more than half as the price reached $28,764.37. This year support level for BTC is at $28, 731. A breakout of the April resistance at $64,876 was reached in October, which pushed the price to the most recent all-time high.

At two different times between September and October, the price of BTC using the RSI shows that price has been overbought. Price has crossed to the lower region of the Bollinger bands. El Salvador has adopted Bitcoin as a legal tender. Some other countries like Panama, Ukraine are in the race to adopt Bitcoin as a legal tender. In a situation where Bitcoin price drops below the price it was acquired, this might affect the economy of the countries as the purchasing power will be affected.

There are indications that the price of BTC falls below $30,000. This might be a bad one for the El-Salvador economy as it will be below the price it was initially bought. A breakout to the downside of the support level at $55,851 might push the price to $29,000.

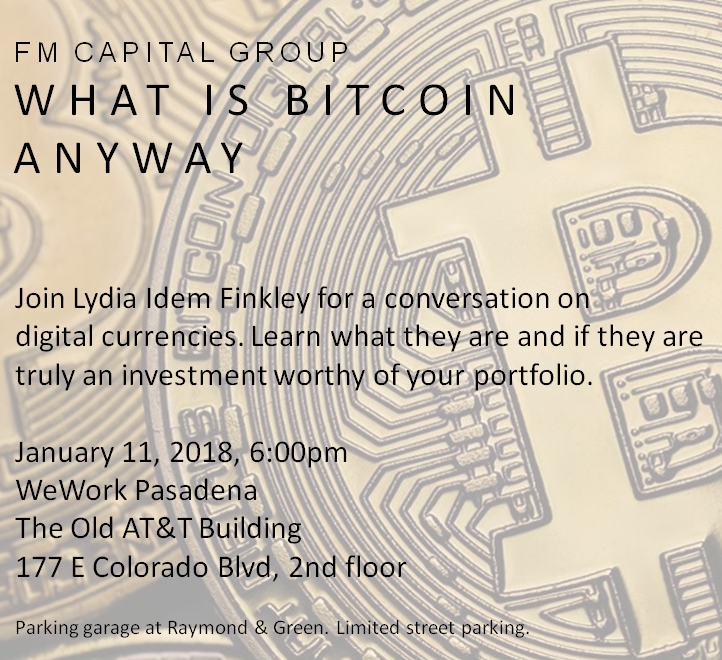

Some of these ideas are in our clients’ portfolios. To understand which ones can work for you or for help to invest for your own wealth, talk to our advisors at FM Capital Group. Would you like more information on Investment Advisory, Portfolio Services, and VC? Schedule a meeting with us here.