- EURGBP Update: bears moving in (FaithMightFX)

- Cable Setting Up A Bear Flag? (Forex Live)

- Yen dangles near 4-month low, commodity currencies firm (Reuters)

- Prospects for the UK economy (National Institue of Economic and Social Research) [PDF]

- GBPJPY Update (50’s Blog)

Tag: EURGBP

-

Sterling Digest, November 2 2012: NFP Friday

-

EURGBP Update: bears moving in

$EURGBP price action today proving once again why I don’t like to buy euros. While the $EURGBP daily chart started the week looking very constructive, price today collapsed ahead of the 50% Fibonacci level of last week’s price decline. The subsequent price drop found support at the 0.8000 level but bounced again back to 0.8035 intraday. Only a close above 0.8030 would make the bullish picture at the start of the week stand. However, as we head into the New York close, price is below the key 0.8030 level. Watch where price closes the day. If below 0.8030, any pop higher will be met by sellers. If above 0.8030, watch price to move back towards the highs at 0.8050-70. In any case, sellers seem to be lining up making $EURGBP look short term bearish on its failure to get to and break back above 0.8100.

Disclosure: No position

-

Sterling Digest, October 31 2012: mixed signals – banking vs. economy

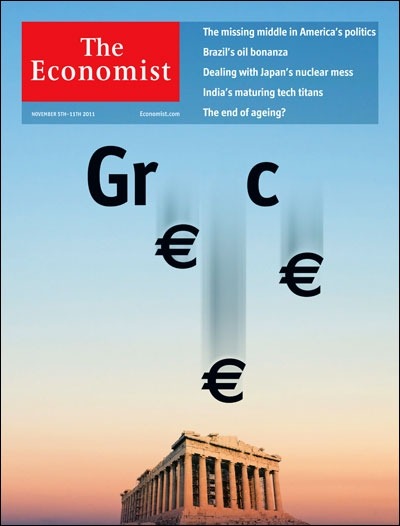

- Time Running Out for Greece (Currency Solutions)

- CBI: UK Oct Retail Reported Sales Surge; Highest Since June (Forex Live)

- BOE: Number Of Institutions Participating In FLS Rises To 30 (Forex Live)

- U.K. Gilts Retain a Sheen In the Face of U.K. Growth (Wall Street Journal)

- EU to UK: budget rebate “no longer warranted” (Financial Times)

-

Are Euro Bulls Back?

As the market closed Friday trading, $EURGBP encouraged bulls with a close above the 0.80 major psychological level. The close above 0.8030, however, should give bulls even more confidence into this week’s open. As a major support/resistance level, we see the influence a candle close above 0.8030 can have, even more so than the whole number.

I’m still not a fan of a long euro position. But the recent high at 0.8160 is a new high. We have higher lows on the daily chart here. And my friend JC has been bullish the euro ($EURUSD) for some time now. It now looks to me that euro long is the path of least resistance.

Disclosure: Closed shorts at 0.8032 for +56.8 pips.

-

The Temperamental USD

The USD has threatened to rally for months now. But the $GBPUSD remains in its 300-pip range between 1.5500 and 1.5800. Every time traders, and I do mean ME, gets bullish or bearish due to price action, the USD finds a way to do just the opposite.

For example, despite completing the quarter to 1.5750 on USD ($DX_F) weakness this week, cable never broke above the level to challenge the highs at 1.5800 midterm support and resistance. I was bullish cable going into this trading session. I thought price would continue to rally into 1.5750 – 1.5800 zone and then experience a sharp selloff. The selloff came sooner than expected when risk aversion kicked in as Spanish bond yields and equities spooked the market

So what happens next week? With Spanish (and Italian) yields hitting these high rates at the end of the European session, we can expect the USD to continue to rally when the market opens in Monday trading causing this “Strong USD, Strong GBP” theme to play out once again. As such, this week’s GBP bears should enjoy some profits heading into the weekend. $GBPNZD and $GBPAUD short positions, in particular, paid out nicely this week with continuations in the weak sterling vs. commodities trend. However, do not underestimate this USD. It still rules capital flows and when it is strong on risk aversion fever, GBP will also benefit in the crosses. Most notably, the $EURGBP, $GBPNZD, and $GBPCAD are strong candidates into next week. Trade what YOU see!

Looking for 0.7800 to hold on a bounce

This week’s hold above 1.95 despite kiwi rally looks very good for bulls

A close above 1.58 supported by the 61.8 Fib gives some life to bulls -

Strong USD, Strong GBP

There is a new theme emerging with the USD BREAKOUT this week. Everything is weak against USD. $GBPUSD has fallen over 650 pips in 4 weeks. It ended last week on a technical break of the 61.8% Fibonacci retracement level of its entire rally off the January 2012 lows. That was the last defense for bulls though their case was lost with price action below 1.60 for 2 weeks now. However bearish cable may be this does not at all roll neatly into a weak sterling story.

On the contrary, sterling is killing almost everything else. GBP is at multi-year highs against the euro. No secret there as to why. But the commodity dollars are also weakening tremendously against sterling on broad-based weakness in commodities. The strong USD combined with slowing Chinese growth is looking to make commodity weakness a new trend in the short-term.

When trading these markets, timing is crucial. The reason for the choppy consolidation around 1.60 in $GBPAUD and $GBPCAD is due to the sterling weakness in $GBPUSD and general GBP strength in $EURGBP and $GBPNZD. The EURGBP close below 0.80 signals more GBP strength; even as the $GBPUSD close below 1.5750 signals more GBP weakness there. The correlation is ironic. But price action is truth. The strong USD — strong GBP theme bears paying attention to as we head into summer trading.

-

Sterling Digest, May 22 2012: mixing business and pleasure

Could be a G8 reaction to markets G8 summit leaders enjoyed their weekend in a retreat, unconference with very mixed reaction from markets. The open was spent violently going nowhere as cable is still bouncing around 1.58. No momentum or conviction on either side. Sounds like opposing G8 stances, doesn’t it. As the news week gets underway a huge drop in UK inflation that has hit its lowest levels in over a year. Less inflation leaves the door open for more QE at a time where economic data has not been supporting the hawks at the BoE. The market looks ahead to the BoE minutes release tomorrow to see if recent hawks have new dovish feathers.

- The Calculated Mover: EURGBP (DailyFX)

- GBPJPY, Pivot Points Standard (Chart.ly)

- GBPUSD Update (50’s Blog)

- Step Aside British Pound, Japanese Yen Returns As Safety Currency Of Choice (Seeking Alpha)

- British economy may ‘never quite recover’ from a severe Euro collapse (The Telegraph)

- IMF tells UK to consider rate cut to boost growth (BBC)

- UK’s Cameron calls for euro contingency plans (Reuters)

- Statement from G8 world leaders (Reuters)

- G8 summit: Leaders must make friends at the G8, says David Cameron (The Telegraph)

-

Sterling Digest, May 17 2012: blame the eurozone

With a new election looming, Greece is slouching towards the drachma An interesting theme has caught fire in the markets in recently: BLAME EUROPE. The entire world blames the Eurozone for global economic slow down, weak markets, and high inflation. The Eurozone blames Greece. The Greeks blame the government. The government blames the markets. The markets punish the euro.

- David Cameron says UK’s ‘safety’ paramount in euro crisis (BBC)

- U.K. Wages Will Keep Falling, While Bonus Payments Slump (WSJ)

- David Cameron: Eurozone “either has to make-up or it is looking at a potential break-up” (Open Europe)

- Lecturing Germany on the euro could be a diplomatic own goal for Cameron (The Telegraph)

- SNB: Defending the Floor (WSJ)

- NERVES BUILD OVER RISK OF “DISORDERLY” FALL OF BRAZIL’S REAL (Dow Jones)

- France will not ratify current EU fiscal pact (Al Jazeera)

-

Sterling Digest, May 15 2012: safety status rules

Safety trumps economics The safe haven sterling rallies on. After a dip in GBP on weak UK trade balance numbers, the $GBPAUD, $GBPCAD, $GBPNZD, and $EURGBP continued on in their strong sterling bull trend. The only currencies that gained on the safe sterling today are the almighty rulers of risk aversion: the greenback and yen.

- Yields on UK government bonds drop to record low at 1.87% (The Guardian)

- Austerity Under Fire: One Of Several Economic Drags On The U.K. Vs. The U.S. (Seeking Alpha)

- RBA hints at further rate cuts (The Sydney Morning Herald)

- Commodities at five-month lows (FT)

- UK PMI Manufacturing Exports (Markit Economics) [chart]

- GBPUSD Update (50’s Blog)

- GBPUSD Daily Chart (yfrog)

- EUR/GBP Daily Outlook May 15, 2012 (Daily Forex)

-

Sterling Digest, May 11 2012: the cracks appear

Hollande may not be any different for the euro Sterling ends the week weak across the board. Profit-taking was the theme this Friday trading session as investors banked pips on a strong bull trend in sterling that has been raging for weeks. As we head into the weekend, the question that traders start to ask is: did we witness a correction this week or the beginning of a reversal as the market comes to grips with a very weak UK economy relative to others in the G10 such as Canada, Australia, and the US. Watch the major psychological level at 1.6000 in $GBPUSD, $GBPAUD, and $GBPCAD for answers into the new trading week ahead.

- King Seen Signaling QE an Option as Euro Tensions Flare (Bloomberg)

- Euro Anti-Austerity Votes Pose Dangers for Britain (EconoMonitor)

- David Cameron: the man in the middle in Europe (The Telegraph)

- GBPUSD Update (50’s Blog)

- Lots of questions about GBPCAD (Chart.ly)

- The Nasty Cable Trade (MarketVision TV)

- EUR/GBP: Retest Of .8000 Likely After Brief Bounce (FX360)