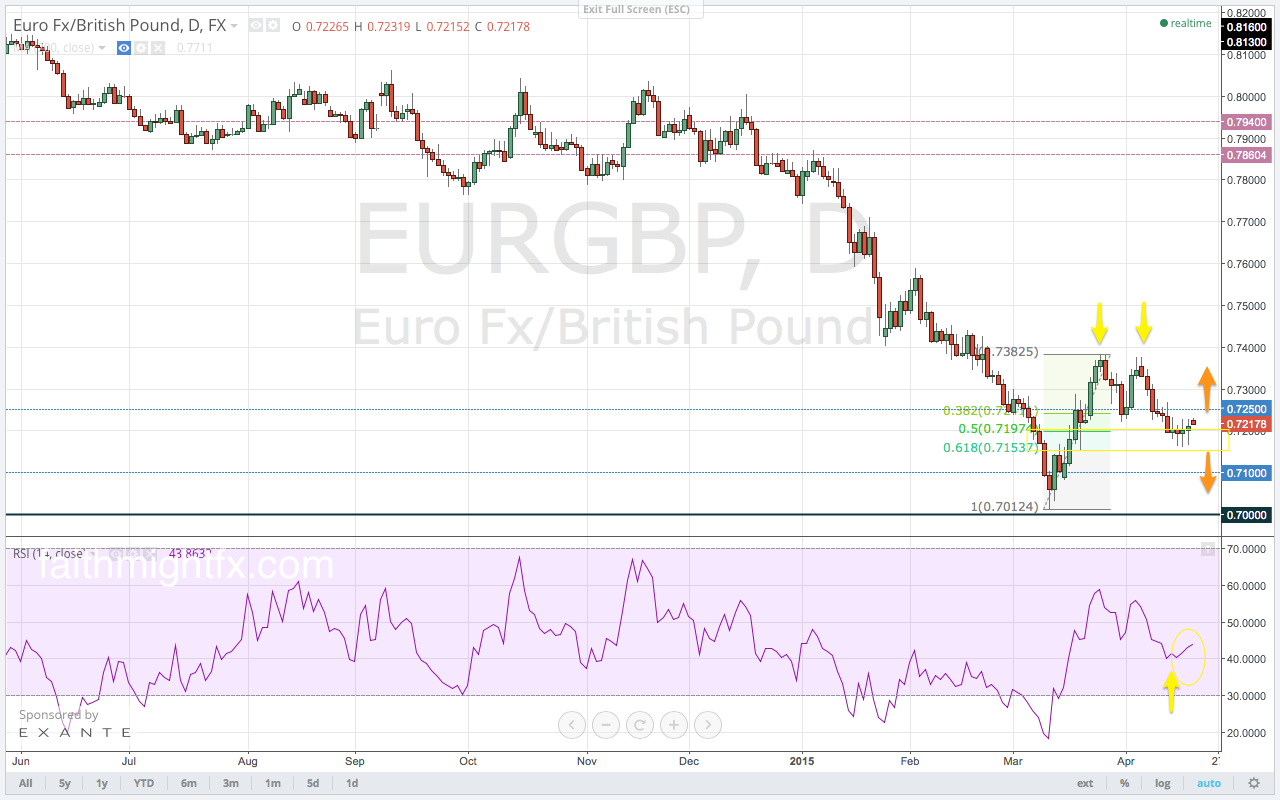

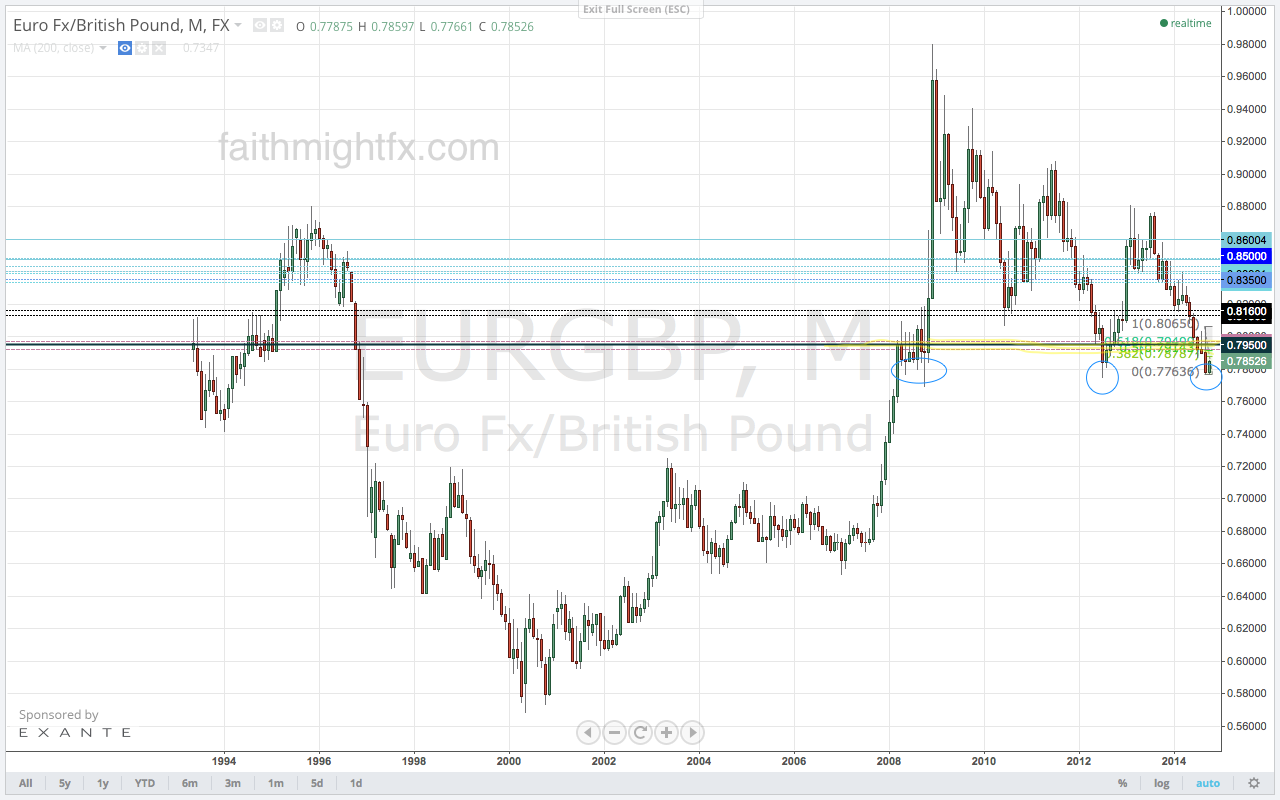

Each week, I highlight a chart out of the Quid Report.

We have unfinished business in the $EURGBP after the break of support this week. Greece will remain a basket case because the current Greek government is so new, so young and so boldly naive. The old establishment that makes up the Eurogroup will always have tension with Greece as the kids on the block govern in their own way. The latest proposal could really pressurize the euro.

This is an excerpt from this week’s issue of Quid Report. Subscribers receive my research on all major GBP pairs at the top of the week, including access to @faithmightfx on Twitter for daily, real-time calls and adjustments to the weekly report. AVAILABLE NOW.