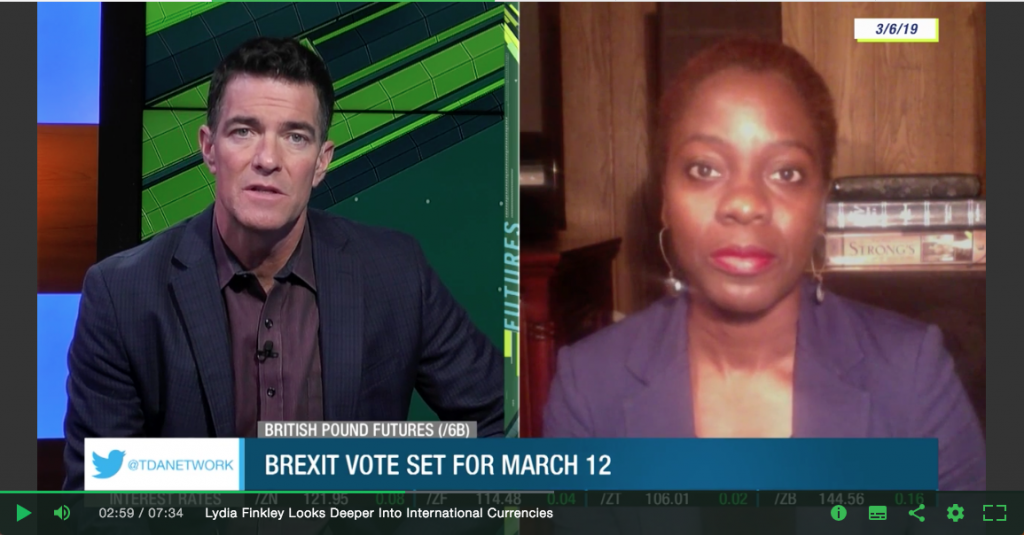

I ended the trading week this Friday morning on the TD Ameritrade Network talking as one of the guests on the Futures with Ben Lichenstein show. In light of the surprise resignation announcement of UK Prime Minister Theresa May hours before I went on, it isn’t any wonder that Ben and I discussed the Brexit, the implications of another prime minister resignation brought on by the Brexit, and what effects all of this will have on the forex markets.

We also talked about the rise of risk aversion in the markets and what that will mean for the U.S. dollar and Japanese yen as safe haven currencies. But the one safe haven that I did not mention this morning is the Swiss franc. Luckily, Dayo already wrote an analysis yesterday looking at the current trend in the $EURCHF. So read that and watch my interview below for an understanding of the new fundamental landscape in the forex markets heading into the summer trading months.