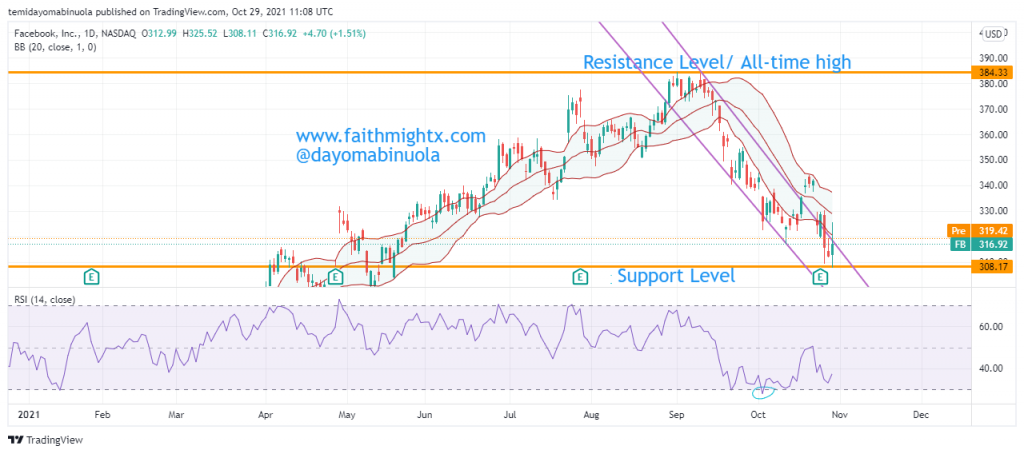

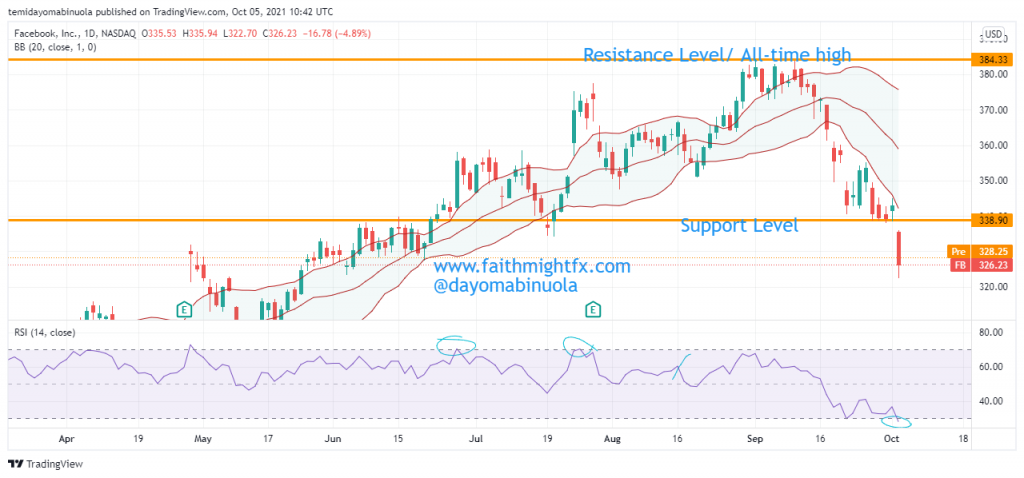

Facebook opened the year 2022 with a share price of $337, after it ranged for the most part of Q4 2021. Through the last quarter of 2021, the price ranged between $299 at the lower end and $353 at the upper end. The first breakout to the downside occurred on January 24, 2022. This breakout only lasted for a few days and the price found its way back into the range. On February 2, 2022, the price closed at $323 which was still in the range.

However, on the next trading day (February 3, 2022), a gap-down occurred which made the share price open at $244. At this point, the price was outside of the range and a bearish movement had kicked in as a result of the gap-down. The price kept falling till it hit a new support level at $186. This fall wiped out the profit that was made between June 2020 till September 2021 (the month when the price reached an all-time high at $384). The last time the tech giant’s share price got this low was in April 2020.

On March 16, 2022, the price bounced off the support line. RSI indicates oversold positions on the weekly timeframe. Could this be the bull run investors in $FB have been waiting months for? If this bull run continues, the share price could go beyond a psychological level of $300 and hit $368.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here.