Yesterday, I had the pleasure of chatting with Dale Pinkert, host of FXStreet’s Live Analysis Room. We talked markets and, of course, all things GBP.

Tag: FXB

-

Sterling Digest, 27 December 2013: the Last Friday

The reason why GBP continues to rally in some pairs and may correct in others for 2014 It has been an incredible 2013 for GBP sterling. It is only fitting that we see these breakouts only extend further on this last Friday session of 2013. The $GBPUSD, $GBPNZD, $GBPCAD, $GBPAUD, and $GBPJPY all hit multi-year highs today. Amongst these, $GBPUSD is the only seeing a correction off the highs. Others, like the $EURGBP and $GBPCHF, actually saw sterling decline today though both recovered losses as trading wore on. In thin holiday markets, this last Friday saw volatile price action in contrast to very rangebound markets during the early half of this week. Given the year that was 2013 in sterling, what does 2014 hold in store for GBP trading? Instead of the uniform moves that we got for much of the 2nd half of 2013, it looks like sterling will be a mixed bag in 2014.

- Sterling Proves Pessimists Wrong (WSJ)

- BRITISH POUND 2014 FX OUTLOOK – BE EXTREMELY SELECTIVE (BK Asset Management)

- Britain ‘will be Europe’s top economy by 2030’ (The Guardian)

- Sterling in 2014- 6 vital points by which to chart progress (Forex Live)

- My Interview on FXStreet’s Live Analysis Room (FMFX)

- The FED Takes Markets Back To The Old Normal (FMFX)

- What Are the Markets Whispering for 2014? (FMFX)

- Playing GBP In 2014 – Morgan Stanley (eFXnews)

-

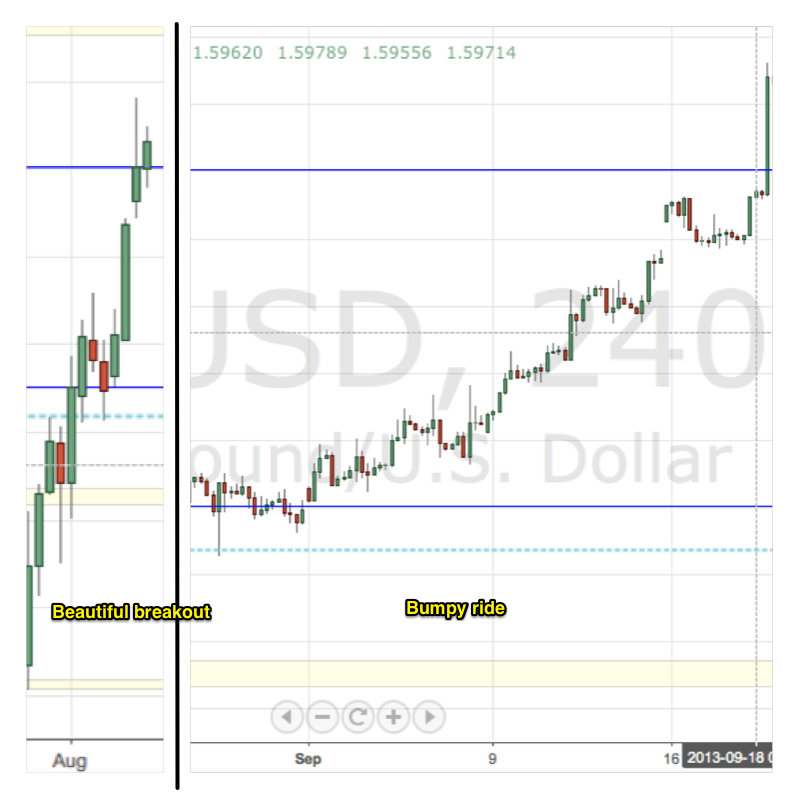

Sterling Digest, 26 September 2013: grumpy bulls

No wonder bulls are grumpy We left off the Digest musing over the strength in sterling due to robust UK economic data as GBP hit long-term resistance levels against all major currencies. Since August, GBP has experienced tremendous breakouts in some pairs and significant price corrections in others. Now that $GBPUSD is above 1.60, $GBPCAD above 1.65, $GBPAUD above 1.71 and $EURGBP at 0.84, it seems as though GBP bulls are having their way. However, these moves have not been without resistance. The moves higher in sterling have been a grind with slow, choppy moves that have been difficult to trade on anything but a short term basis. With a light calendar this week, the market has allowed GBP to correct but robust economic data gave life to sterling as $GBPUSD, in paritcular, managed not to loose its important 1.60 level. With 3Q at its end, October brings the market its first glimpse of fall season data. If the UK economy continues to put in robust results, expect GBP to continue its summer rally back to long-term resistance levels.

- GBP/USD Maintains Bullish Bias (FMFX)

- Charts I am watching for this coming week (Peter Brandt) [scroll through PDF to $GPBCAD analysis]

- Sterling Proves Pessimists Wrong (Money Beat WSJ)

- UK CBI distributive trades survey september: 34 vs +24 exp (Forex Live)

- Financial Policy Committee statement from its policy meeting, 18 September 2013 (Bank of England)

- Bank of England hits back at critics of forward guidance (FT)

- Pimco: Get Set for a Hefty Sterling Decline (Money Beat WSJ)

Read the last issue: Sterling Digest, 23 August 2013: reality bites

-

Sterling Digest, 13 August 2013: mixed post guidance

Carney remixes guidance for UK Sterling has been mixed since the announcement of forward guidance giving the Bank of England (BoE) a dual mandate to target both inflation and unemployment. It also means that economic data takes on increased importance as markets parse news to determine central bank sentiment and direction in price action. However, sterling has been mixed in the week after forward guidance was unveiled. Last week, GBP rallied across the board post-announcement taking $GBPUSD to 1.5571 and $EURGBP to 0.8578. In this new trading week, however, GBP has weakened considerably off those highs. The spotlight of this week will be the release of the BoE meeting minutes which will give the market a peek into the central bank’s true sentiment on forward guidance. Given the unanimous vote last month not to increase QE, a split vote threatens to weaken the GBP and increase volatility in the near term.

- The Carney roundup (Forex Live)

- GBP Post-BoE Fwd Guidance: A Buy Or A Sell? (eFXnews)

- Timing Is Always Important (FMFX)

- Bank of England Inflation Report – August 2013 (Bank of England) [PDF]

- Bank of England Governor Letter to the Chancellor of the Exchequer (Bank of England) [PDF]

- BoE’s Forward Guidance Cheered by GBP (City Index)

- The mystery of UK slack (FT)

- UK Earning Growth vs. Inflation (Reuters) [CHART]

- New guidance will stamp Carney’s authority on Bank of England (FT)

-

Timing Is Always Important

Sterling has completed some big time levels in the past week. $GBPUSD hit one-month highs at 1.5571. $GBPAUD broke out higher to 1.7340. And $EURGBP mean reverted back to 0.86 after hitting 5-month highs at 0.8750. I say all that so you can understand why I’m very much on the defensive into this new week. It is important to recognize how likely it is that these particular pairs start the week consolidating these major moves.

With the $GBPUSD linked to the almighty USD, cable will certainly lead. Opening below 1.55 signals weakness that could be short-lived as the Monday session gets underway. 1.5430 resistance-turned-support and the 1.5400 50% Fibonacci level of the rally from 1.5102 to 1.5571 are the key levels of support to watch now at the market open. $EURGBP below 0.8600 has 0.8570 as key to direction. The loss of 1.6925 resistance-turned-support signals further losses toward 1.6750 in the $GBPAUD.

If you enjoyed these major moves, take a seat back. If you missed these major moves, take a seat back. Timing is a critical factor in our trading. Be mindful of the timing: big moves, August trading, and new shifts in some of the major central banks. There is no need to rush or force trading, today, in particular. Often times, the best opportunities in the market are those you can wait on.

Mentioned above:

- How to play August, month of transition (Pip Train)

- And You Thought August Was Boring (All Start Charts)

-

Sterling Digest, 6 August 2013: flavors of guidance

Which flavor of guidance will Carney serve up? This week, it is all about the Inflation Report released tomorrow. With no statement released after the Bank of England decided not to change monetary policy, the market has been in hot anticipation of this formal forward guidance that Mark Carney will issue for England. The discussion of forward guidance has become fragmented: hard guidance vs. soft guidance; inflation target vs. GDP target. Given the state of the UK economy, it will be interesting to hear what Carney has to say in his 1st inflation report. Even more interesting will the be the market reaction. Yesterday’s strong retail sales caused sterling to rally hard across the board. Today, however, sterling has weakened after strong manufacturing numbers were released. Either the market is running out of steam or it is already looking ahead to tomorrow’s inflation report.

- Bank of England’s Mark Carney to unveil new interest rates guidance (The Guardian)

- Mark Carney set for interest rate promise to lift economy (The Telegraph)

- Bank of England risks blow to credibility (FT)

- U.K. economy picks up pace (CNN Money)

- UK recovery picks up speed as manufacturing roars back to life (The Telegraph)

- Pound rallies as Carney holds back a statement (Forex Live)

- Wall Street pros believe a Fall taper is already priced into markets (CNBC)

-

Sterling Digest, 30 July 2013: forward guidance

FORWARD! The new fancy buzzword in sterling markets is forward guidance and Carney is supposed to deliver a hardline version of it after the Bank of England (BoE) announces its decision on monetary policy on Thursday. However, there are mixed views on how markets will react. Some expect $GBPUSD to move higher to challenge to the 2013 highs. Many others, on the other hand, believe the $GBPUSD to move back below 1.50 in reaction to forward guidance. Given sterling’s reaction to the soft forward guidance delivered after last month’s BoE meeting and in light of a progressing economic recovery in the UK, it appears that anything is possible. It quite likely sterling satisfies both bears and bulls in the 2nd half of this year.

- State Of Play: Carney’s BOE May Go For Stability, Not Stimulus (eFXnews)

- Savers hammered as long-term interest rates hit nine-year low (The Telegraph)

- The Runway Should Be Rocky For The Pound Until The August Inflation Report (Seeking Alpha)

- Sterling After UK GDP And Ahead Of Next Week’s BoE (Bloomberg via eFXnews) [VIDEO]

- UK GDP Tapers Pessimism, not QE (City Index)

- A very stable cable (Forex Live)

- Standard Bank sees GBP/USD below 1.50 on BOE guidance (Forex Live)

- Why Consider the WisdomTree United Kingdom Hedged Equity Index (WisdomTree) [PDF]

- UK economy ‘on the mend’ after 0.6% growth, says chancellor (BBC)

Image credit (Read the article too)

-

GBP/USD Ahead Of Key Data

The $GBPUSD has met all expectations here with its move right into the 61.8% Fibonacci retracement level of the latest bearish wave.

The market now waits on the UK GDP release. The expectations in the market are high for a positive beat which actually increases the downside risks in cable. If GDP disappoints, I believe the rally will be over. The technicals support a resumption of the bear trend with the 61.8% Fibonacci level capping the rally so far and a diverging RSI at these new highs. However, an upside beat or even an inline print will fuel this rally right back to 1.5500. A daily close above this psychological level will mark the beginnings of a reversal in the $GBPUSD.

Trade what you see.

Mentioned above:

UPDATE:

I corrected my thoughts on an upside or inline GDP print in my interview chat with FXStreet (at the 3:00 mark).

-

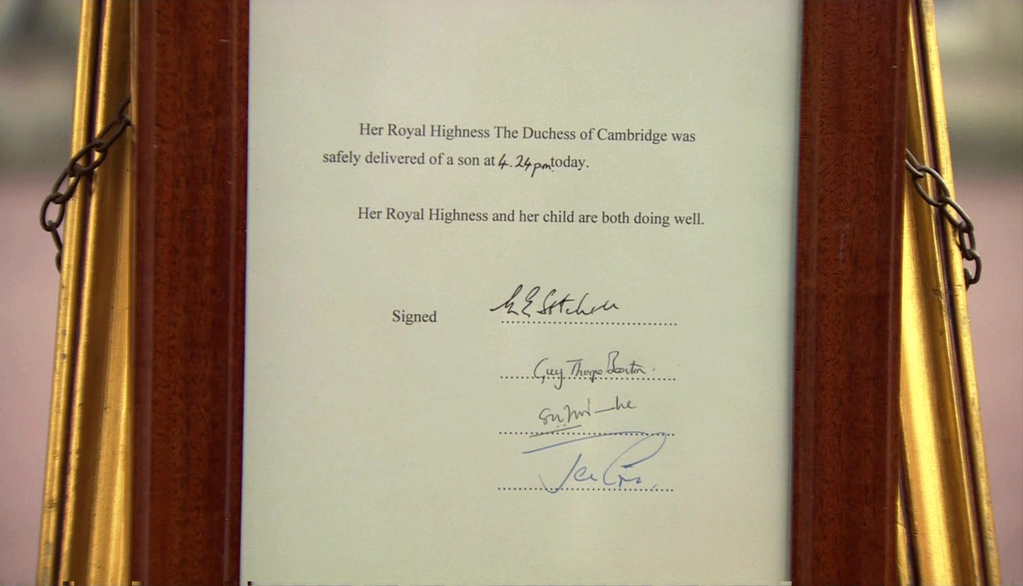

Sterling Digest, 23 July 2013: #royalbaby bump

It’s a #royalbabyboy! The UK monarchy has a new addition and the hype surrounding the birth of the new prince could arguably be called overdone. But sterling opened the week to news that Kate Middleton was in labor and rallied very nicely in the wake of the good news. $GBPUSD made new highs at 1.5384. $EURGBP broke to new lows at 0.8582. The baby has been here less than 24 hours and he has become responsible for lifting the UK into economic recovery. Talk about influence! In all seriousness though, with the economic calendar extremely light this week, sterling traders are looking ahead to Thursday’s UK GDP release. In light of the some robust numbers from retail sales and PMI in the past weeks, GDP is expected to surprise to the upside. Such a surprise will continue to fuel sterling strength and possibly induce a reversal in the $GBPUSD and $EURGBP. However, GDP expectations are so high that a disappointment may just end the rally.

- NEWS IN CHARTS: UK GDP TO SURGE! (ALPHA NOW)

- Royal Baby Bump for U.K. Economy? Don’t Bet on It (Wall Street Journal)

- UK exports at their highest since recession, say firms (The Guardian)

- British economy has turned a corner, senior Tories claim (The Telegraph)

- The UK’s fall from grace has been horrific – but we might be turning a corner (The Telegraph)

- Minutes of the Monetary Policy Committee Meeting held on 3 and 4 July (Bank of England)

- BOE Left Battling Perception that ‘No Action’ Means ‘Tightening’ (Wall Street Journal)

- QE Is So Out (Business Insider)

- What Next For GBP/USD?: The One Chart That Says It All (eFXnews)

-

Sterling Digest, 16 July 2013: beware the squeeze

The squeeze always shakes out the weak. Don’t be weak. Sterling sits on a fence depending on which currency you trade it against. After hitting new 2013 lows last week, the $GBPUSD has since rallied as high as 1.5220. Unable to get back below 1.50, there is a threat that cable rallies even higher. The $GBPAUD, after hitting new 2013 highs, has since retreated back to 1.6350. The $EURGBP is enjoying a nice, albeit slow, breakout to the upside reaching as high as 0.8700. While this week’s data threatens to be GBP-negative, particularly the release of the Bank of England meeting minutes, pay attention to price action. Lower prices may simply translate to better buy opportunities for rallies. With many GBP bears in the market, the squeeze higher could come slowly and painfully. Be aware.

- Carney BOE Guidance Seen Pushing QE on Back Burner (Bloomberg)

- BOE’s Miles : Well aware of rate rise impact on households (Forex Live)

- Rising import costs putting pressure on small businesses (Financial Director)

- GBPUSD vs. UK-US 2yr yield spread (StockTwits) [CHART]

- GBPUSD Update (50’s Blog) [CHART]

- Sellers Strong But May Need More Time (FaithMightFX)

- GBPUSD stalling at hourly trend line after US retail sales rally (Forex Trading TV) [VIDEO]

- Global PMI Data June 2013 (Avondale Asset Management) [CHART]

- The UK economy’s looking up – but no one’s told manufacturers (The Guardian)