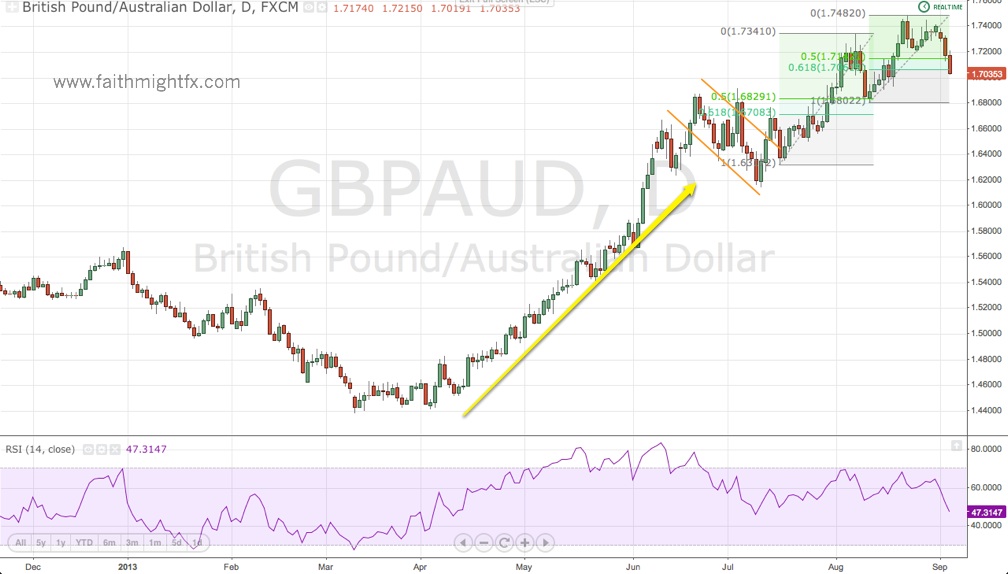

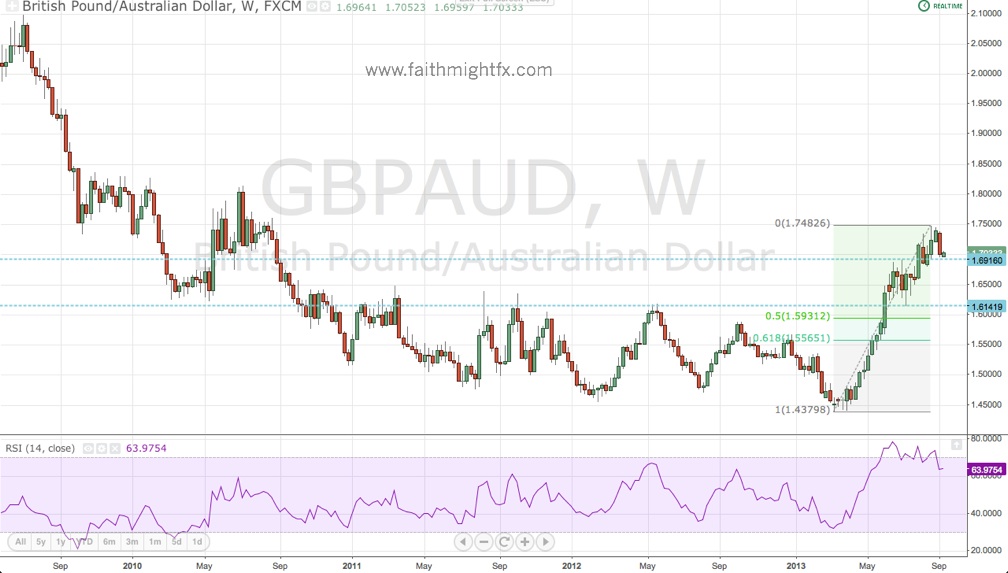

The AUD was the darling currency of the last several years benefiting most from China’s rapid growth rates. The tables turned in 2013, however, as the darling of the forex market became a dog. The $GBPAUD rallied over 3,100 pips on AUD weakness just shy of 1.75 with a high of 1.7482. It had not traded at those levels since 2010.

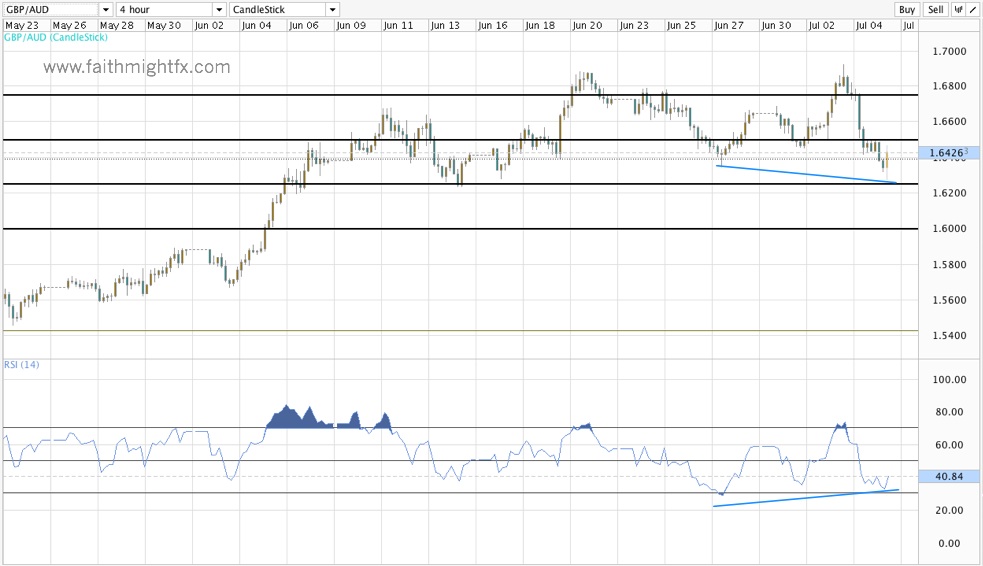

The weekly RSI is very interesting here. There is a divergence here that has been developing for several months now making it a powerful indicator that, now after some time, $GBPAUD bulls are throwing in the towel.

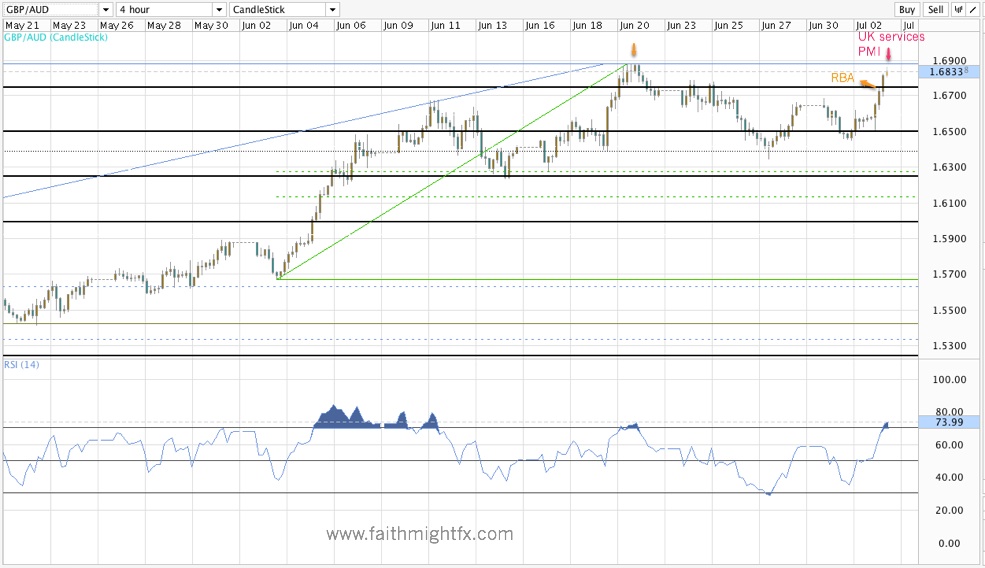

The price movement in the orange channel back in July has been the only “bearish” move in $GBPAUD since April. Since, the pair moved well beyond the 1.6916 July high to make highs last week at 1.7482. The pullback last week turned into a legitimate bearish move with lows breaking the 61.8% Fibonacci level at 1.7061 and moving below the big psychological level at 1.70.

The fundamentals certainly do support a bottom in AUD weakness. Last Tuesday, the RBA signaled an end to outright easing. Much of this breakout rally was due to RBA dovishness and interest rate cuts as other central banks remained unchanged in their monetary policies. Now that the RBA has shifted sentiment, the AUD may be due a significant relief rally.

With the break below 1.70, there are 3 support levels to watch in the coming sessions.

- 1.6916 is the former July high now turned support. We can see price has found support at this level twice before in August.

- The 50% and 61.8% Fibonacci levels at 1.6812 and 1.6653 respectively.

- The July low at 1.6141. A break below this level would mean a serious unraveling of this tremendous 2013 rally.

This is the potential of this breakdown:

Needless to say, we have a long way to go but if the fundamentals continue to improve for the AUD, the 1.5930 level could very well be reached.

Trade what you see.

Mentioned above:

- The Australian Dollar Appears To Bottom Without Fresh Catalysts For Rate Cuts (Seeking Alpha)

- RBA Holds Key Rate at 2.5% Omitting Easing Scope (Bloomberg)