Each week, I highlight a chart out of the Quid Report.

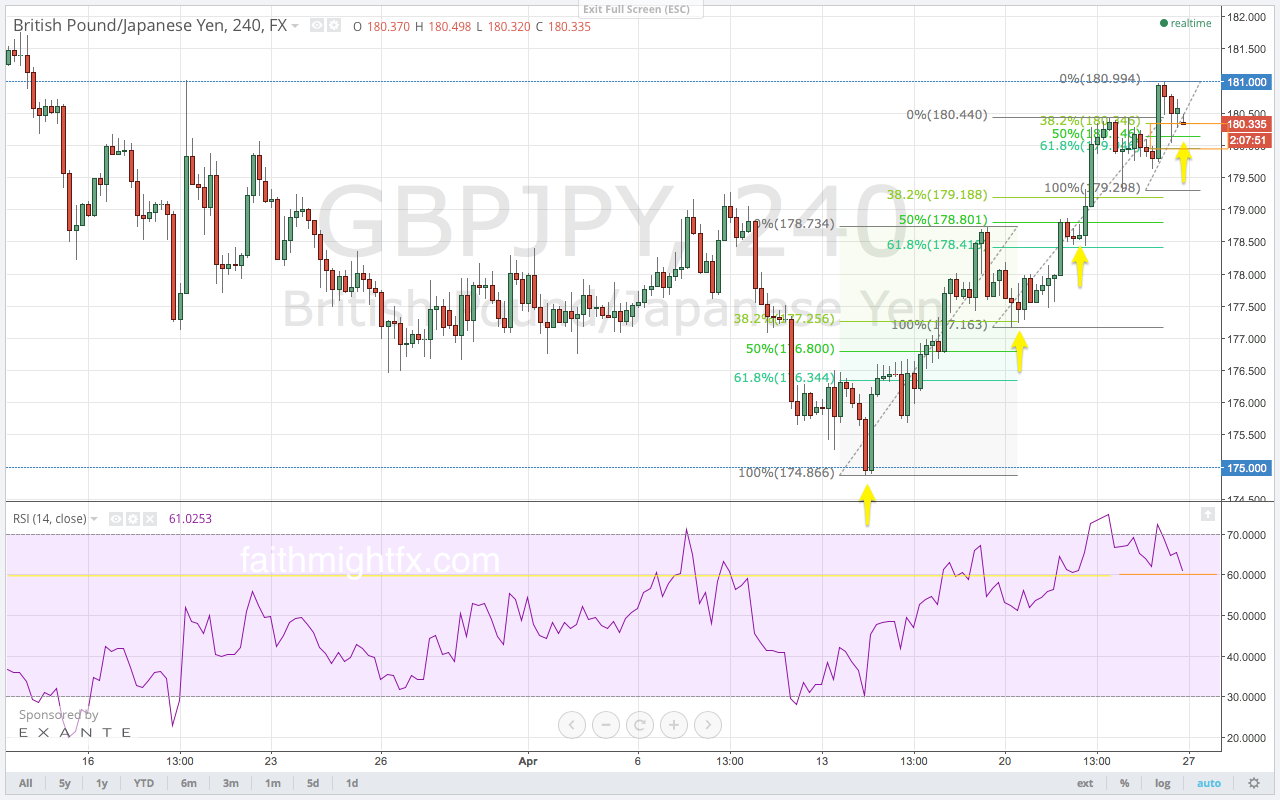

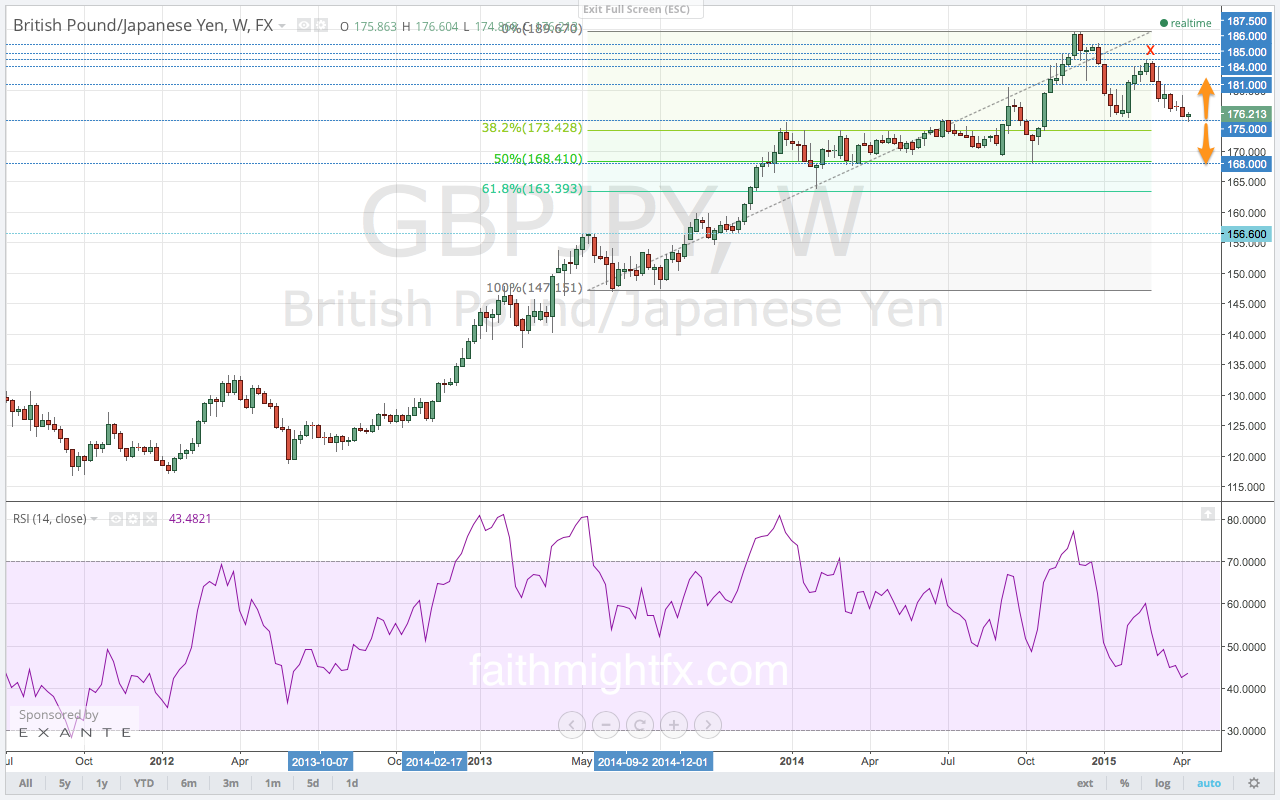

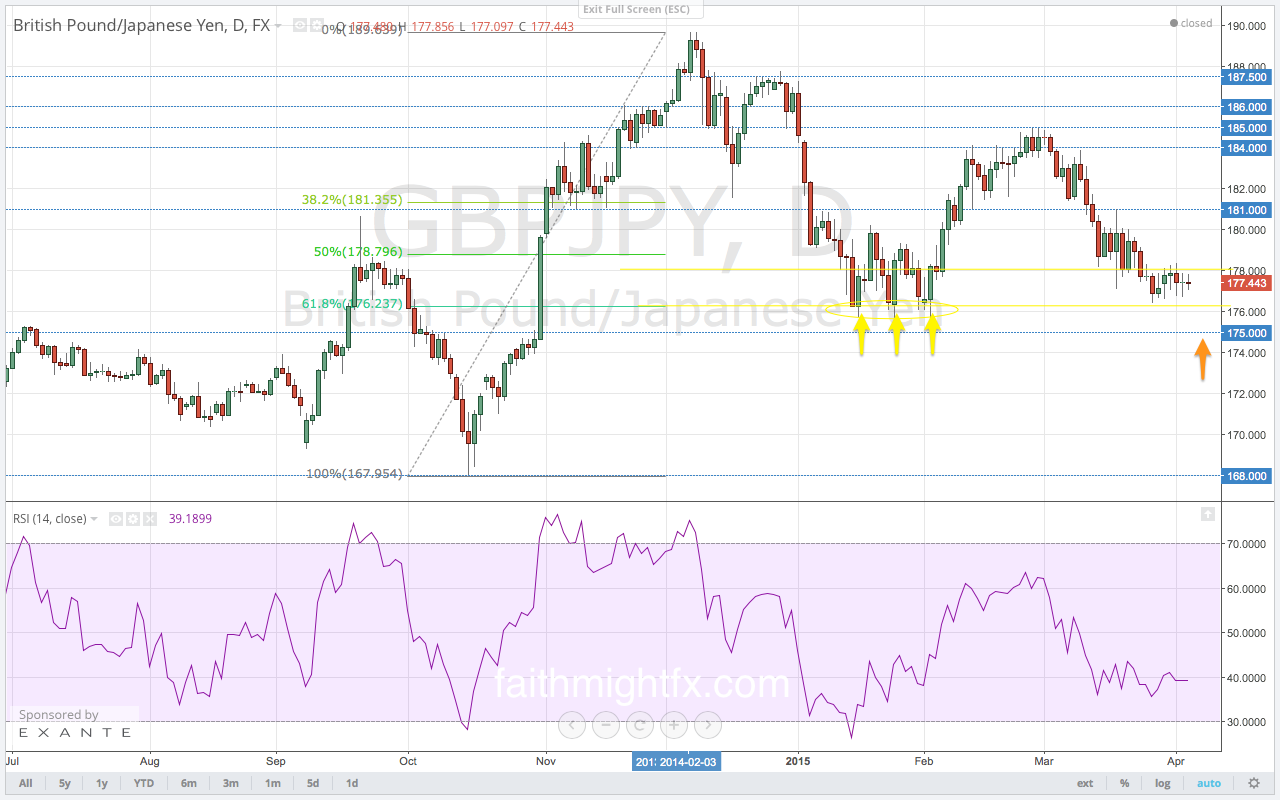

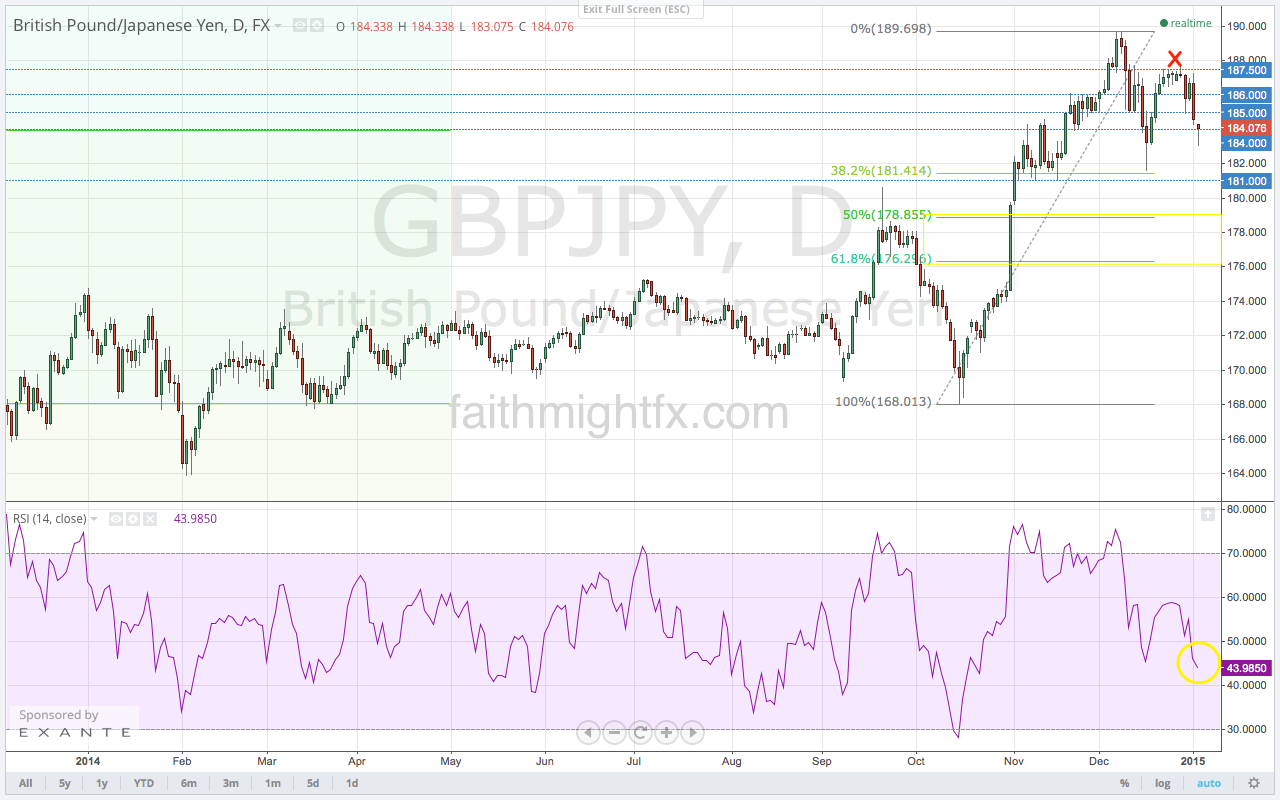

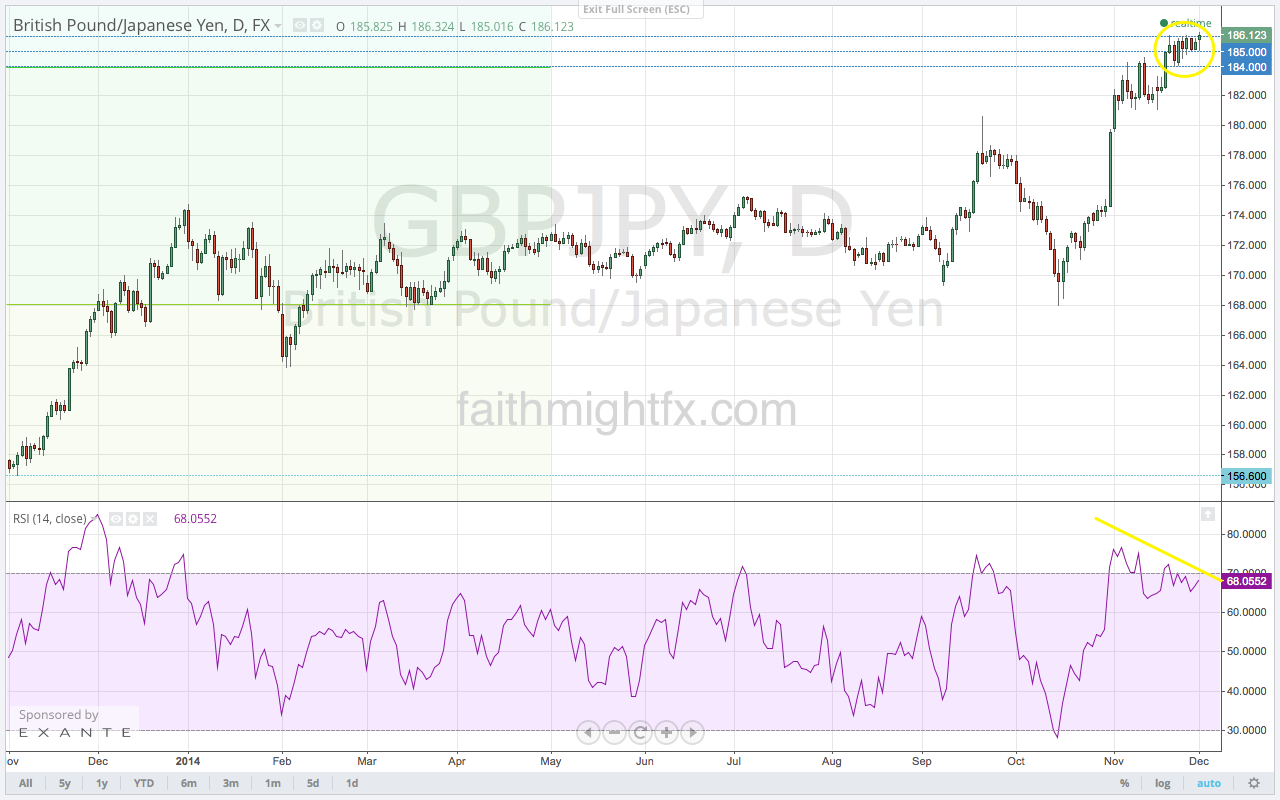

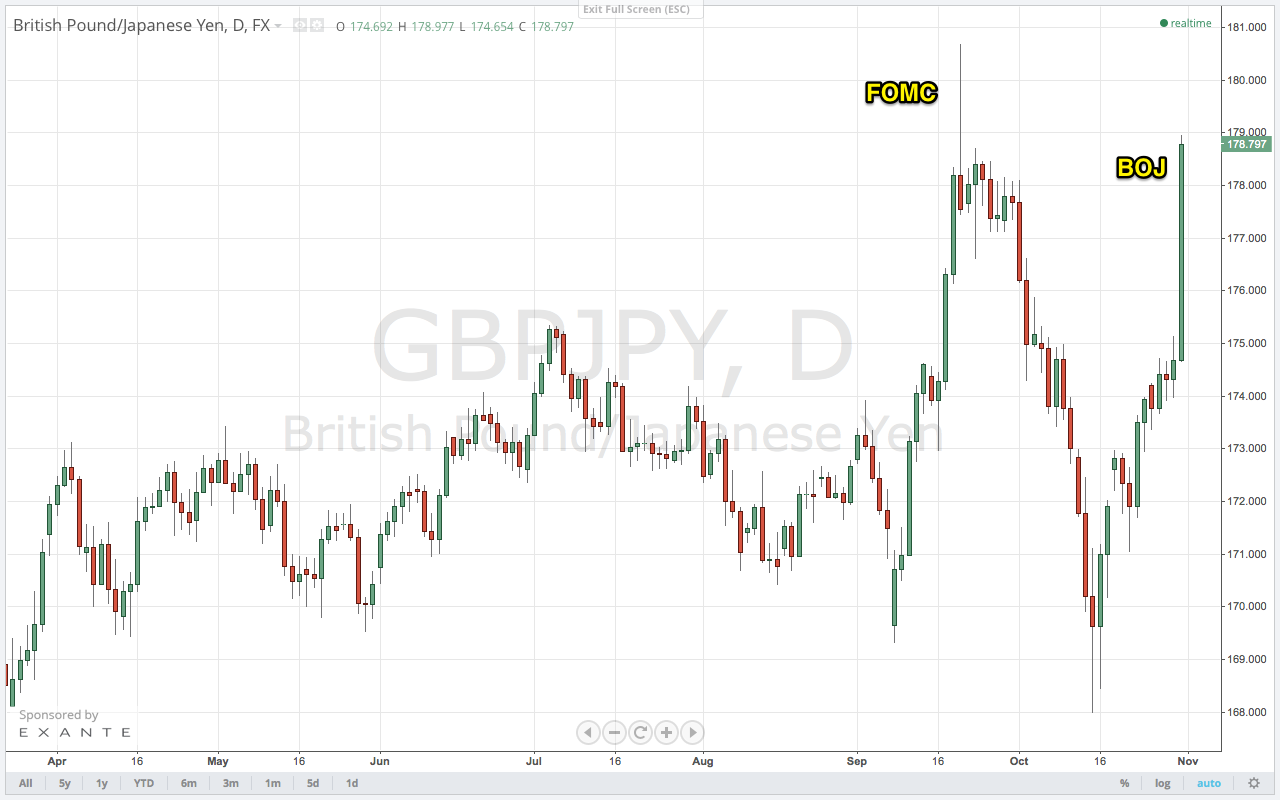

The Bank of Japan (BoJ) fueled yen weakness despite keeping monetary policy as is to maintain its massive quantitative easing (QE) program. While the BoJ does not see a need to further expand QE, they do confess that they will not meet their inflation target in 3 years. This admission gave sterling traders the green light to send the $GBPJPY back to the February highs at 184.00. This chart shows an early entry into this rally on dips back below 181.00, well ahead of when the BoJ policy statement was released.

This is an excerpt from this week’s issue of Quid Report. Subscribers receive my research on all major GBP pairs at the beginning of the week, including access to @faithmightfx on Twitter for daily, real-time calls and adjustments to the weekly report. AVAILABLE NOW.