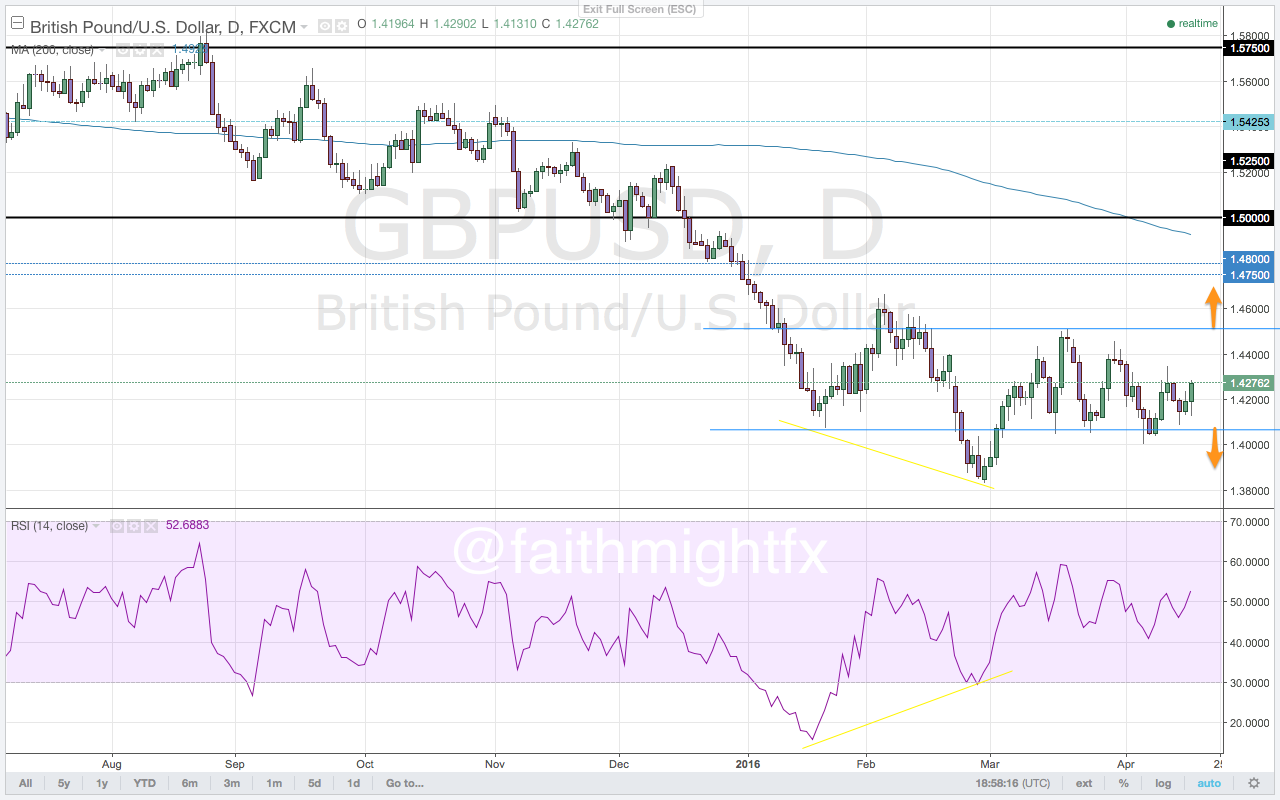

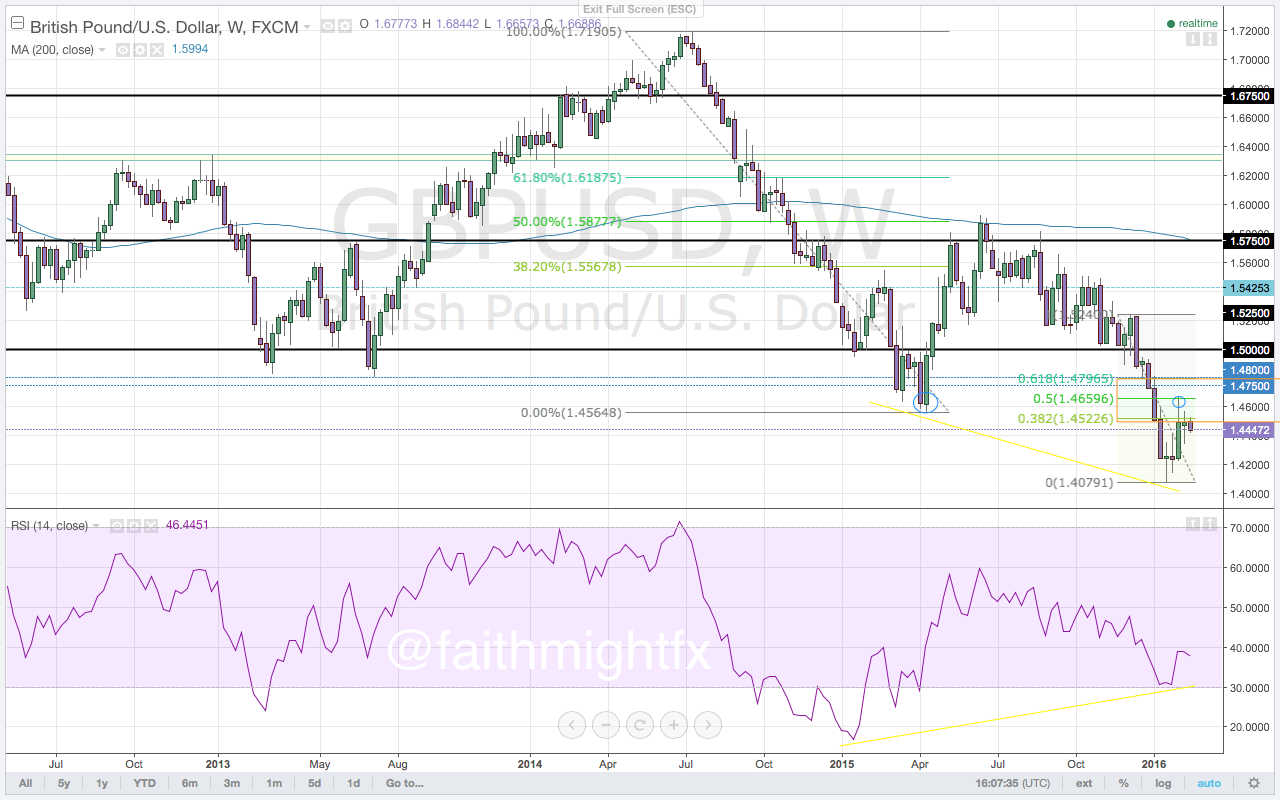

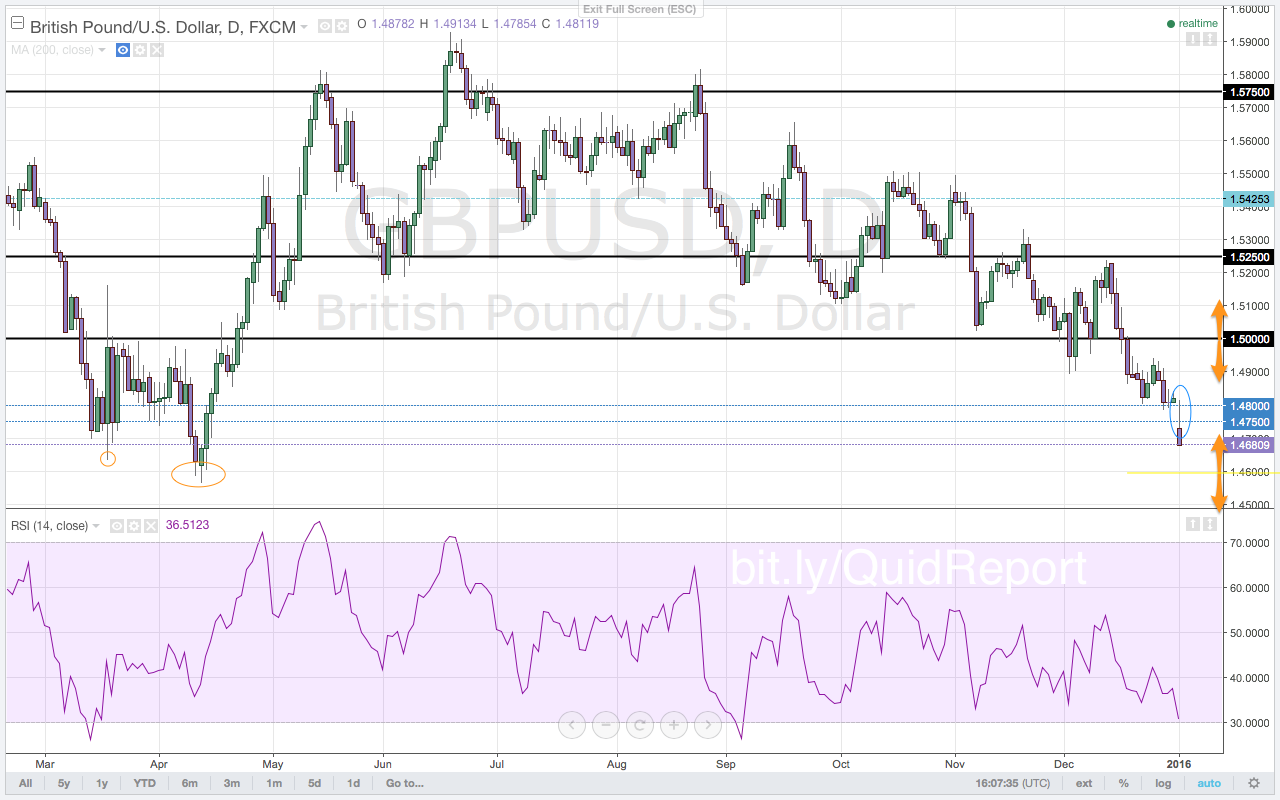

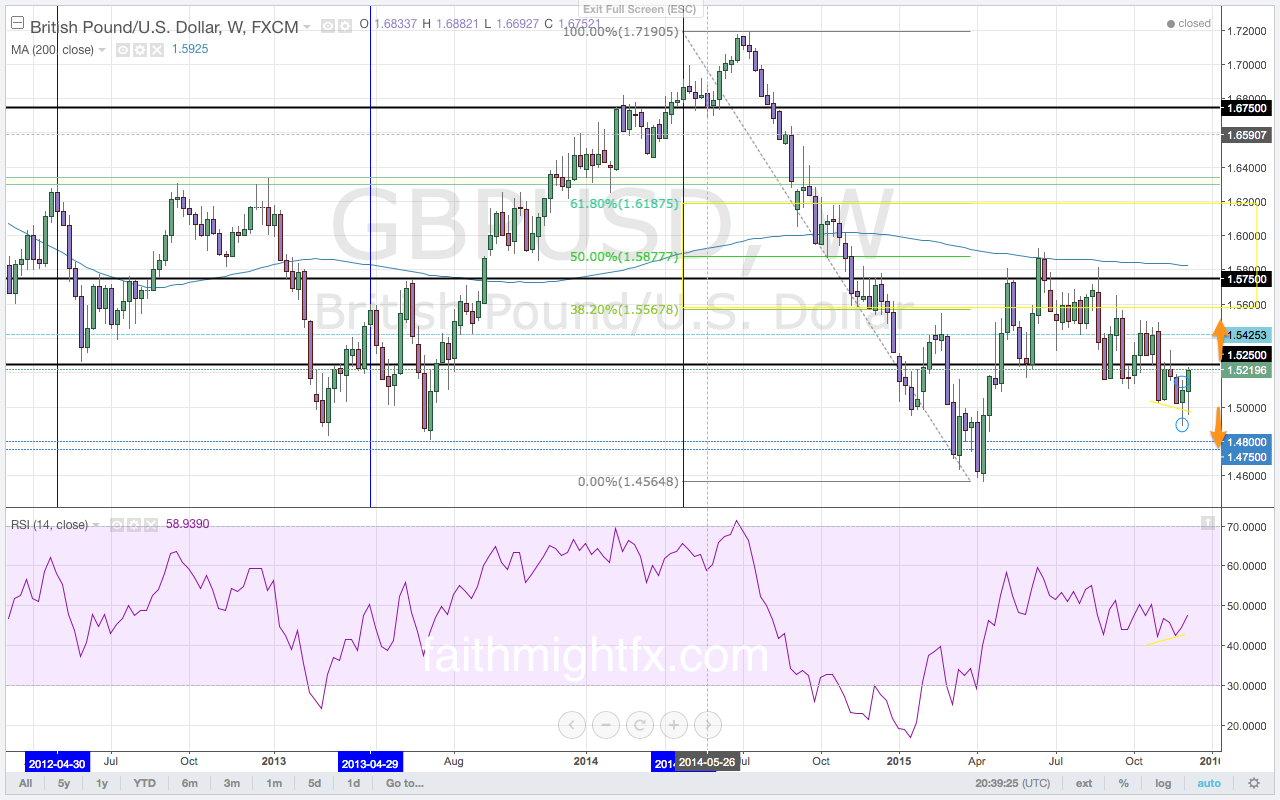

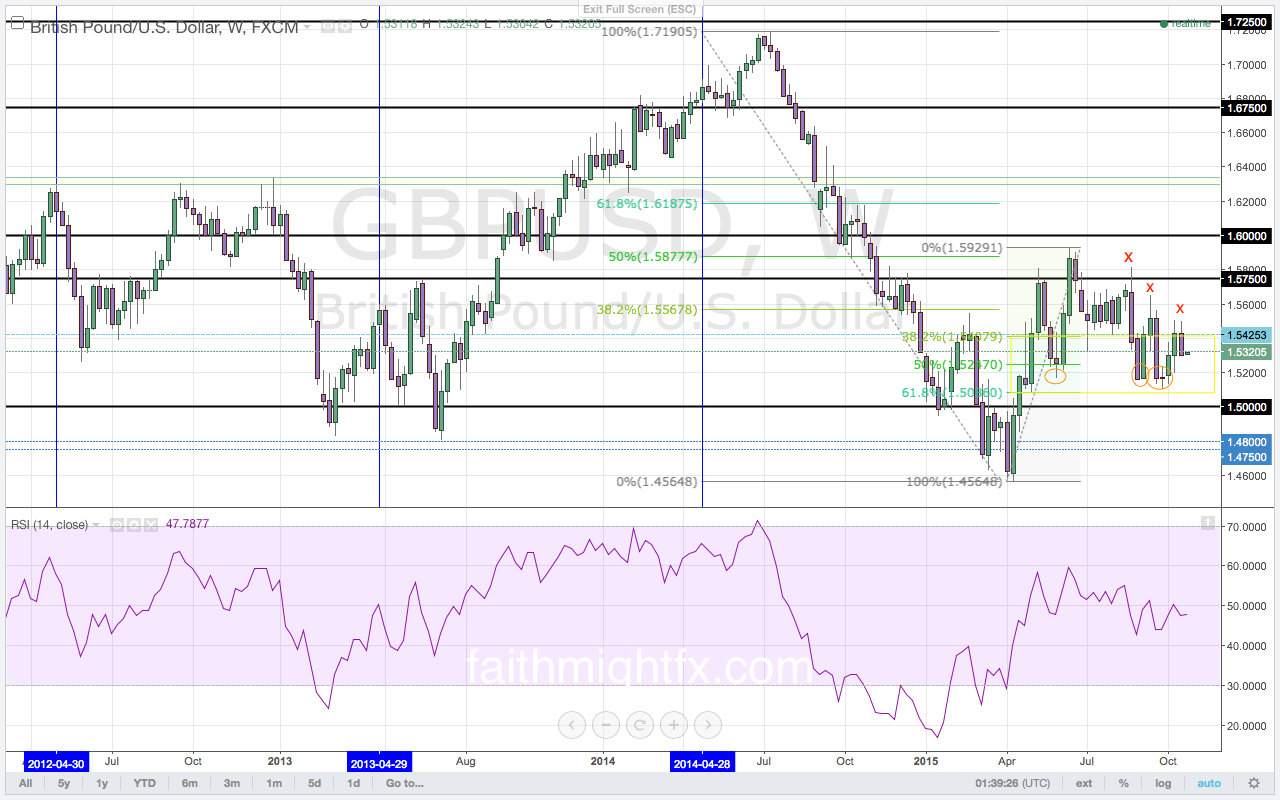

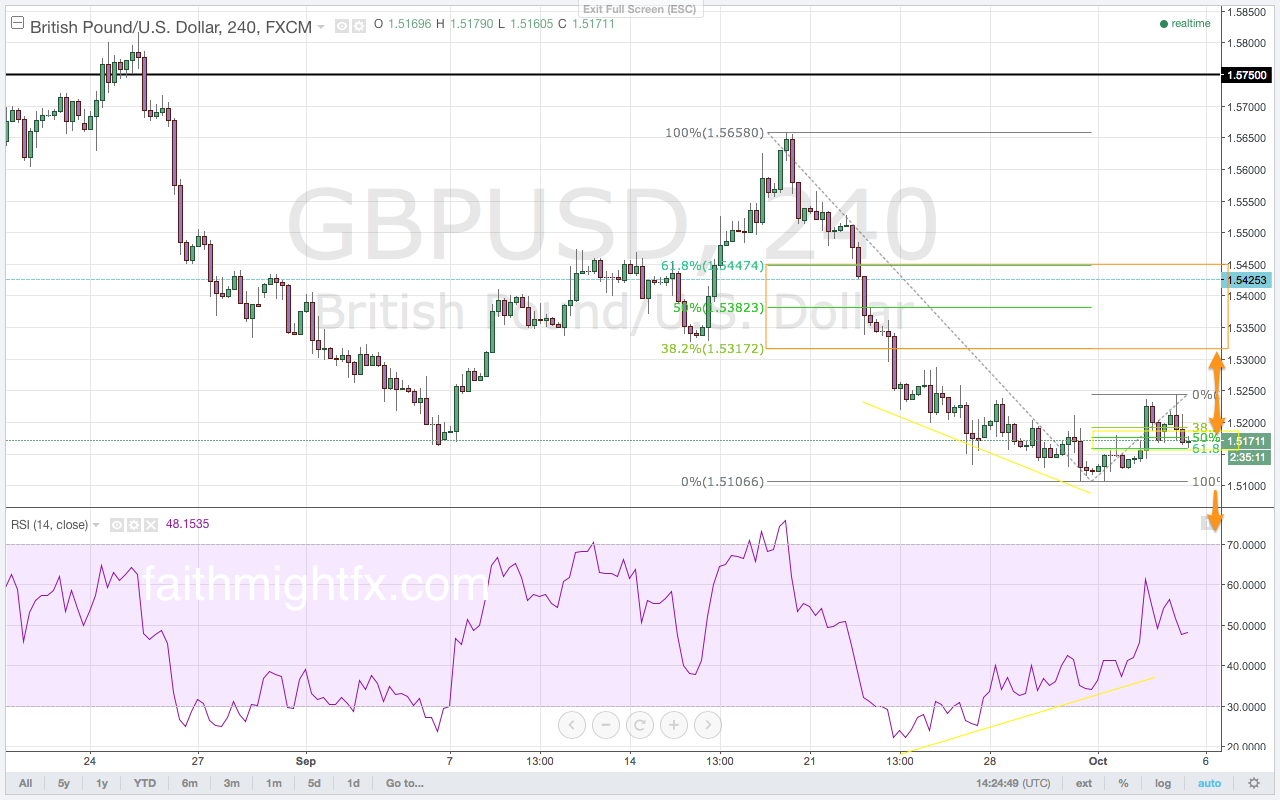

Federal Reserve Chairwoman Janet Yellen continues to insist that the central bank will raise interest rates this year. As such, the USD is showing strength on Yellen’s jawboning. The Federal Reserve has 3 months and only 2 more meetings scheduled ahead of the year end. Up until the release of the U.S. non-farm payrolls report, U.S. equities were not responding to the hawkish calls. Further weakness plagued the $SPX after it declined to the August 24th Black Monday lows. It was unable to sustain any rallies until Friday’s release of the weak U.S. jobs report. As long as industrial sectors are tepid, inflation is low, and the labor markets are softening, the Federal Reserve members don’t seem to agree that raising rates after ending QE is the correct course of action. Despite the Federal Reserve delaying to increase interest rates, the rally that occurred on the back of USD weakness (Volume 30) was completely reversed. Now that the market finally believes that the Federal Reserve will take no action on monetary policy, the $GBPUSD will likely rally on risk appetite and USD weakness. The failed high on the upside break of the consolidation range resulted in a new low lower than the previous low at 1.5135. With the move off the failed high complete, the $GBPUSD is free to move in either direction. With risk appetite returning to markets on the back of $SPX strength, the USD may weaken in this new week of trading. The lows circled in orange is a formidable zone of support to the downside. All attempts to move below 1.5162 has been met with supply. The new trading week opens finding resistance at the 1.5250 level. A break above this level fuels a rally back towards the 1.5500 level.

After holding below the Friday highs, the $GBPUSD has moved lower as the new trading week gets underway. Price is back below the 1.5200 level signaling a return to the support zone starting at 1.5162 through 1.5100. A break lower moves to the 61.8% Fibonacci level where there is confluence with former lows at 1.5089 and the key 1.5076 level. However, weak fundamentals from the U.S. could also rule price action this week. The week kicks off with the release of the non-manufacturing ISM number during the Monday open. Soft U.S. economic reports will counter intuitively rally the S&P 500 as the market interrupts weak data with dovish U.S. monetary policy. This interpretation weakens the USD because it will signal an increasingly dovish Federal Reserve. If equities respond to weak economic data with more weakness, however, risk aversion will strengthen the USD.

Outlook for the week:

This is an excerpt from this week’s issue of QUID REPORT. Subscribers receive my research on all major GBP pairs at the beginning of the week, including access to @faithmightfx on Twitter for daily, real-time updates to the weekly report. AVAILABLE NOW.