The U.S. jobs report was phenomenal. All kind of good points including a rise in the participation rate and an uptick in wage earnings. Finally! But 1 data point doesn’t make a trend. A data point that did trend this week, however, is U.S. retail sales. Retail sales in the world’s largest consumer economy missed for the second month in a row. And it missed big.

US December and January retail sales combined -1.7%

— Michael Hewson (@mhewson_CMC) February 12, 2015

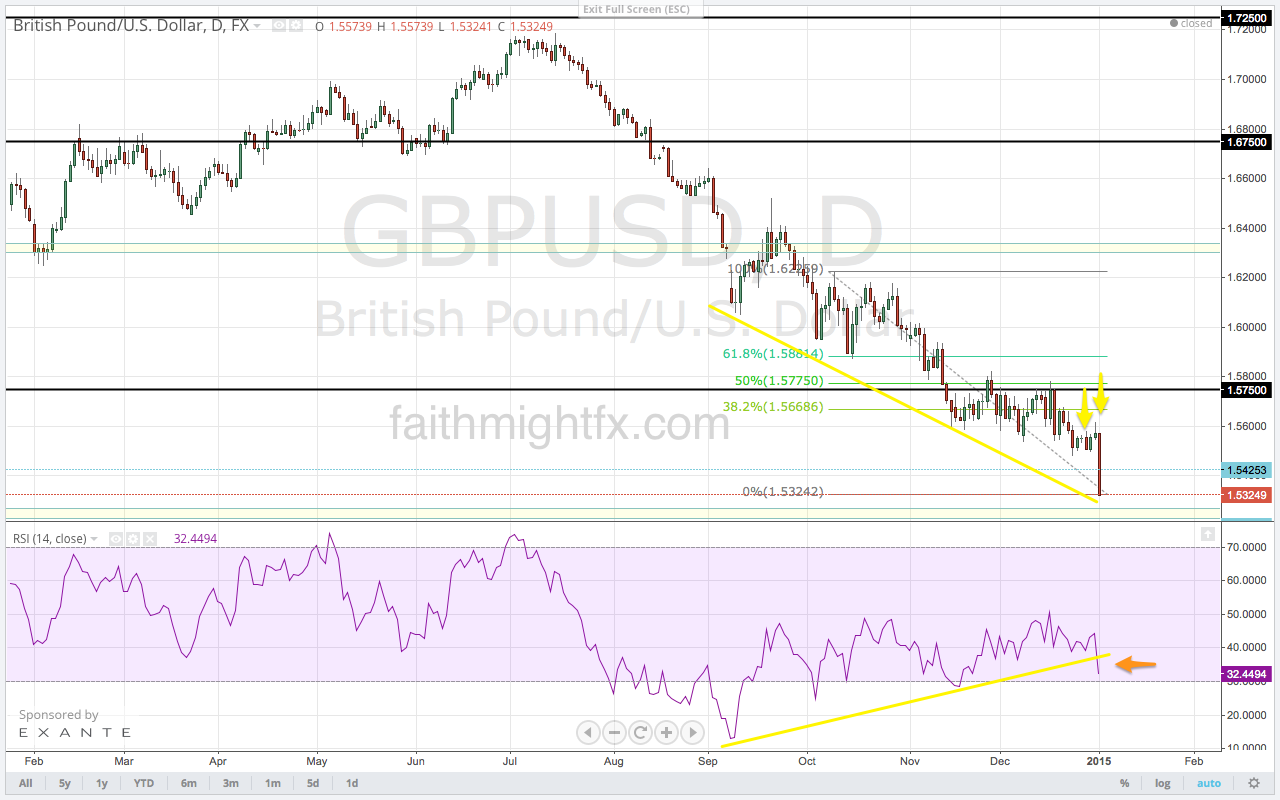

This has sent the USD to consolidate lower across the board. Even oil has managed to stage an impressive rally to close the week. Oil continues to be a major headline in the markets. It was mentioned throughout the Bank of England’s Quarterly Inflation Report. With low inflation in the UK, due to oil prices, coupled with wage growth, the BoE believes inflation to rise faster than expected. Thus, rate hike expectations have actually accelerated resulting in a renewed rally in the GBP that could drive direction in sterling pairs in the mid-term.

- Mark Carney: Interest rates could hit new low (The Scotsman)

- The Tragedy of Modern Banking (Kass’ Korner)

- $2 Billion Vanished in Nigeria This Week and Most People Didn’t Notice (Venture Africa)

- Retail Sales Mystery: Where Are Americans’ Gas Savings Going? (WSJ)

- End of month thoughts: Dollar pushed (Piptrain.com)