Of course, the only thing still on the wire is the Scottish referendum. But the Scots stand to rock the world as secessionists everywhere get emboldened by the possibility of independence. Naturally, the referendum polls are just as emotional as the voters they reflect. Sterling spiked to new weekly lows across the board as the Yes vote took lead last weekend. Then the No vote moved ahead as the trading week unfolded and sterling surged big time right back to familiar highs in all the GBP pair majors. Headed into the actual election this week, expect price to actually weaken as buyers take profit and sellers take advantage of the recent highs. Even with the Bank of England set to make a monetary policy announcement, all eyes this week are on the referendum vote. Friday, the day after the vote, will be the most interesting trading day of the week and may set the tone for the rest of the year.

- Scotland and Zanzibar share a related history and perhaps a smilier fate. (Africa Is A Country)

- The UK has issued a reminbi-denominated bond, only the 2nd eurobond in its history. It’s has to pay for this divorce somehow. (Xinhua)

- Why everyone in the world will be listening to Yellen this week. (Business Insider)

- There are 5 lessons GBP traders can learn from the Quebec referendum (Forex Live)

- Anybody remember Mark Carney saying something about raising interest rates? No? We didn’t think so. (Bloomberg, FX Agenda, Forex Live)

- In case you didn’t know, Scotland independence could have big implications (WSJ, Breaking Views, CNN Money, Telegraph, eFXnews)

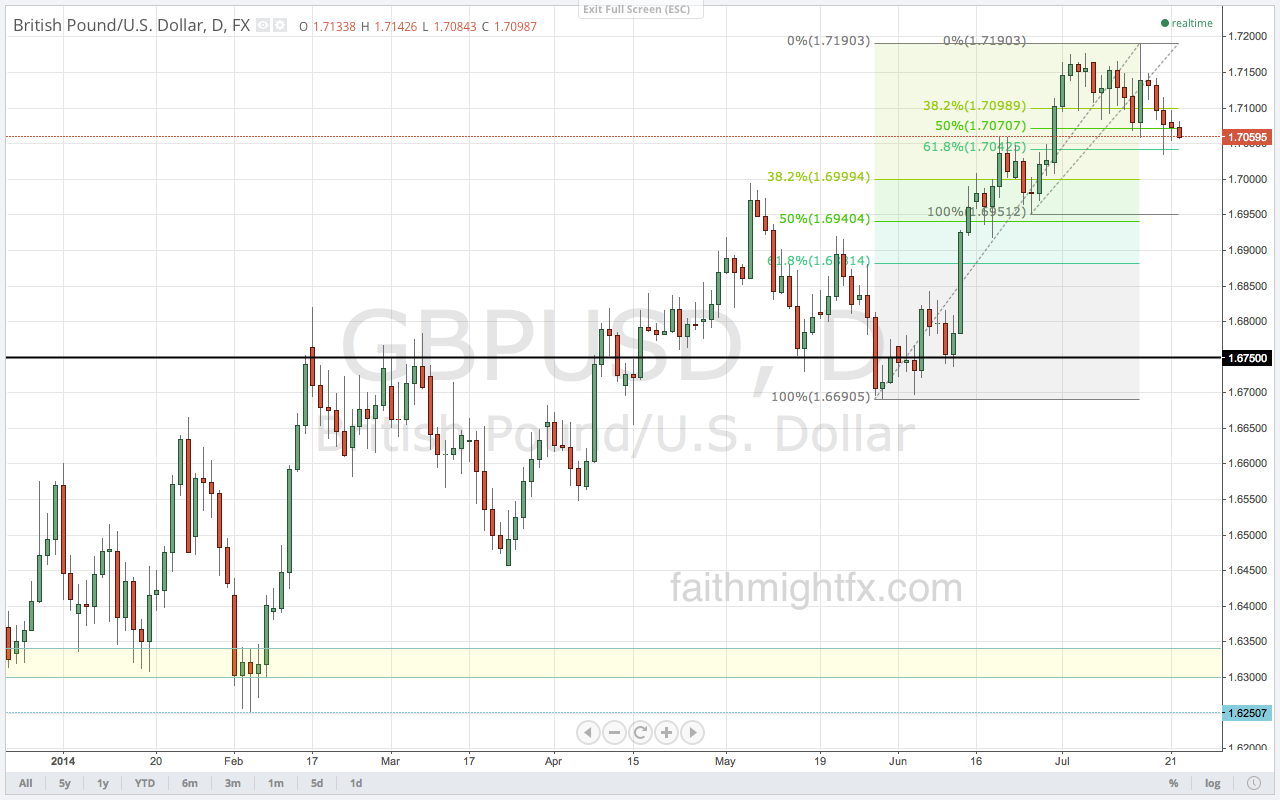

- As with any trade, only price pays. Nice technical looks at some GBP pairs. (Pip Train, Dragonfly Capital, All Star Charts, FaithMightFX)