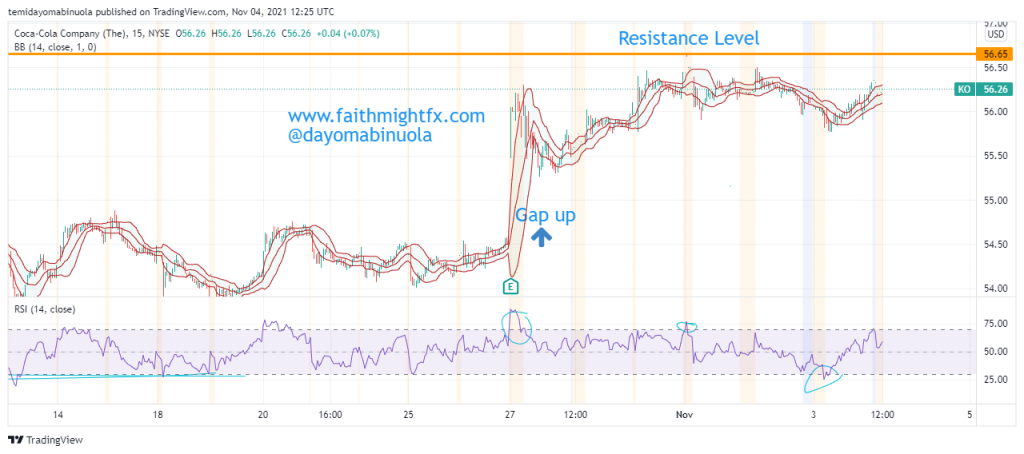

After the full takeover of BodyArmor by Coca-Cola in November 2021, the share price of Coca-Cola had a brief bullish run that took the share price from $56.29 in November 2021 to $67.11 in April 2022, which now stands as the current all-time high for Coca-Cola.

In the month of May 2022, Coca-Cola’s share price dipped from the all-time high down to $62.66. Price rallied shortly afterward and the price reached $66.39. The bears counteracted the rally as the price was pushed down to $59.66. $59.66 is the current support level. In the week of May 23rd, the price rallied and the bulls were able to get the price to $64.68 which was the closing price for the week.

This recent bull run might not be maintained as the bears might overpower the bulls and push price lower to reach $60. If the price eventually breaks $60 to the downside, the price might continue to fall further.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here