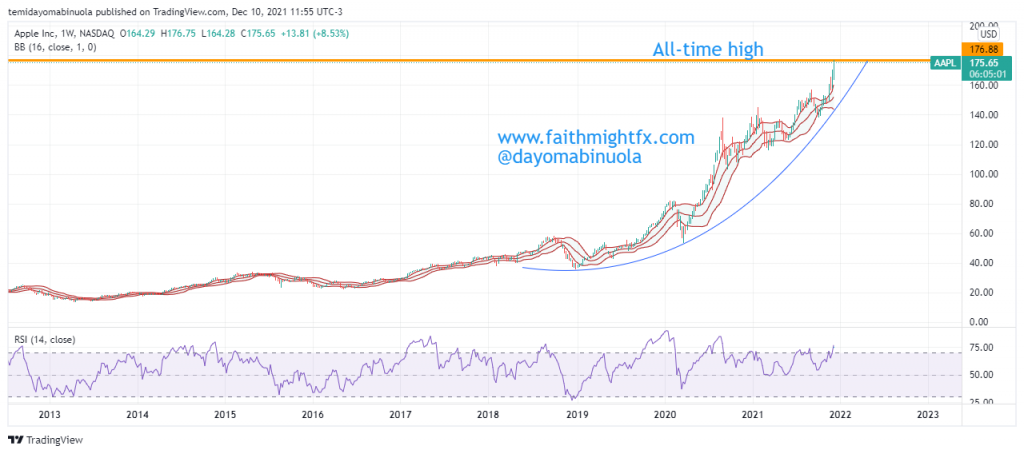

Apple becomes the first company in America to reach the new milestone of $3Trillion Market Cap. The technology company has done tremendously since the pandemic. The pandemic lowest price was $53.32. The current price stands at $179.70 which is a day after the all-time high at $182.93 was reached. Therefore, investors have gained about 3x since the pandemic low. Since Tim Cook became the CEO of Apple on the 24th of August 2011, there has been a massive rally in the share price of Apple. He has been able to achieve about 10X in the last decade. The market cap has jumped from $340billion to $3Trillion. Apple investors have been enjoying a jolly ride due to good leadership.

In December 2021, our analysts concluded that the price of $AAPL should reach a new all-time high, which might eventually take the market cap to $3Trillion as a result of continuous profit-making. Going forward, a correction might occur which leads to the market cap dropping from $3Trillion. Apple’s share price might drop about 18% in the coming weeks, which might eventually bring the share price down to $149.07, a level below the September 2021 all-time high of $157.55. Since the latter months of 2019, the price of Apple has been overbought multiple times, as the price only had a few corrections. Meanwhile, there is no indication of price reversals.

Some of these ideas are in our clients’ portfolios. To understand which ones can work for you or for help to invest for your own wealth, talk to our advisors at FM Capital Group. Would you like more information on Investment Advisory, Portfolio Services, and VC? Schedule a meeting with us here.