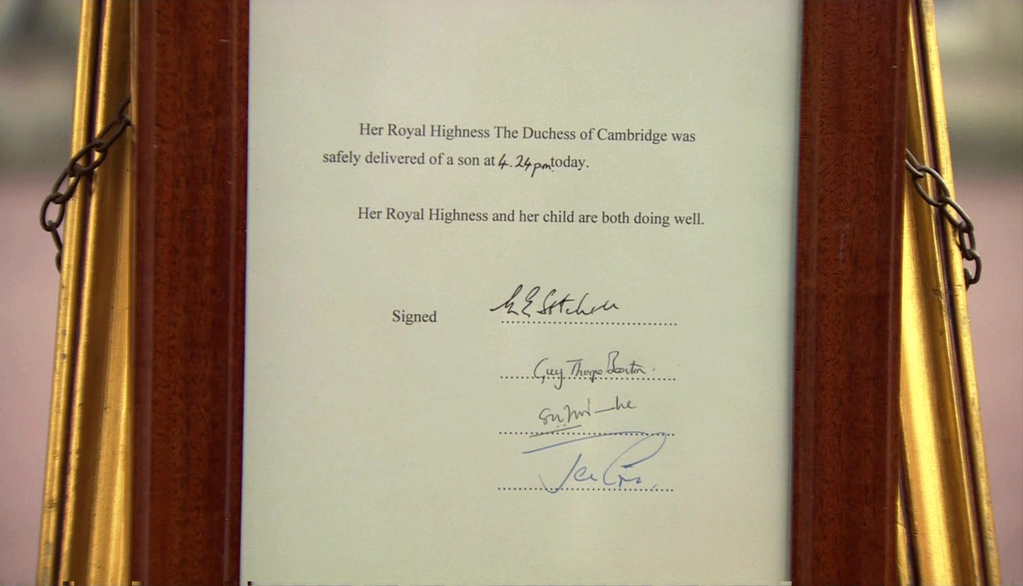

The UK monarchy has a new addition and the hype surrounding the birth of the new prince could arguably be called overdone. But sterling opened the week to news that Kate Middleton was in labor and rallied very nicely in the wake of the good news. $GBPUSD made new highs at 1.5384. $EURGBP broke to new lows at 0.8582. The baby has been here less than 24 hours and he has become responsible for lifting the UK into economic recovery. Talk about influence! In all seriousness though, with the economic calendar extremely light this week, sterling traders are looking ahead to Thursday’s UK GDP release. In light of the some robust numbers from retail sales and PMI in the past weeks, GDP is expected to surprise to the upside. Such a surprise will continue to fuel sterling strength and possibly induce a reversal in the $GBPUSD and $EURGBP. However, GDP expectations are so high that a disappointment may just end the rally.

- NEWS IN CHARTS: UK GDP TO SURGE! (ALPHA NOW)

- Royal Baby Bump for U.K. Economy? Don’t Bet on It (Wall Street Journal)

- UK exports at their highest since recession, say firms (The Guardian)

- British economy has turned a corner, senior Tories claim (The Telegraph)

- The UK’s fall from grace has been horrific – but we might be turning a corner (The Telegraph)

- Minutes of the Monetary Policy Committee Meeting held on 3 and 4 July (Bank of England)

- BOE Left Battling Perception that ‘No Action’ Means ‘Tightening’ (Wall Street Journal)

- QE Is So Out (Business Insider)

- What Next For GBP/USD?: The One Chart That Says It All (eFXnews)