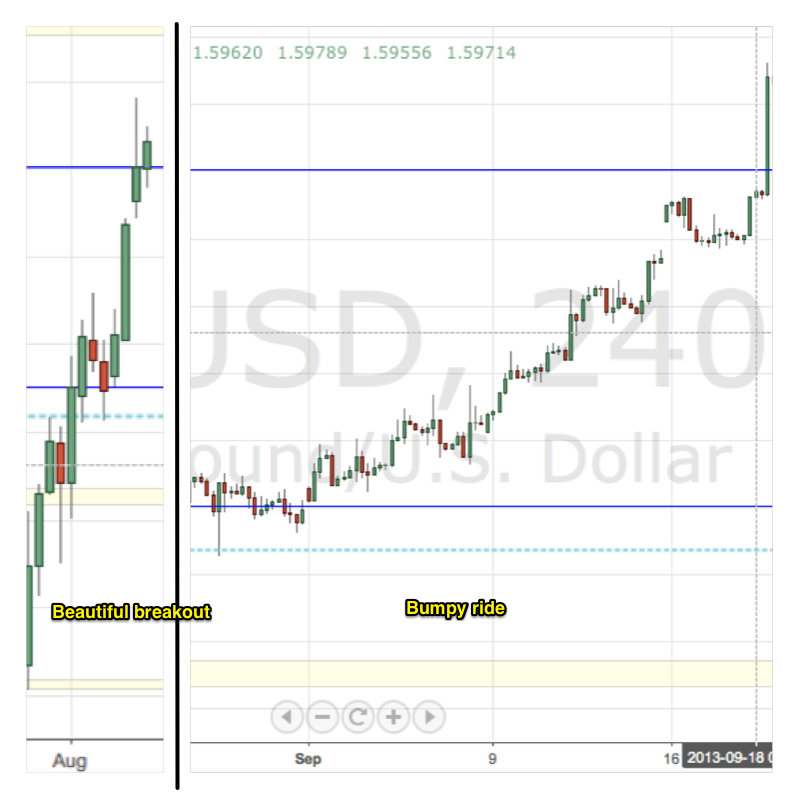

We left off the Digest musing over the strength in sterling due to robust UK economic data as GBP hit long-term resistance levels against all major currencies. Since August, GBP has experienced tremendous breakouts in some pairs and significant price corrections in others. Now that $GBPUSD is above 1.60, $GBPCAD above 1.65, $GBPAUD above 1.71 and $EURGBP at 0.84, it seems as though GBP bulls are having their way. However, these moves have not been without resistance. The moves higher in sterling have been a grind with slow, choppy moves that have been difficult to trade on anything but a short term basis. With a light calendar this week, the market has allowed GBP to correct but robust economic data gave life to sterling as $GBPUSD, in paritcular, managed not to loose its important 1.60 level. With 3Q at its end, October brings the market its first glimpse of fall season data. If the UK economy continues to put in robust results, expect GBP to continue its summer rally back to long-term resistance levels.

- GBP/USD Maintains Bullish Bias (FMFX)

- Charts I am watching for this coming week (Peter Brandt) [scroll through PDF to $GPBCAD analysis]

- Sterling Proves Pessimists Wrong (Money Beat WSJ)

- UK CBI distributive trades survey september: 34 vs +24 exp (Forex Live)

- Financial Policy Committee statement from its policy meeting, 18 September 2013 (Bank of England)

- Bank of England hits back at critics of forward guidance (FT)

- Pimco: Get Set for a Hefty Sterling Decline (Money Beat WSJ)

Read the last issue: Sterling Digest, 23 August 2013: reality bites