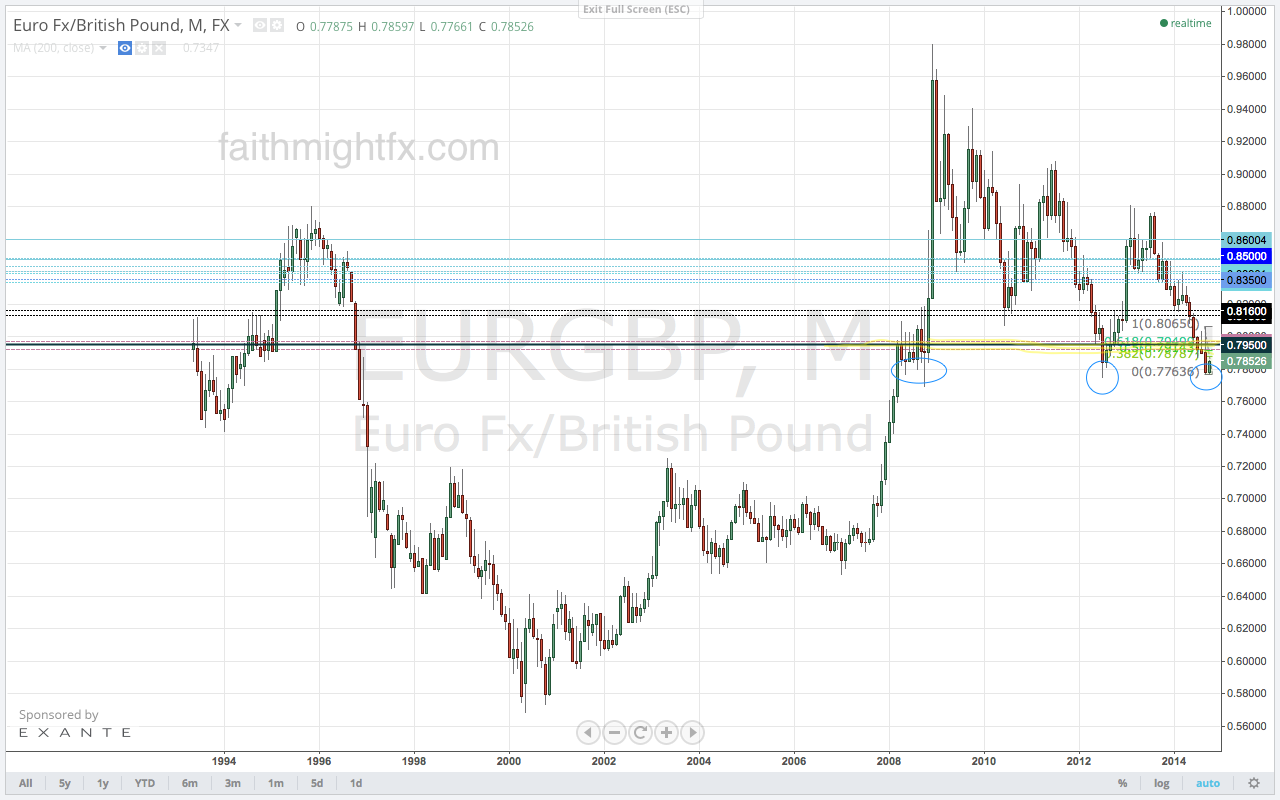

The EUR has taken new ECB policy very hard. In 2014, the currency has lost over 600 pips against the pound sterling and 1,500 pips versus the US dollar. Those are substantial moves. You have to ask yourself if the short euro trade is not already crowded. Couldn’t it stand to reason that the currency rally into the end of the year? If not, for a couple of weeks? For now 1.2500 $EURUSD has managed to stymie the weakness there. $EURGBP is also bouncing off its multi-year support at 0.7750. Now that the ECB has pulled the trigger on negative interest rates and bond buying, the markets are breathing a sigh of relief and covering positions. It’s a new quarter after all. This 1st full week of trading could see the euro stage a corrective, relief rally.

So far, the $EURGBP remains stuck in its huge wedge formation. Price has found resistance all trading session at the 0.7960 level. However, swing traders are looking to the 38.2% Fibonacci level at 0.7880 and 0.7920-70 for an indication of supply and demand. That’s the upside potential.

However, the downside has serious potential. A break below 0.7750 has huge implications with support not likely until 0.7500/7400. For as long as the ECB is accommodative in the face of tightening out of the BoE, the long-term potential is certainly in the bears favor.

One Reply to “Euro Finds Its Feet”