I asked the question as the week closed on Friday.

Is the USD really going to weaken in the face of all this shifting geopolitics? Technicals and fundies diverging. Boo. $GBPUSD

— Lydia Idem Finkley (@faithmight) March 28, 2015

For all the geopolitical stress on markets right now, it is no wonder that USD weakness can’t get a foothold in cable. Looming in the background are many geopolitical risks at play. War is waging, energy markets are changing, deflation won’t go away, and yields won’t go higher. Elections around the globe have created shifts in fiscal policy. We see that with Greece. Nigeria voted in a new president and a change of government over the weekend. The U.S. will do the same next year. While equities have remained at highs, perhaps markets are getting a bit more cautious and risk averse. This undoubtedly helps the U.S. dollar along with the Japanese yen and the Swiss franc – our traditional safe haven currencies.

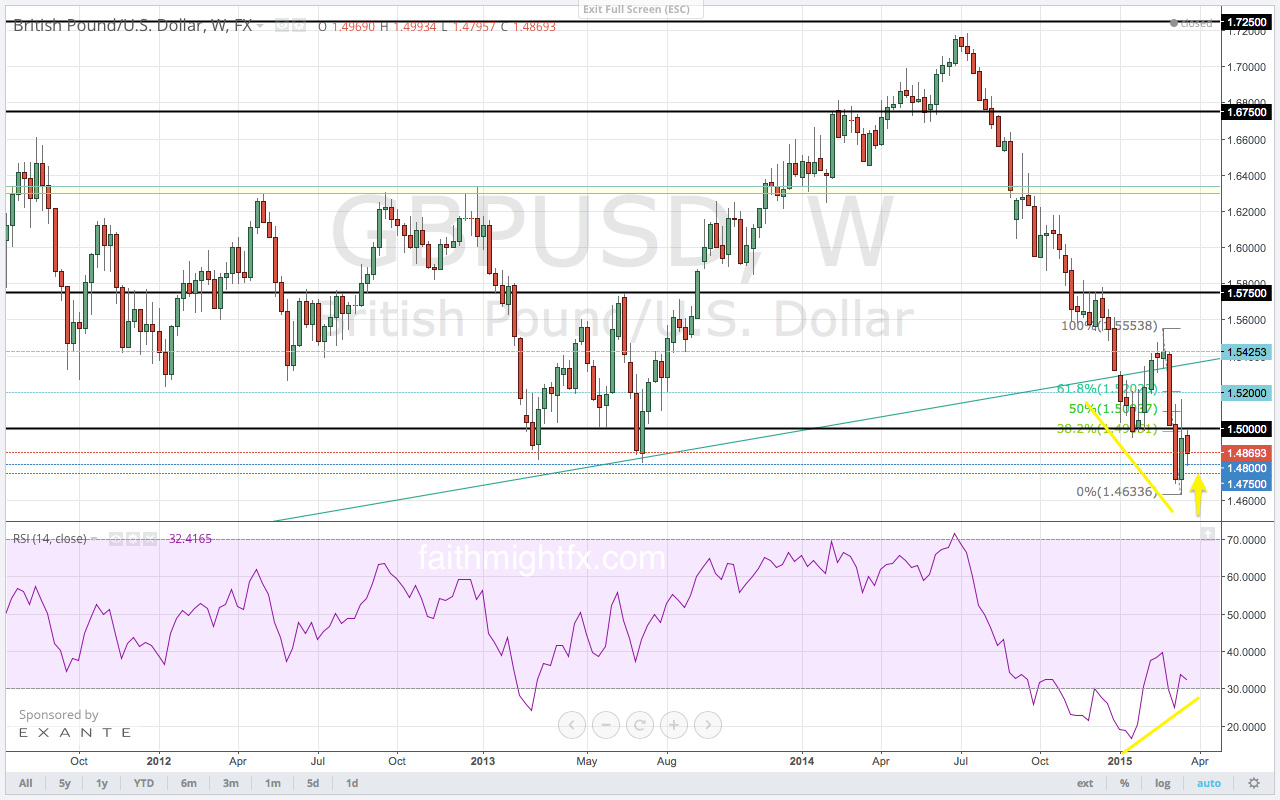

If USD strength is to really breakout, versus the GBP in particular, price will need to break and close 2 CONSECUTIVE candles below the support zone between 1.4750-1.4800. We’ve been faked out before.

While the recent lows were a breakout below support, we got an immediate weekly close back above the support zone. With the bullish divergence here, it looks like a false breakdown may be in place. We’ll get our confirmation this week especially with the economic releases due out this week. IF price holds support, this will be a bullish signal worth taking advantage of.

This is an excerpt from this week’s issue of Quid Report. Subscribers receive my research on all major GBP pairs at the top of the week, including access to @faithmightfx on Twitter for daily, real-time calls and adjustments to the weekly report. IF INTERESTED, SIGN UP NOW AND RECEIVE A FREE TRADING BOOK. AVAILABLE NOW.