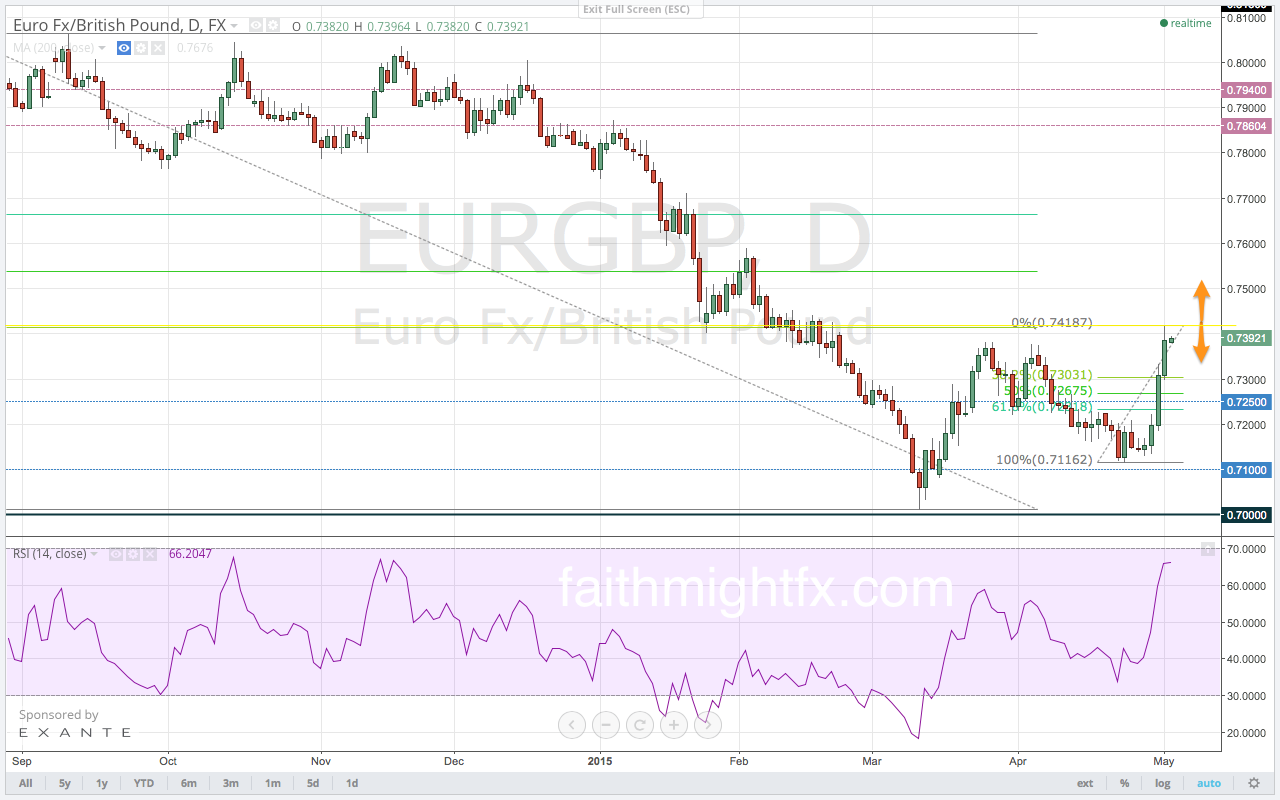

The $EURGBP staged a monster breakout last week. We cited last week that the $EURGBP had the potential to rally if Greece received a bailout. No bailout came but the buyers still stepped out to buy the euro. One reason is just simple profit taking. At the end of the month, traders squared positions after the euro’s break of multi-year support levels. Another reason is the approach of summer trading. Trading desks are getting ready for the thinner summer market environment. So taking profits off the table and squaring up positions for summer trading may account for a large part of these EUR strength flows.

The $EURGBP had been previously range bound. It broke that range to the upside and broke above 0.7250 right away. It quickly confirmed the breakout on a 4-hr chart close above 0.7250. The $EURGBP immediately rallied 166 pips higher to 0.7416. Offers lined up at the highs with profit-takers and sellers. The $EURGBP is in a terrific downtrend after all. The Greek crisis makes it hard to buy euros for the long term so taking profits at the 38.2% Fibonacci level seems very prudent. But as news of a nearing bailout deal that will please everybody is starting to develop, the euro finds itself in a relief rally. The timing of the rally with election jitters underscores the upside move potential in the $EURGBP. The volatility that is supposed to occur around a change in Parliament has dissipated since hitting markets 2 weeks ago. Perhaps now, the week of the election, market volatility will return that can send the $EURGBP higher still.

If price breaks above last week’s high, it will go to the 0.7500 psychological level. A break higher targets the 50% Fibonacci level at 0.7568. But if price were to move lower in the new trading week, watch the 1st set of Fibonacci levels on the 4-hour chart. These levels mark a correction of the breakout rally of last week. The 38.2% Fibonacci level at 0.7373 should be a place where late buyers will look to enter the rally. Buyers who held from last week know this is also an opportune time to add to long positions. A move lower still targets the Fibonacci levels on the daily chart. These Fibonacci levels are over the entire rally off the 0.7016 lows.

This is an excerpt from this week’s issue of Quid Report. Subscribers receive my research on all major GBP pairs at the beginning of the week, including access to @faithmightfx on Twitter for daily, real-time calls and adjustments to the weekly report. AVAILABLE NOW.