Cable ended April hitting the 50% Fibonacci retracement level to the PIP. Pretty impressive for a 30-day rally. As $GBPUSD tops out at 1.5606, it begins the 1st week of May with a lower high (as of this writing). Seasonality trends would have traders note that cable has topped out in April each of the last 3 years. In May 2010, cable was below 1.55 and fell to brand new long-term lows by the end of the month. $GBPUSD finds itself in a similar situation with price action only 40 pips above 1.5500. This week’s BoE rate decision will be closely watched thanks to the RBA’s long-awaited interest rate cut. Most still think the BoE holds policy until Mark Carney takes the helm so Thursday’s event could be a non-event. As such, sterling could be a mixed bag. The ECB, RBA, and BoJ are clearly dovish while the BoC and RBNZ are hawkish. The Fed is on watch but positive data continues to build the case for a strong USD. The BoE’s decision sets the tone for sterling the next 30 days. Which way will the Old Lady lean?

- Reason for hope – Bank of England deputy governor Paul Tucker (The Journal)

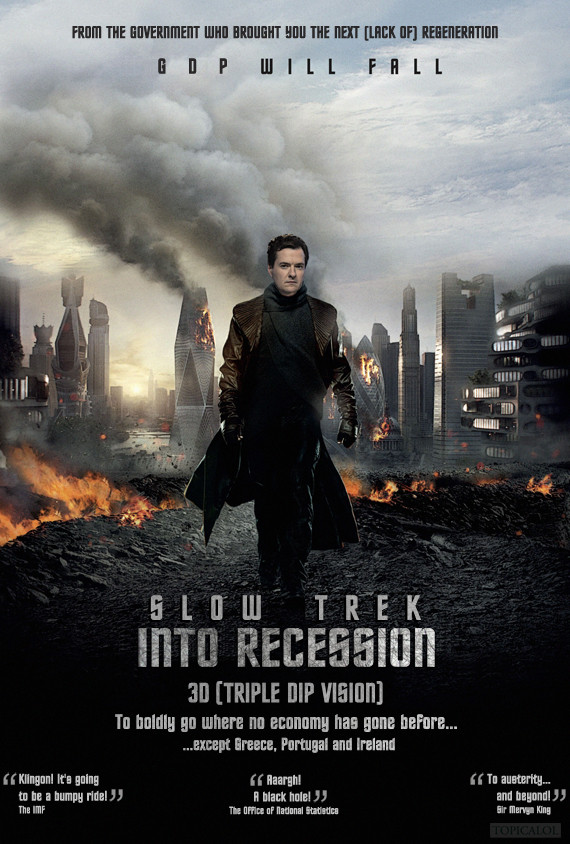

- George Osborne tells FPC to focus on short-term growth (Telegraph)

- Reserve Balances for UK Banks Increases by 2.3% in April to Reach New All-Time High (EcPoFi – Economics, Politics, Finance)

- Has there been a double dip recession? (Office of National Statistics)

- Cable pulled down by the euro’s vortex of suck (Forex Live) [chart]

- UK government riding the bubble (Forex Live)

- Outlooks & Strategies For EUR/USD, And GBP/USD – Barclays (eFxnews)

- Devaluing the pound won’t do what its advocates want it to do (Adam Smith Institute)